- United States

- /

- Auto Components

- /

- NasdaqGS:GTX

Could SaaS Tools Define the Next Phase of Garrett Motion's (GTX) Technology Advantage?

Reviewed by Sasha Jovanovic

- On November 19, 2025, PTC announced an expansion of its partnership with Garrett Motion, with Garrett adopting PTC's Codebeamer+ application lifecycle management and Windchill+ product lifecycle management solutions to further its SaaS-driven transformation.

- This expanded collaboration builds on Garrett’s enterprise-wide use of cloud-native tools, aiming to unify engineering disciplines, improve product data accessibility, and accelerate the integration of advanced technologies such as artificial intelligence.

- We’ll explore how Garrett Motion’s move to unified cloud-based engineering tools could influence its investment narrative and future growth prospects.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Garrett Motion Investment Narrative Recap

To be a Garrett Motion shareholder today, you need confidence in the company's ability to profitably transition from its legacy turbocharger business to growth in electrified powertrain technologies. The November partnership with PTC, while a meaningful technology step for unifying product data and accelerating AI adoption, does not directly shift the near-term catalysts or the core risk: the slow pace of revenue replacement as the industry moves away from internal combustion engine components.

The most relevant recent announcement is the October earnings report, which showed solid growth in both sales and earnings for Q3 2025. This underscores that, even as Garrett lays the foundation for future technology capabilities, its financial momentum remains closely tied to its established products, and the shift toward zero-emission offerings is still developing at a measured pace. In contrast, investors should be aware of the risk that, even with new technology initiatives, Garrett's growth in electrified segments may not...

Read the full narrative on Garrett Motion (it's free!)

Garrett Motion's outlook anticipates $3.8 billion in revenue and $339.1 million in earnings by 2028. This scenario is based on annual revenue growth of 3.1% and an earnings increase of $38.1 million from current earnings of $301.0 million.

Uncover how Garrett Motion's forecasts yield a $19.00 fair value, a 17% upside to its current price.

Exploring Other Perspectives

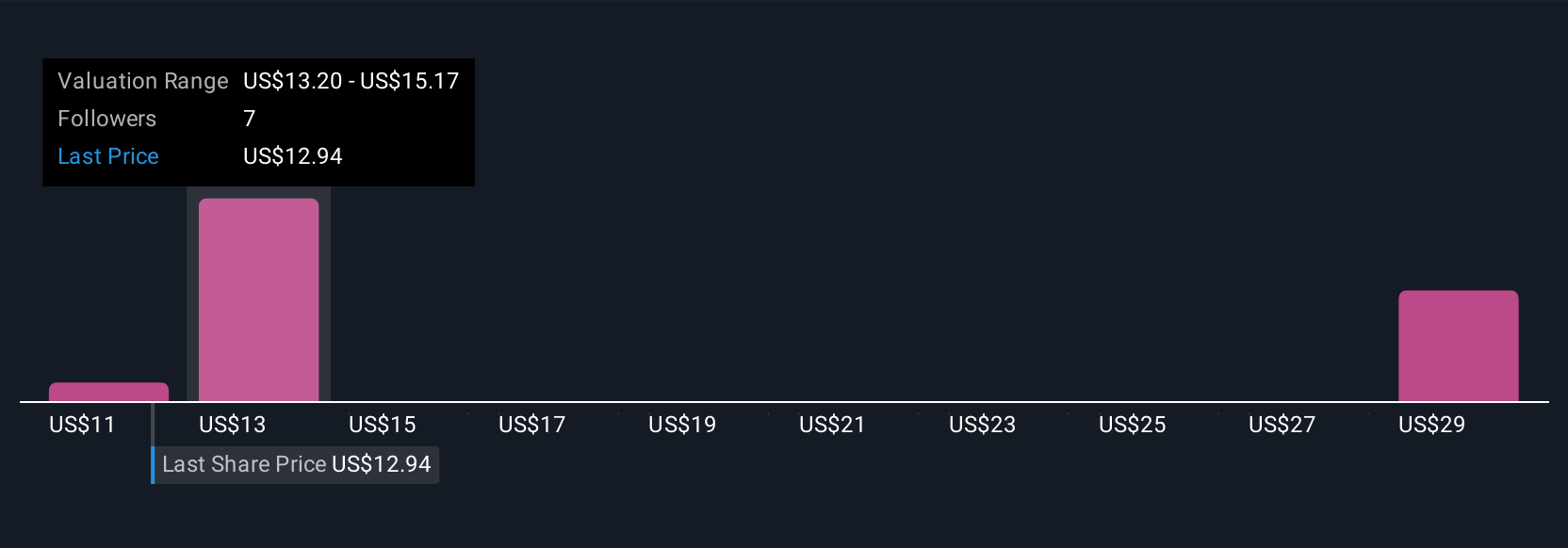

Simply Wall St Community members set fair values for Garrett Motion between US$19 and US$35.54, based on two independent analyses. While opinions vary widely, the biggest risk remains the company's heavy exposure to declining internal combustion engine markets, reminding you that future performance projections can differ sharply depending on key industry assumptions.

Explore 2 other fair value estimates on Garrett Motion - why the stock might be worth over 2x more than the current price!

Build Your Own Garrett Motion Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Garrett Motion research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Garrett Motion research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Garrett Motion's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GTX

Garrett Motion

Designs, manufactures, and sells turbocharging, air and fluid compression, and high-speed electric motor technologies for original equipment manufacturers and distributors in the United States, Europe, Asia, and internationally.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives