- United States

- /

- Auto Components

- /

- NasdaqGS:GT

What The Goodyear Tire & Rubber Company's (NASDAQ:GT) 26% Share Price Gain Is Not Telling You

The The Goodyear Tire & Rubber Company (NASDAQ:GT) share price has done very well over the last month, posting an excellent gain of 26%. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 8.7% over the last year.

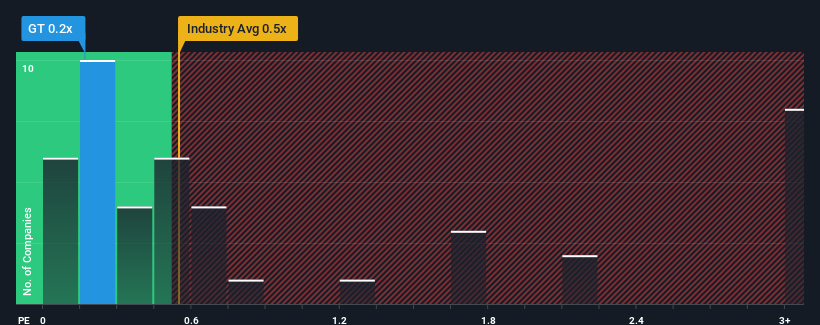

Although its price has surged higher, it's still not a stretch to say that Goodyear Tire & Rubber's price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Auto Components industry in the United States, where the median P/S ratio is around 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Goodyear Tire & Rubber

How Goodyear Tire & Rubber Has Been Performing

Goodyear Tire & Rubber has been struggling lately as its revenue has declined faster than most other companies. One possibility is that the P/S is moderate because investors think the company's revenue trend will eventually fall in line with most others in the industry. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Goodyear Tire & Rubber's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Goodyear Tire & Rubber's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.9%. Regardless, revenue has managed to lift by a handy 8.0% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to slump, contracting by 0.2% per annum during the coming three years according to the eight analysts following the company. With the industry predicted to deliver 40% growth per year, that's a disappointing outcome.

With this in consideration, we think it doesn't make sense that Goodyear Tire & Rubber's P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Key Takeaway

Its shares have lifted substantially and now Goodyear Tire & Rubber's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It appears that Goodyear Tire & Rubber currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

Plus, you should also learn about this 1 warning sign we've spotted with Goodyear Tire & Rubber.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GT

Goodyear Tire & Rubber

Develops, manufactures, distributes, and sells tires and related products and services worldwide.

Undervalued with questionable track record.

Similar Companies

Market Insights

Community Narratives