- United States

- /

- Auto Components

- /

- NasdaqGS:GNTX

Is Gentex Stock a Bargain After a 17% Year-to-Date Decline in 2025?

Reviewed by Bailey Pemberton

- If you've ever found yourself wondering whether Gentex stock is currently a value opportunity or a potential trap, you're in the right place.

- Despite growing curiosity, Gentex shares have dropped 1.8% over the last week and a notable 15.6% in the past month, putting the year-to-date performance at -17.1%.

- These declines follow recent headlines about the automotive industry’s supply chain challenges and shifting demand for vehicle electronics. Both of these factors have amplified investor uncertainty, especially for companies like Gentex that sit at the intersection of tech and manufacturing.

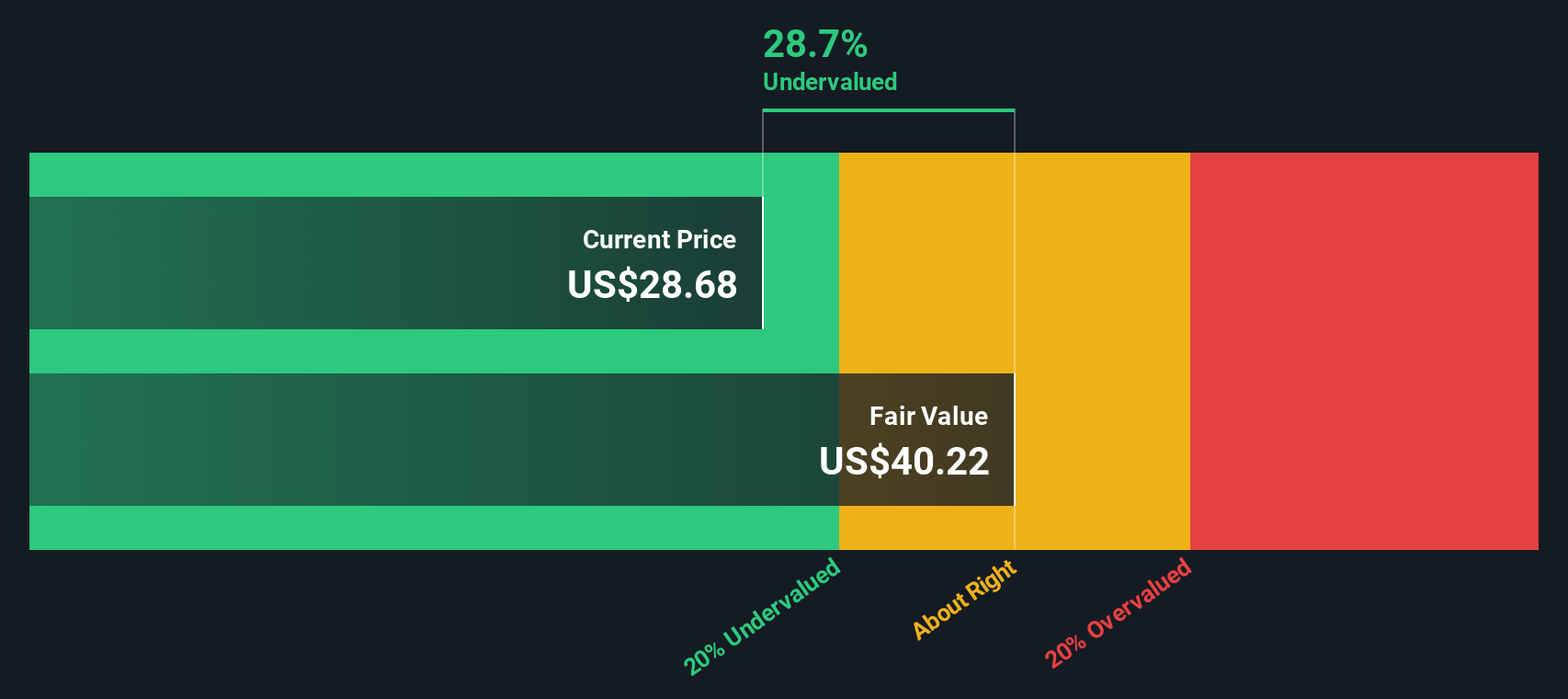

- Right now, Gentex scores a 4 out of 6 on our valuation checklist, hinting at potential underappreciated value. We'll break down what this score means and how we get there using a range of valuation tools, but there's an even sharper way to cut through the noise coming up at the end of this article.

Find out why Gentex's -21.0% return over the last year is lagging behind its peers.

Approach 1: Gentex Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the fair value of a company by projecting its future free cash flows and discounting them back to today's value. This method attempts to capture what Gentex is truly worth based on its ability to generate cash well into the future, rather than on short-term market sentiment.

For Gentex, the most recent reported Free Cash Flow stands at $388.5 million. Analysts provide detailed estimates for the next several years, projecting steady growth. By 2027, Free Cash Flow is expected to reach $409 million. Looking out over a full decade, extrapolations forecast Free Cash Flow rising to about $597 million by 2035, based on moderate annual increases.

Running these figures through the DCF model yields an intrinsic value per share of $43.08. Given the current market price, this implies Gentex stock is trading at a 45.9% discount to its estimated fair value. In simple terms, DCF analysis suggests Gentex shares are significantly undervalued at today's prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Gentex is undervalued by 45.9%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

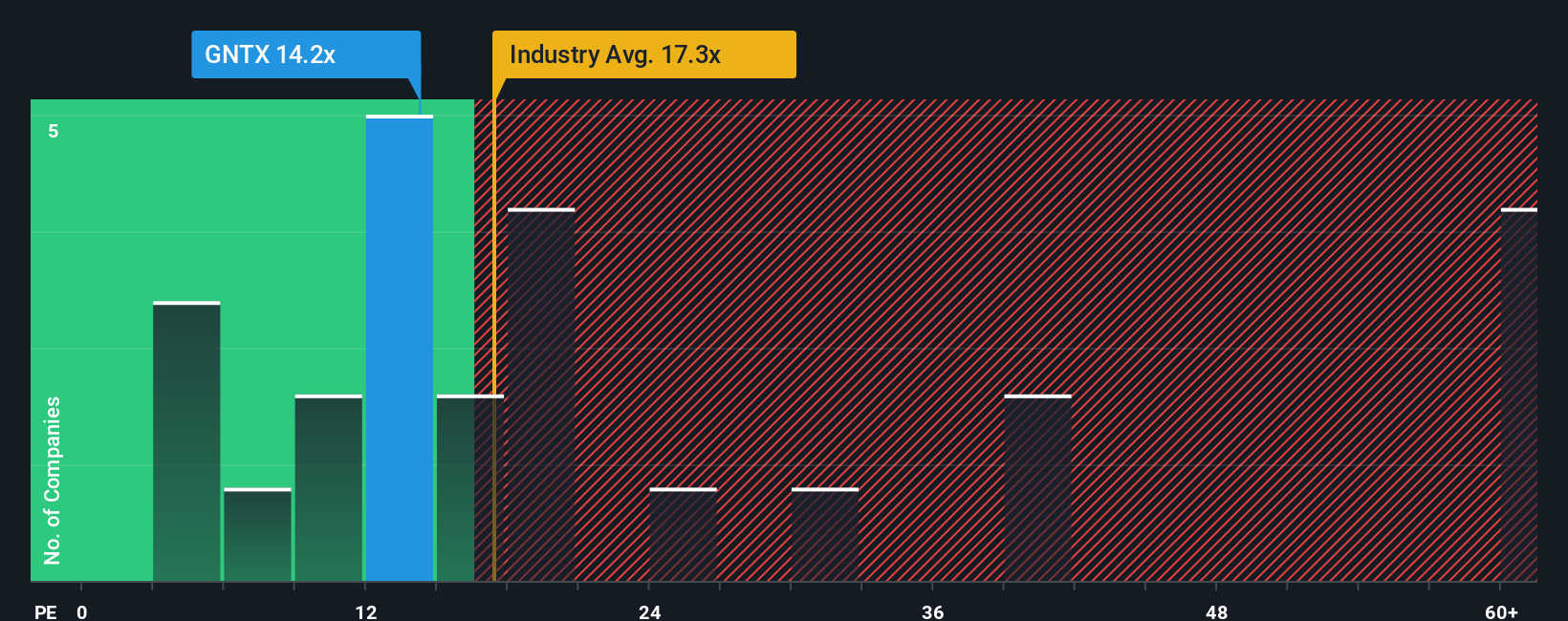

Approach 2: Gentex Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Gentex, as it directly relates a company’s current share price to its per-share earnings. For businesses generating steady profits, the PE ratio helps investors gauge how much they are paying for current earnings power, making it an especially meaningful indicator for established firms in mature industries.

What constitutes a “normal” or “fair” PE ratio depends on several factors, including growth expectations and risk. Higher growth companies typically trade at higher PE multiples, while firms facing uncertainty or industry headwinds often command lower ratios. Therefore, simply looking at a company’s PE in isolation can be misleading unless put in proper context.

Currently, Gentex trades at a PE ratio of 13.7x. This is noticeably below the industry average of 19.1x and the average of direct peers, which stands at 21.1x. However, instead of relying solely on simple averages, Simply Wall St calculates a “Fair Ratio” in this case, 12.7x that takes into account Gentex’s earnings growth, profit margins, risks, size, and its industry dynamics. This tailored benchmark gives a more complete picture than looking at industries or peers alone, as it adjusts for what genuinely matters to the company’s future prospects and potential risks.

With Gentex’s current PE almost identical to its Fair Ratio, the stock appears to be valued about right by the market when considering its unique fundamentals and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

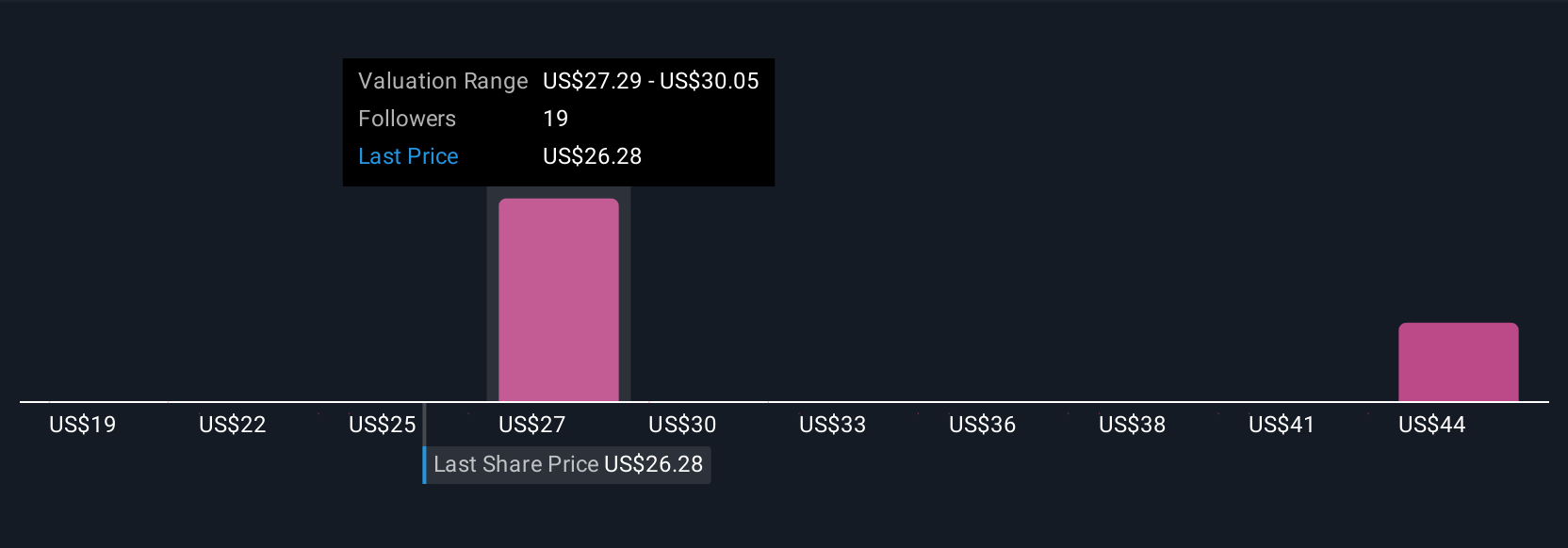

Upgrade Your Decision Making: Choose your Gentex Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal take on a company's story, where you connect what Gentex does today, your expectations for its future revenues, earnings, and margins, and arrive at what you believe is a fair value for the stock. Narratives help turn the numbers into a story you can track and adjust, making investment analysis more approachable and meaningful.

On Simply Wall St's Community page, millions of investors are already using Narratives to blend their outlook and assumptions about Gentex with up-to-date forecasts, risks, and news. By creating your own Narrative, you can instantly see how your scenario stacks up as the fair value you calculate is directly compared to the latest share price, whether Gentex looks undervalued or overvalued. Importantly, Narratives update automatically when fresh news or quarterly results are released, so your view always reflects what matters now.

For example, one investor might build a bullish Narrative for Gentex based on aggressive margin expansion, rising revenue, and award a fair value of $42.0. A more cautious investor factoring in risks from the China auto market and supply chain disruptions might target just $24.0, highlighting how perspectives, not just calculations, drive smarter decision making.

Do you think there's more to the story for Gentex? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GNTX

Gentex

Designs, develops, manufactures, markets, and supplies digital vision, connected car, dimmable glass, and fire protection products in the United States, China, Germany, Japan, Mexico, the Republic of Korea, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives