- United States

- /

- Auto

- /

- NasdaqCM:GGR

Take Care Before Jumping Onto Gogoro Inc. (NASDAQ:GGR) Even Though It's 29% Cheaper

To the annoyance of some shareholders, Gogoro Inc. (NASDAQ:GGR) shares are down a considerable 29% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 84% loss during that time.

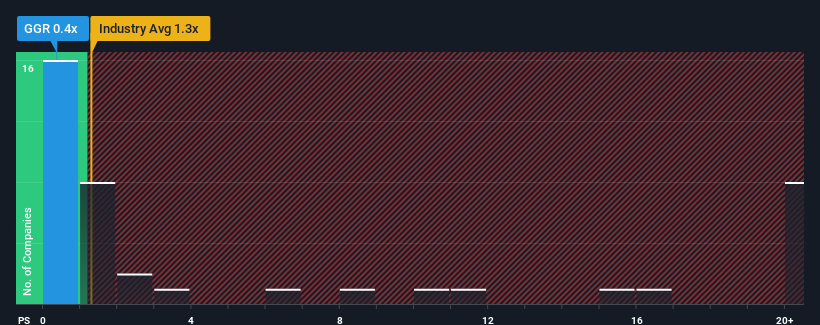

Following the heavy fall in price, Gogoro may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.4x, considering almost half of all companies in the Auto industry in the United States have P/S ratios greater than 1.3x and even P/S higher than 11x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Gogoro

How Has Gogoro Performed Recently?

Gogoro hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Gogoro's future stacks up against the industry? In that case, our free report is a great place to start.How Is Gogoro's Revenue Growth Trending?

In order to justify its P/S ratio, Gogoro would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 8.3%. This means it has also seen a slide in revenue over the longer-term as revenue is down 1.1% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 14% during the coming year according to the three analysts following the company. With the industry predicted to deliver 14% growth , the company is positioned for a comparable revenue result.

In light of this, it's peculiar that Gogoro's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

Gogoro's recently weak share price has pulled its P/S back below other Auto companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Gogoro's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Gogoro that you should be aware of.

If you're unsure about the strength of Gogoro's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:GGR

Gogoro

Engages in the research, development, manufacture, sale, and distribution of electric scooters and bikes, and electric scooter enabling components in Taiwan, India, and internationally.

Fair value with imperfect balance sheet.

Market Insights

Community Narratives