- India

- /

- Real Estate

- /

- NSEI:ARKADE

Top Undiscovered Gems with Strong Fundamentals This September 2024

Reviewed by Simply Wall St

As global markets celebrate the Federal Reserve's recent rate cut, small-cap stocks are gaining renewed attention from investors. The Russell 2000 Index, although still below its all-time high, has shown promising performance in this optimistic environment. In this context, identifying stocks with strong fundamentals becomes crucial. This article highlights three undiscovered gems that stand out due to their robust financial health and potential for growth amidst the current economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mobile Telecommunications | NA | 3.85% | -0.40% | ★★★★★★ |

| Namibia Breweries | 16.64% | 3.90% | 55.88% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| African Rainbow Capital Investments | NA | 37.52% | 38.29% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| AB Akola Group | 83.34% | 22.22% | 28.43% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

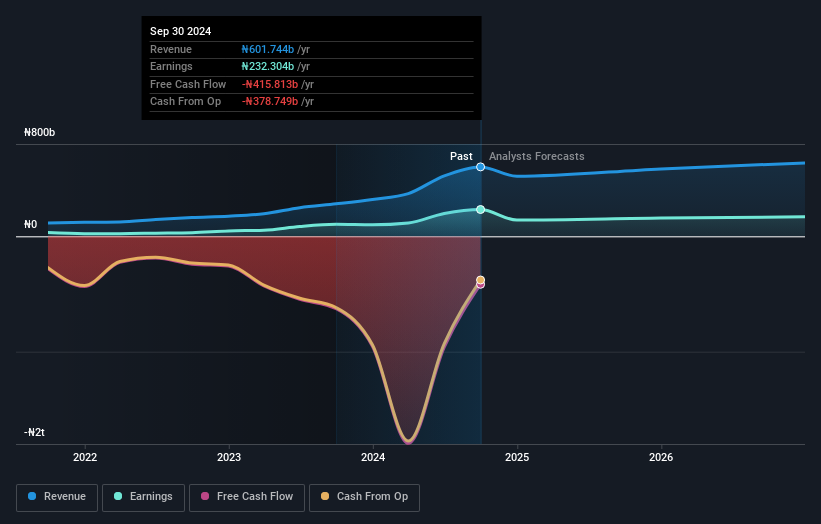

Fidelity Bank (NGSE:FIDELITYBK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Fidelity Bank Plc offers a range of banking products and services to both corporate and individual customers in Nigeria, with a market cap of NGN577.28 billion.

Operations: Fidelity Bank Plc generates revenue through interest income from loans and advances, as well as fees and commissions from various banking services. The bank's net profit margin is 11.23%.

With total assets of NGN7,026.5B and equity at NGN467.1B, Fidelity Bank stands out with a price-to-earnings ratio of 5x, below the market average of 7.6x. Despite high bad loans at 4.1%, its earnings have grown impressively by 34.3% annually over five years and are forecast to grow another 17.3% per year ahead. The bank's liabilities are primarily low-risk customer deposits (72%), ensuring stability amidst growth challenges in the industry.

- Get an in-depth perspective on Fidelity Bank's performance by reading our health report here.

Understand Fidelity Bank's track record by examining our Past report.

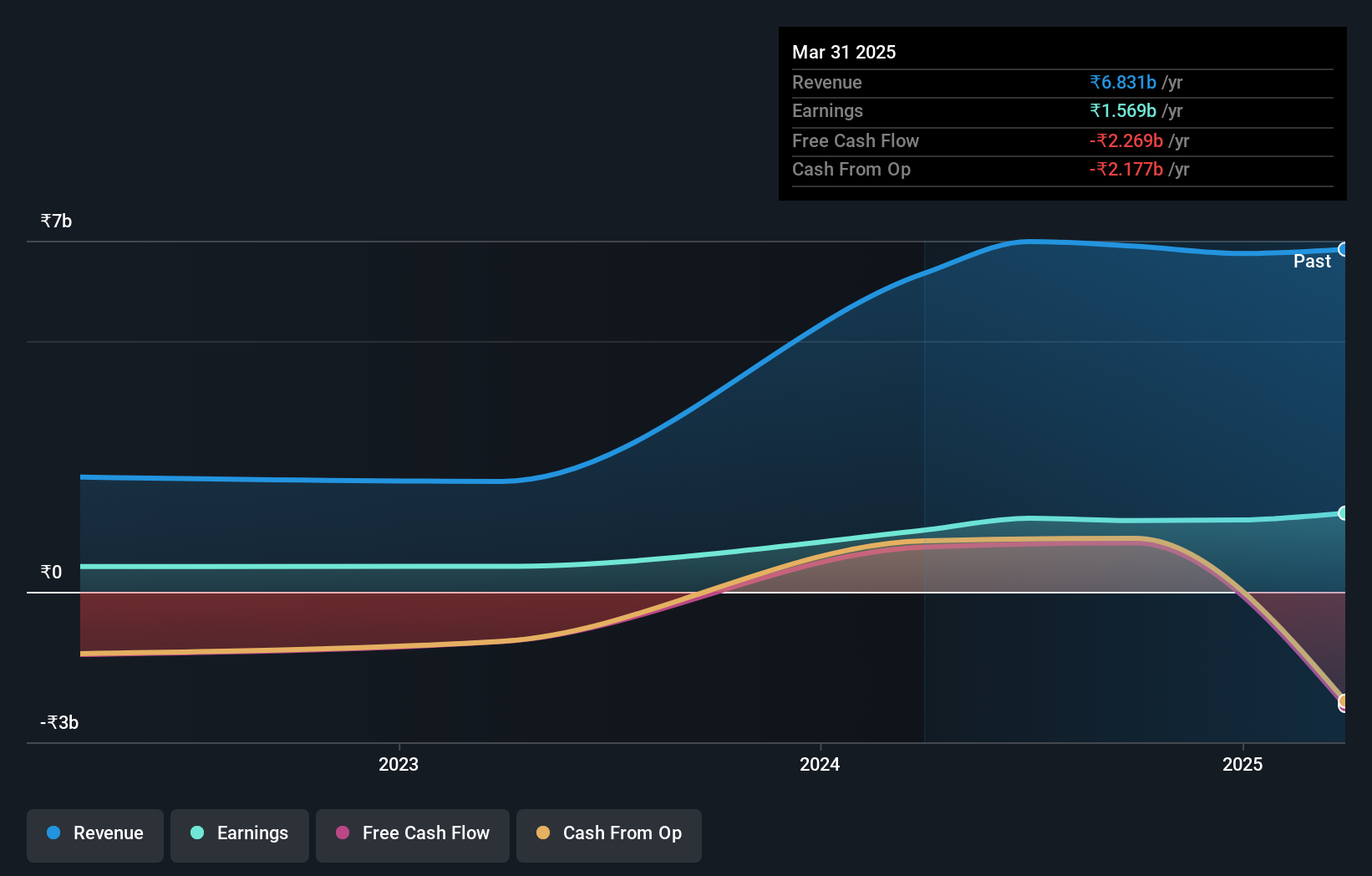

Arkade Developers (NSEI:ARKADE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Arkade Developers Limited is a real estate development company in India with a market capitalization of ₹30.79 billion.

Operations: Arkade generates revenue primarily from its real estate development activities. The company's net profit margin stands at 12.5%.

Arkade Developers, a small cap player in the real estate sector, has shown impressive earnings growth of 142.4% over the past year, outpacing the industry’s 23.8%. The company reported net income of INR 1.23 billion for the full year ending March 2024, up from INR 507.83 million previously. Additionally, Arkade's interest payments are well covered by EBIT at a ratio of 53.5x and it trades at an attractive discount to its estimated fair value by 53.8%.

- Delve into the full analysis health report here for a deeper understanding of Arkade Developers.

Examine Arkade Developers' past performance report to understand how it has performed in the past.

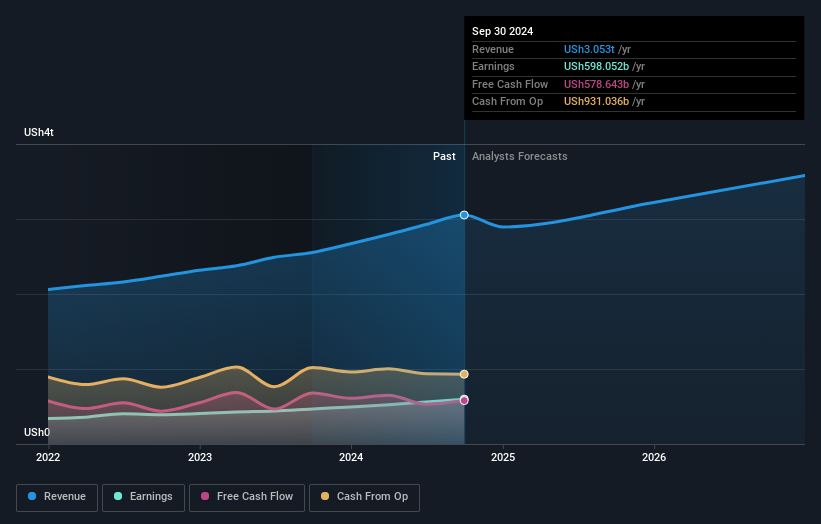

MTN Uganda (UGSE:MTNU)

Simply Wall St Value Rating: ★★★★★☆

Overview: MTN Uganda Limited offers telecommunication and mobile financial services in Uganda, with a market cap of UGX4431.46 billion.

Operations: MTN Uganda generates revenue primarily from telecommunication services and mobile financial services. The cost structure includes network maintenance, customer service, and administrative expenses. The company reported a net profit margin of 11.23% in the latest fiscal year.

MTN Uganda has shown impressive performance with earnings growing 27.3% over the past year, surpassing the Telecom industry’s 24.2%. The company's debt to equity ratio has significantly improved from 112.5% to 18.7% in five years, indicating better financial health. Trading at 5.2% below its estimated fair value and with a net debt to equity ratio of just 9.3%, MTNU appears undervalued and financially stable despite recent share price volatility over three months.

Make It Happen

- Access the full spectrum of 4854 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ARKADE

Arkade Developers

Operates as a real estate development company in India.

Solid track record with excellent balance sheet.