- Taiwan

- /

- Water Utilities

- /

- TPEX:8435

Zimmite Taiwan Ltd.'s (GTSM:8435) Financials Are Too Obscure To Link With Current Share Price Momentum: What's In Store For the Stock?

Zimmite Taiwan's (GTSM:8435) stock up by 4.1% over the past three months. However, the company's financials look a bit inconsistent and market outcomes are ultimately driven by long-term fundamentals, meaning that the stock could head in either direction. Specifically, we decided to study Zimmite Taiwan's ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

View our latest analysis for Zimmite Taiwan

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Zimmite Taiwan is:

15% = NT$106m ÷ NT$706m (Based on the trailing twelve months to September 2020).

The 'return' refers to a company's earnings over the last year. One way to conceptualize this is that for each NT$1 of shareholders' capital it has, the company made NT$0.15 in profit.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Zimmite Taiwan's Earnings Growth And 15% ROE

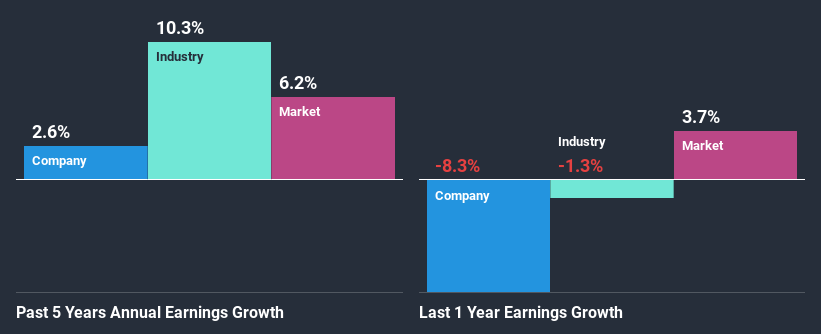

To start with, Zimmite Taiwan's ROE looks acceptable. On comparing with the average industry ROE of 9.4% the company's ROE looks pretty remarkable. However, for some reason, the higher returns aren't reflected in Zimmite Taiwan's meagre five year net income growth average of 2.6%. That's a bit unexpected from a company which has such a high rate of return. We reckon that a low growth, when returns are quite high could be the result of certain circumstances like low earnings retention or poor allocation of capital.

As a next step, we compared Zimmite Taiwan's net income growth with the industry and were disappointed to see that the company's growth is lower than the industry average growth of 7.5% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Zimmite Taiwan's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Zimmite Taiwan Efficiently Re-investing Its Profits?

Zimmite Taiwan has a three-year median payout ratio of 96% (implying that it keeps only 4.1% of its profits), meaning that it pays out most of its profits to shareholders as dividends, and as a result, the company has seen low earnings growth.

Additionally, Zimmite Taiwan has paid dividends over a period of nine years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth.

Summary

In total, we're a bit ambivalent about Zimmite Taiwan's performance. Despite the high ROE, the company has a disappointing earnings growth number, due to its poor rate of reinvestment into its business. Wrapping up, we would proceed with caution with this company and one way of doing that would be to look at the risk profile of the business. Our risks dashboard would have the 2 risks we have identified for Zimmite Taiwan.

If you’re looking to trade Zimmite Taiwan, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Zimmite Taiwan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:8435

Zimmite Taiwan

Engages in the industrial water treatment activities in Taiwan and China.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026