- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:8114

Why Investors Shouldn't Be Surprised By Posiflex Technology, Inc.'s (TWSE:8114) 33% Share Price Surge

Posiflex Technology, Inc. (TWSE:8114) shares have continued their recent momentum with a 33% gain in the last month alone. The annual gain comes to 146% following the latest surge, making investors sit up and take notice.

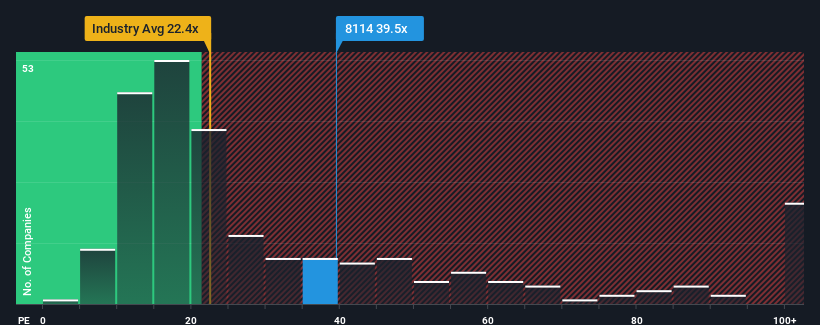

After such a large jump in price, Posiflex Technology may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 39.5x, since almost half of all companies in Taiwan have P/E ratios under 21x and even P/E's lower than 14x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Posiflex Technology hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Check out our latest analysis for Posiflex Technology

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Posiflex Technology's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 13%. Even so, admirably EPS has lifted 154% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 61% as estimated by the four analysts watching the company. That's shaping up to be materially higher than the 25% growth forecast for the broader market.

With this information, we can see why Posiflex Technology is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Posiflex Technology's P/E is flying high just like its stock has during the last month. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Posiflex Technology maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Posiflex Technology that we have uncovered.

You might be able to find a better investment than Posiflex Technology. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:8114

Posiflex Technology

Engages in the manufacture and sale of industrial computers and peripheral equipment in Taiwan, the United States, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives