Stock Analysis

- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:8114

Exploring Three High Growth Tech Stocks With Promising Potential

Reviewed by Simply Wall St

As global markets navigate mixed signals, with the S&P 500 capping off a strong two-year performance despite recent contractions in manufacturing activity and revised GDP forecasts, investors are keeping a keen eye on high-growth sectors like technology. In this landscape, identifying promising tech stocks involves assessing their potential to thrive amid economic fluctuations and leveraging innovation to capture market opportunities.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.23% | 56.37% | ★★★★★★ |

| TG Therapeutics | 29.99% | 44.07% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1254 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Beijing Beetech (SZSE:300667)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Beetech Inc. engages in the production and sale of smart sensors and optoelectronic instrument products, with a market cap of CN¥3.07 billion.

Operations: The company focuses on smart sensors and optoelectronic instruments. Revenue is primarily generated from these product lines, contributing significantly to its financial performance.

Beijing Beetech, recently transitioning to profitability, showcases a robust earnings forecast with an expected annual growth of 55.3%, significantly outpacing the Chinese market's average of 25.1%. Despite a recent dip in revenue to CNY 518.63 million from CNY 565.08 million year-over-year and a shift from net income to a loss of CNY 3.76 million, the firm's aggressive R&D investment aligns with its technological advancements and market positioning. This strategy underpins its potential in an increasingly competitive electronic industry landscape, although it faces challenges like high share price volatility and lower-than-benchmark forecasted return on equity at just 8.1%.

- Click here to discover the nuances of Beijing Beetech with our detailed analytical health report.

Explore historical data to track Beijing Beetech's performance over time in our Past section.

Enplas (TSE:6961)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Enplas Corporation is a company that manufactures and sells semiconductor components, automobile parts, optical communication devices, and life science products in Japan and internationally, with a market cap of ¥44.44 billion.

Operations: The company's revenue streams are primarily driven by its Semiconductor Business, generating ¥16.25 billion, followed by the Energy Saving Solutions Business at ¥13.84 billion. The Digital Communication and Life Science segments contribute ¥5.64 billion and ¥2.58 billion, respectively.

Enplas, navigating the competitive tech landscape, has demonstrated a promising trajectory with an annual revenue growth of 7.9%, outpacing the Japanese market average of 4.2%. Despite facing challenges such as a highly volatile share price over the past three months, the company's commitment to innovation is evident in its R&D spending trends. Notably, Enplas has increased its R&D investments significantly, aligning with an earnings forecast that anticipates a robust growth rate of 21.2% per year. This strategic focus on development could potentially secure its position in high-tech sectors moving forward.

- Take a closer look at Enplas' potential here in our health report.

Gain insights into Enplas' historical performance by reviewing our past performance report.

Posiflex Technology (TWSE:8114)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Posiflex Technology, Inc. manufactures and sells industrial computers and peripheral equipment in Taiwan, the United States, and internationally with a market cap of NT$40.11 billion.

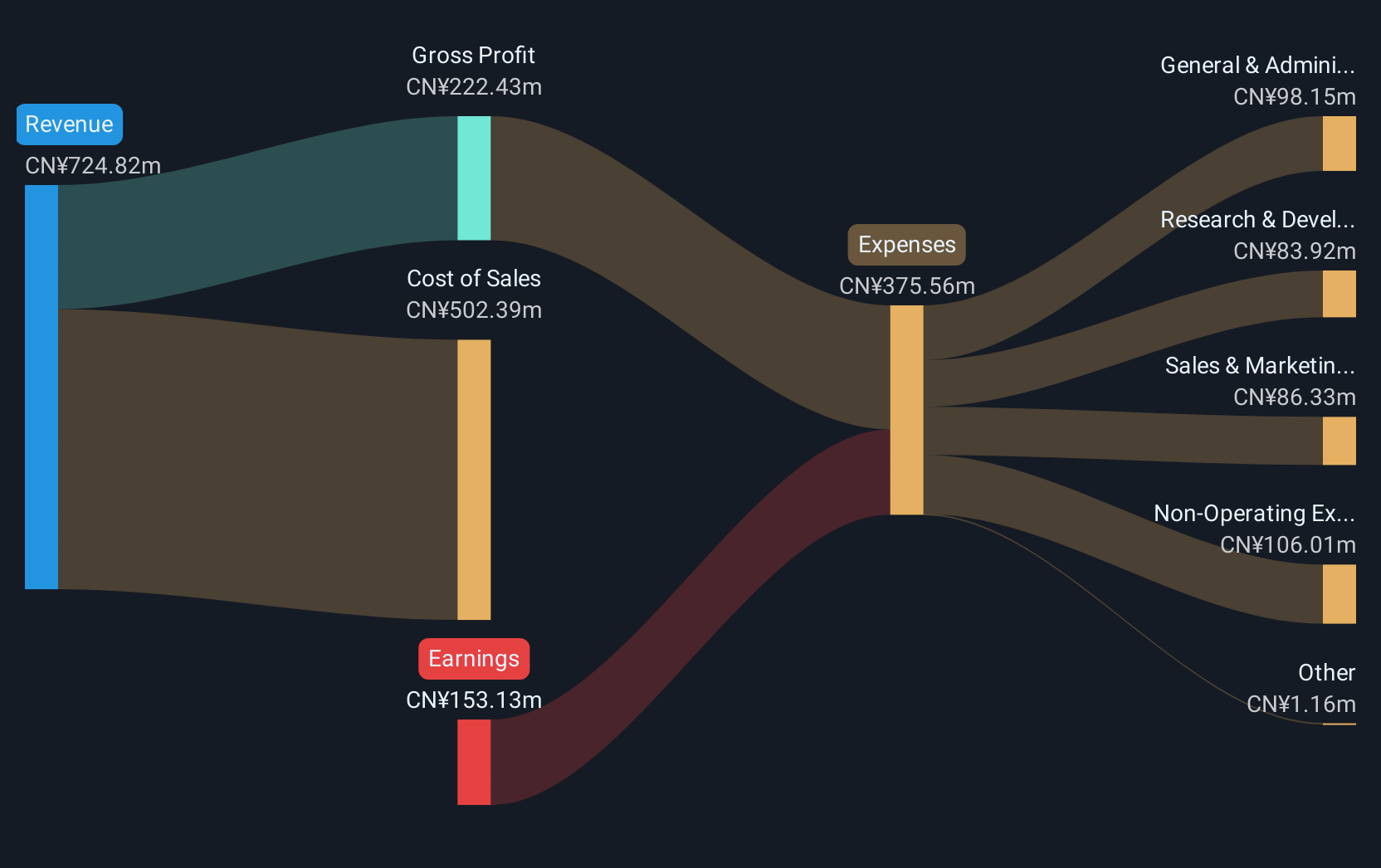

Operations: The company generates revenue primarily from the United States and domestic markets, with sales figures of NT$7 billion and NT$2.51 billion, respectively.

Posiflex Technology has showcased remarkable growth, with a 41.7% increase in sales and a 64.5% surge in net income for the nine-month period ending September 2024, compared to the previous year. This performance is underscored by significant earnings per share growth from TWD 5.2 to TWD 8.02 basic, reflecting robust operational efficiency and market demand. The company's strategic emphasis on R&D is evident as it continues to innovate within the tech sector, aligning with industry trends towards enhanced technological solutions and services that promise sustained revenue streams in an increasingly digital economy.

- Click here and access our complete health analysis report to understand the dynamics of Posiflex Technology.

Assess Posiflex Technology's past performance with our detailed historical performance reports.

Key Takeaways

- Click here to access our complete index of 1254 High Growth Tech and AI Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8114

Posiflex Technology

Engages in the manufacture and sale of industrial computers and peripheral equipment in Taiwan, the United States, and internationally.