- Taiwan

- /

- Tech Hardware

- /

- TWSE:3706

A Piece Of The Puzzle Missing From MiTAC Holdings Corporation's (TWSE:3706) 32% Share Price Climb

Despite an already strong run, MiTAC Holdings Corporation (TWSE:3706) shares have been powering on, with a gain of 32% in the last thirty days. The annual gain comes to 102% following the latest surge, making investors sit up and take notice.

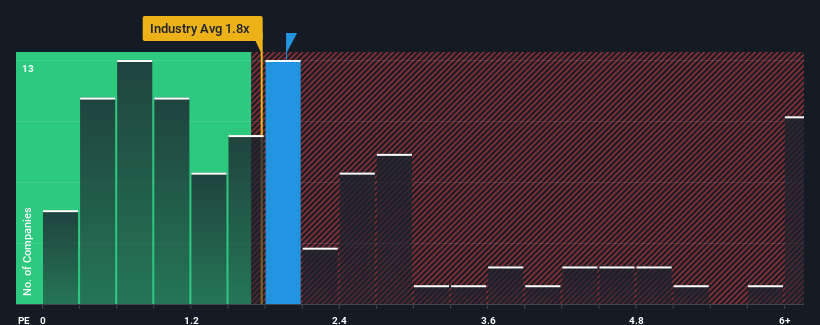

Although its price has surged higher, there still wouldn't be many who think MiTAC Holdings' price-to-sales (or "P/S") ratio of 2x is worth a mention when the median P/S in Taiwan's Tech industry is similar at about 1.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for MiTAC Holdings

What Does MiTAC Holdings' P/S Mean For Shareholders?

Recent times haven't been great for MiTAC Holdings as its revenue has been falling quicker than most other companies. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Want the full picture on analyst estimates for the company? Then our free report on MiTAC Holdings will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, MiTAC Holdings would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 14% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 37% during the coming year according to the only analyst following the company. That's shaping up to be materially higher than the 21% growth forecast for the broader industry.

With this in consideration, we find it intriguing that MiTAC Holdings' P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

MiTAC Holdings appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that MiTAC Holdings currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for MiTAC Holdings that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3706

MiTAC Holdings

Designs, develops, manufactures, and distributes computers and ancillary equipment, and communication related products in Taiwan, Europe, the United States, and internationally.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success