- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3533

Lotes' (TWSE:3533) 47% CAGR outpaced the company's earnings growth over the same five-year period

For many, the main point of investing in the stock market is to achieve spectacular returns. And highest quality companies can see their share prices grow by huge amounts. Just think about the savvy investors who held Lotes Co., Ltd (TWSE:3533) shares for the last five years, while they gained 511%. This just goes to show the value creation that some businesses can achieve. It's even up 11% in the last week. But this might be partly because the broader market had a good week last week, gaining 9.6%. We love happy stories like this one. The company should be really proud of that performance!

Since it's been a strong week for Lotes shareholders, let's have a look at trend of the longer term fundamentals.

View our latest analysis for Lotes

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

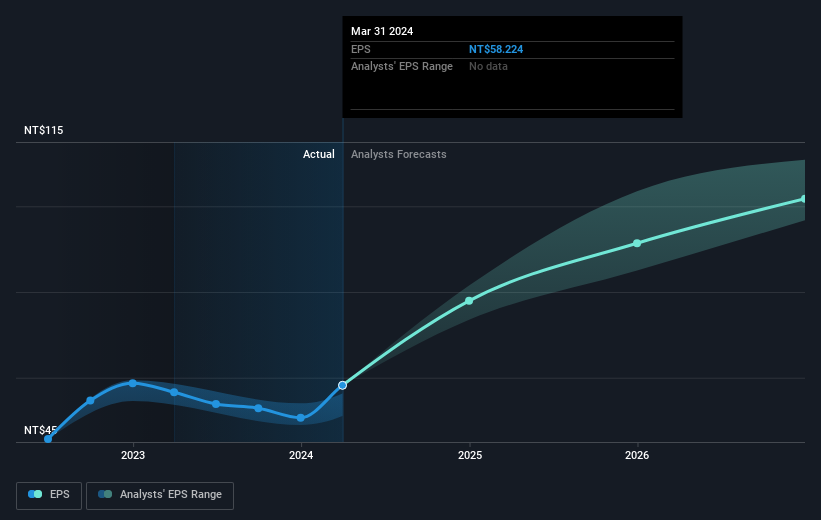

During five years of share price growth, Lotes achieved compound earnings per share (EPS) growth of 27% per year. This EPS growth is slower than the share price growth of 44% per year, over the same period. This suggests that market participants hold the company in higher regard, these days. And that's hardly shocking given the track record of growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Lotes' earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Lotes' TSR for the last 5 years was 586%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Lotes shareholders have received a total shareholder return of 100% over the last year. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 47% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Lotes better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Lotes .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3533

Lotes

Designs, manufactures, and sells electronic interconnect and hardware components in Taiwan, Mainland China, and internationally.

Solid track record with excellent balance sheet.