- Taiwan

- /

- Communications

- /

- TWSE:3062

CyberTAN Technology (TWSE:3062) shareholders are still up 79% over 5 years despite pulling back 16% in the past week

CyberTAN Technology Inc. (TWSE:3062) shareholders have seen the share price descend 21% over the month. But at least the stock is up over the last five years. Unfortunately its return of 76% is below the market return of 142%.

Since the long term performance has been good but there's been a recent pullback of 16%, let's check if the fundamentals match the share price.

Check out our latest analysis for CyberTAN Technology

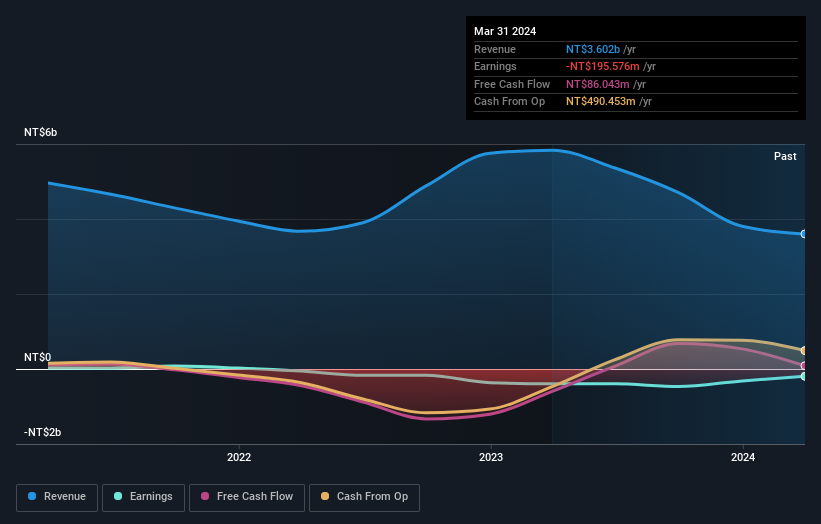

Because CyberTAN Technology made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years CyberTAN Technology saw its revenue shrink by 9.2% per year. The falling revenue is arguably somewhat reflected in the lacklustre return of 12% per year over that time. Arguably that's not bad given the soft revenue and loss-making position. Of course, a closer look at the bottom line - and any available analyst forecasts - could reveal an opportunity (if they point to future growth).

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on CyberTAN Technology's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between CyberTAN Technology's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for CyberTAN Technology shareholders, and that cash payout contributed to why its TSR of 79%, over the last 5 years, is better than the share price return.

A Different Perspective

CyberTAN Technology provided a TSR of 26% over the year. That's fairly close to the broader market return. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 12%. It is possible that management foresight will bring growth well into the future, even if the share price slows down. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - CyberTAN Technology has 2 warning signs (and 1 which is concerning) we think you should know about.

But note: CyberTAN Technology may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3062

CyberTAN Technology

Manufactures and sells broadband and wireless networking equipment in Europe, the United States, Asia, Australia, and internationally.

Adequate balance sheet very low.