- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3019

Earnings Not Telling The Story For Asia Optical Co., Inc. (TWSE:3019) After Shares Rise 32%

The Asia Optical Co., Inc. (TWSE:3019) share price has done very well over the last month, posting an excellent gain of 32%. The last 30 days bring the annual gain to a very sharp 31%.

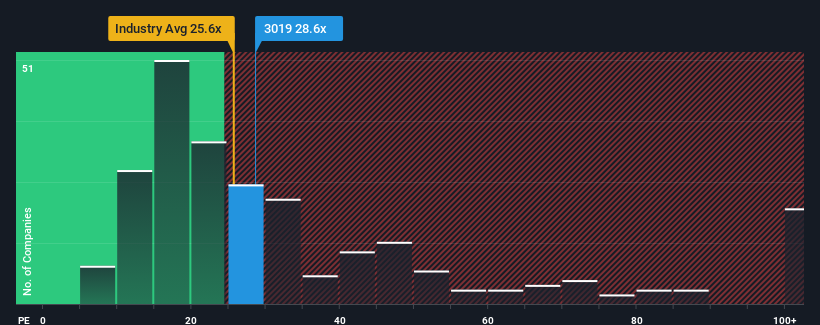

Following the firm bounce in price, given around half the companies in Taiwan have price-to-earnings ratios (or "P/E's") below 23x, you may consider Asia Optical as a stock to potentially avoid with its 28.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

It looks like earnings growth has deserted Asia Optical recently, which is not something to boast about. It might be that many are expecting an improvement to the uninspiring earnings performance over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Asia Optical

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Asia Optical would need to produce impressive growth in excess of the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Fortunately, a few good years before that means that it was still able to grow EPS by 7.1% in total over the last three years. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 24% shows it's noticeably less attractive on an annualised basis.

In light of this, it's alarming that Asia Optical's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Asia Optical's P/E?

Asia Optical's P/E is getting right up there since its shares have risen strongly. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Asia Optical currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 2 warning signs for Asia Optical you should be aware of, and 1 of them doesn't sit too well with us.

You might be able to find a better investment than Asia Optical. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3019

Asia Optical

Manufactures, processes, and sells cameras, riflescopes, photocopier lens, scanner lens and optical components in Taiwan and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives