- Taiwan

- /

- Tech Hardware

- /

- TWSE:3017

High Growth Tech Stocks In Asia To Watch This November 2025

Reviewed by Simply Wall St

As global markets navigate a period of mixed performance, with large-cap tech companies driving gains in the U.S. while smaller-cap indexes face declines, Asia's technology sector is drawing attention amid easing U.S.-China trade tensions and Japan's record stock market highs. In this dynamic environment, identifying high-growth tech stocks involves looking for companies that can capitalize on technological advancements and shifting economic policies to sustain their momentum in an evolving market landscape.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 36.36% | 39.76% | ★★★★★★ |

| Suzhou TFC Optical Communication | 34.14% | 35.43% | ★★★★★★ |

| Zhongji Innolight | 29.30% | 30.93% | ★★★★★★ |

| Accton Technology | 25.14% | 28.54% | ★★★★★★ |

| PharmaEssentia | 34.00% | 50.89% | ★★★★★★ |

| Fositek | 37.36% | 48.39% | ★★★★★★ |

| ASROCK Incorporation | 30.39% | 32.50% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Zhejiang Century Huatong GroupLtd (SZSE:002602)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Century Huatong Group Co., Ltd operates in the auto parts, Internet games, and cloud data sectors both domestically and internationally, with a market cap of CN¥137.30 billion.

Operations: Zhejiang Century Huatong Group Co., Ltd generates revenue through its diverse operations in auto parts, Internet games, and cloud data services. The company's financial performance is influenced by its engagement across these sectors both within China and on an international scale.

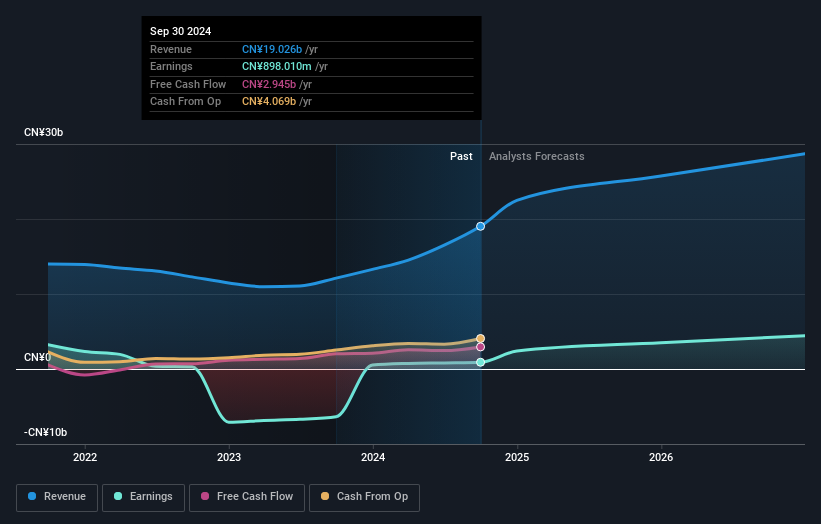

Zhejiang Century Huatong GroupLtd, a prominent figure in the Asian tech landscape, has demonstrated substantial financial growth with a remarkable 319.5% increase in earnings over the past year, outpacing the entertainment industry's average of 16.4%. This surge is supported by robust annual revenue growth of 14.8%, slightly above the Chinese market average of 14.3%. With an expected earnings growth rate of 33.3% per annum, significantly higher than the market forecast of 27%, and a projected return on equity poised to reach 21.9% in three years, the company is well-positioned for sustained profitability despite recent one-off losses totaling CN¥1.8 billion affecting its financials as of September 30, 2025. These figures underscore Zhejiang Century Huatong’s potential within high-growth sectors amid evolving industry dynamics where technology and entertainment increasingly intersect.

Perfect World (SZSE:002624)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Perfect World Co., Ltd. is involved in the research, development, distribution, and operation of online games both in China and internationally, with a market cap of CN¥34.64 billion.

Operations: The company focuses on the creation and global distribution of online games, generating revenue primarily from its gaming operations. A significant portion of its costs is attributed to research and development activities, reflecting its commitment to innovation in the gaming sector.

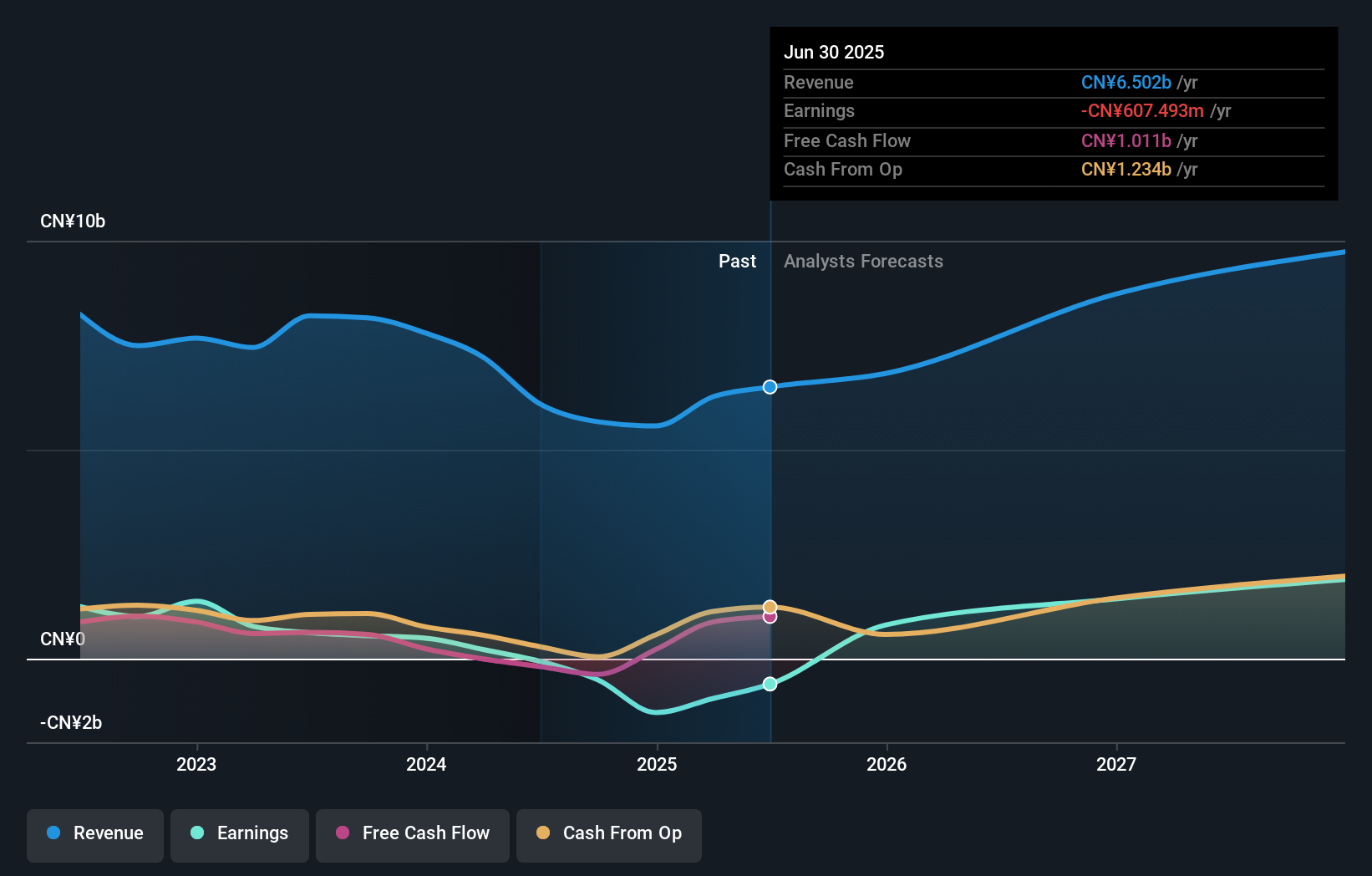

Perfect World Co., Ltd. has pivoted impressively from a net loss to reporting a net income of CN¥665.53 million in the nine months ending September 2025, reflecting an earnings growth of 85.3% annually. This turnaround is underpinned by a robust increase in sales from CN¥4.07 billion to CN¥5.42 billion over the same period, outperforming its previous year's figures significantly. The company's strategic amendments to its articles of association suggest a proactive approach to governance that aligns with its financial trajectory, potentially enhancing investor confidence amidst competitive tech landscapes in Asia.

- Dive into the specifics of Perfect World here with our thorough health report.

Gain insights into Perfect World's past trends and performance with our Past report.

Asia Vital Components (TWSE:3017)

Simply Wall St Growth Rating: ★★★★★★

Overview: Asia Vital Components Co., Ltd. and its subsidiaries specialize in providing thermal solutions globally, with a market capitalization of approximately NT$557.02 billion.

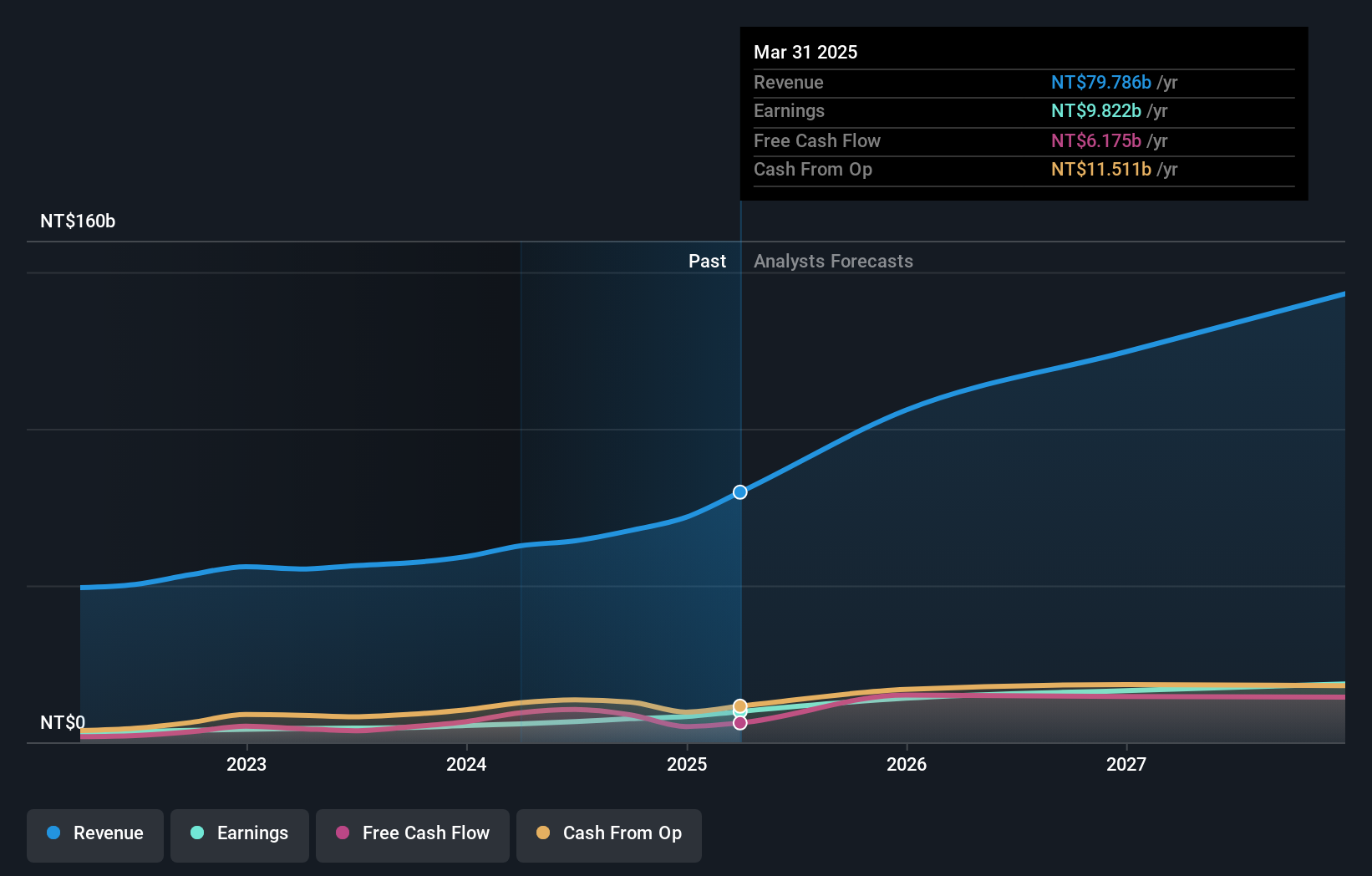

Operations: The company generates revenue primarily through its Overseas Operating Department and Integrated Management Division, with the former contributing NT$106.77 billion and the latter NT$74.12 billion.

Asia Vital Components has demonstrated a robust performance with a notable revenue jump from TWD 31.79 billion to TWD 52.93 billion in the first half of 2025, paralleled by an increase in net income from TWD 3.51 billion to TWD 7.21 billion year-over-year. This financial upswing is underpinned by significant R&D investments, which are crucial for maintaining its competitive edge in the rapidly evolving tech sector of Asia. The company’s active participation in major industry forums and its impressive earnings growth forecast at 32.3% annually suggest strong future prospects, further solidified by an expected revenue growth rate outpacing the TW market's average.

- Click here and access our complete health analysis report to understand the dynamics of Asia Vital Components.

Assess Asia Vital Components' past performance with our detailed historical performance reports.

Key Takeaways

- Delve into our full catalog of 176 Asian High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3017

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives