- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2409

AUO (TWSE:2409) shareholder returns have been splendid, earning 131% in 5 years

It hasn't been the best quarter for AUO Corporation (TWSE:2409) shareholders, since the share price has fallen 11% in that time. But the silver lining is the stock is up over five years. Unfortunately its return of 68% is below the market return of 136%.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

View our latest analysis for AUO

AUO wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years AUO saw its revenue shrink by 2.4% per year. The falling revenue is arguably somewhat reflected in the lacklustre return of 11% per year over that time. Arguably that's not bad given the soft revenue and loss-making position. We'd keep an eye on changes in the trend - there may be an opportunity if the company returns to growth.

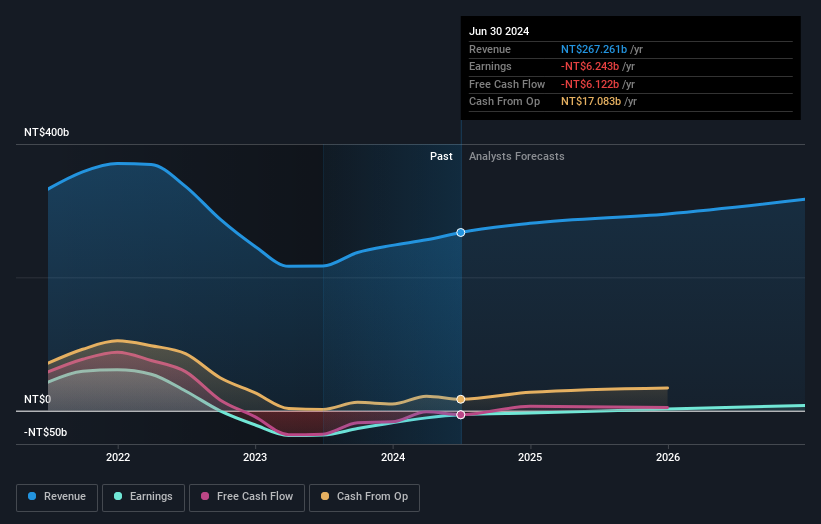

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

AUO is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling AUO stock, you should check out this free report showing analyst consensus estimates for future profits.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of AUO, it has a TSR of 131% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

AUO shareholders gained a total return of 6.9% during the year. Unfortunately this falls short of the market return. On the bright side, the longer term returns (running at about 18% a year, over half a decade) look better. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - AUO has 1 warning sign we think you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2409

AUO

Researches, develops, produces, and sells thin film transistor liquid crystal displays (TFT-LCDs) and other flat panel displays for various applications.

Undervalued with moderate growth potential.