- Taiwan

- /

- Tech Hardware

- /

- TWSE:2399

Recent 11% pullback isn't enough to hurt long-term Biostar Microtech International (TWSE:2399) shareholders, they're still up 96% over 5 years

Biostar Microtech International Corp. (TWSE:2399) shareholders might be concerned after seeing the share price drop 11% in the last week. On the bright side the share price is up over the last half decade. In that time, it is up 79%, which isn't bad, but is below the market return of 142%.

While the stock has fallen 11% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

View our latest analysis for Biostar Microtech International

Biostar Microtech International wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

For the last half decade, Biostar Microtech International can boast revenue growth at a rate of 4.9% per year. Put simply, that growth rate fails to impress. It's probably fair to say that the modest growth is reflected in the modest share price gain of 12% per year. If profitability is likely in the near term, then this might be one to add to your watchlist.

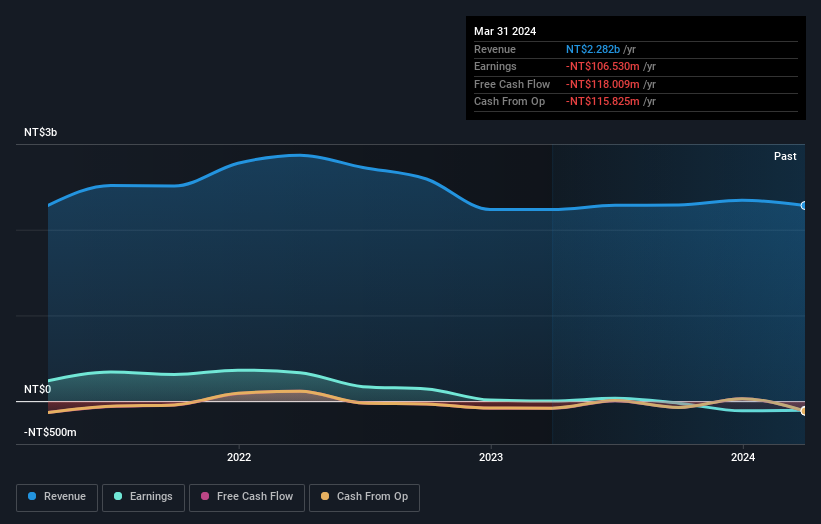

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Biostar Microtech International's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Biostar Microtech International's TSR of 96% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

Biostar Microtech International shareholders are down 11% for the year, but the market itself is up 28%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 14%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

We will like Biostar Microtech International better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Biostar Microtech International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2399

Biostar Microtech International

Engages in the design, development, manufacture, and marketing of various networking solutions in Taiwan and internationally.

Flawless balance sheet minimal.