Stock Analysis

- Taiwan

- /

- Tech Hardware

- /

- TWSE:2377

Micro-Star International (TWSE:2377) shareholders have earned a 21% CAGR over the last five years

Micro-Star International Co., Ltd. (TWSE:2377) shareholders might be concerned after seeing the share price drop 13% in the last month. But the silver lining is the stock is up over five years. In that time, it is up 99%, which isn't bad, but is below the market return of 126%.

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

See our latest analysis for Micro-Star International

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

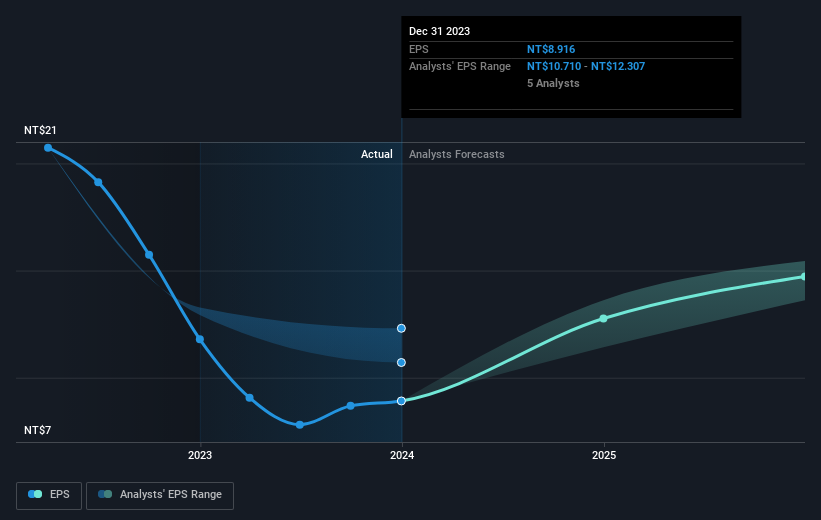

During five years of share price growth, Micro-Star International achieved compound earnings per share (EPS) growth of 4.5% per year. This EPS growth is slower than the share price growth of 15% per year, over the same period. So it's fair to assume the market has a higher opinion of the business than it did five years ago. That's not necessarily surprising considering the five-year track record of earnings growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into Micro-Star International's key metrics by checking this interactive graph of Micro-Star International's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Micro-Star International, it has a TSR of 159% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Micro-Star International provided a TSR of 22% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it's actually better than the average return of 21% over half a decade It is possible that returns will improve along with the business fundamentals. It's always interesting to track share price performance over the longer term. But to understand Micro-Star International better, we need to consider many other factors. For example, we've discovered 1 warning sign for Micro-Star International that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Micro-Star International is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About TWSE:2377

Micro-Star International

Micro-Star International Co., Ltd. manufactures and sells motherboards, interface cards, notebook computers, and other electronic products in Asia, Europe, the United States, and internationally.

Flawless balance sheet and good value.