Stock Analysis

- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2360

Unveiling Three Growth Companies Where Insiders Hold Significant Stakes

Reviewed by Simply Wall St

As global markets continue to navigate through political uncertainties and mixed economic signals, investors are keenly observing the resilience and potential of growth companies. Particularly intriguing are those firms where insiders hold significant stakes, suggesting a strong belief in the company's future prospects amidst current market dynamics.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 15% | 84.1% |

| La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.6% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 101.9% |

| Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

| Vow (OB:VOW) | 31.8% | 97.6% |

| Adocia (ENXTPA:ADOC) | 12.1% | 104.5% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 79.3% |

Here we highlight a subset of our preferred stocks from the screener.

Servyou Software Group (SHSE:603171)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Servyou Software Group Co., Ltd. specializes in providing financial and tax information services in China, with a market capitalization of approximately CN¥8.92 billion.

Operations: The company's primary revenue is derived from financial and tax information services in China.

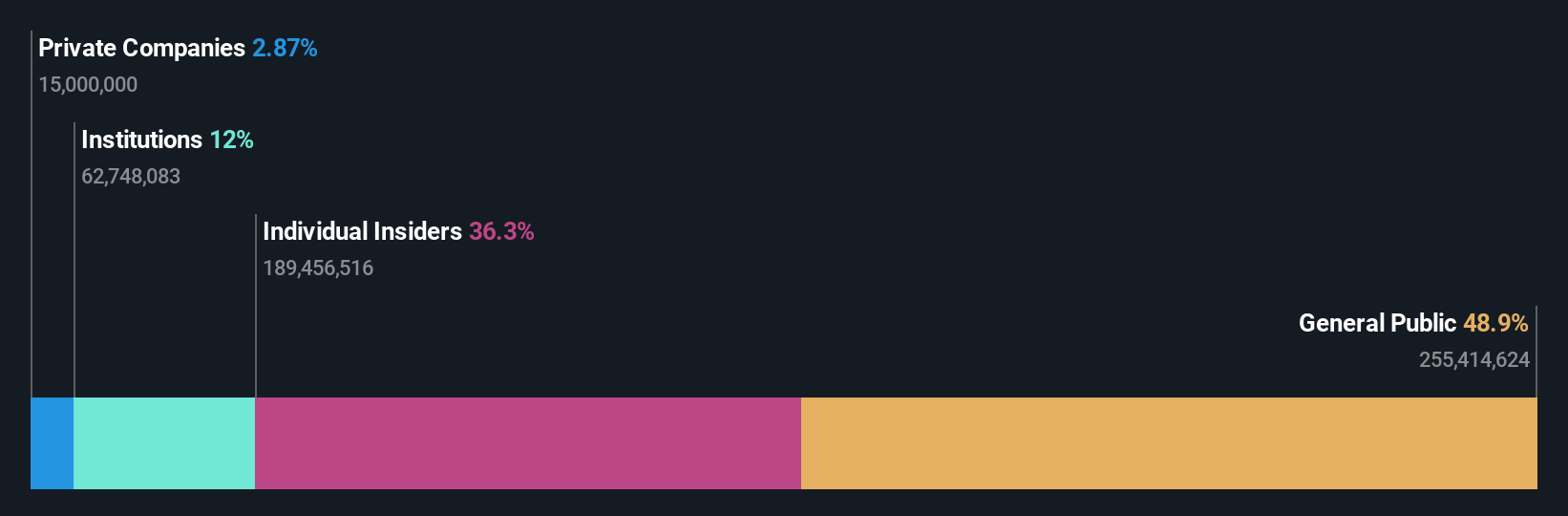

Insider Ownership: 22.8%

Revenue Growth Forecast: 17.7% p.a.

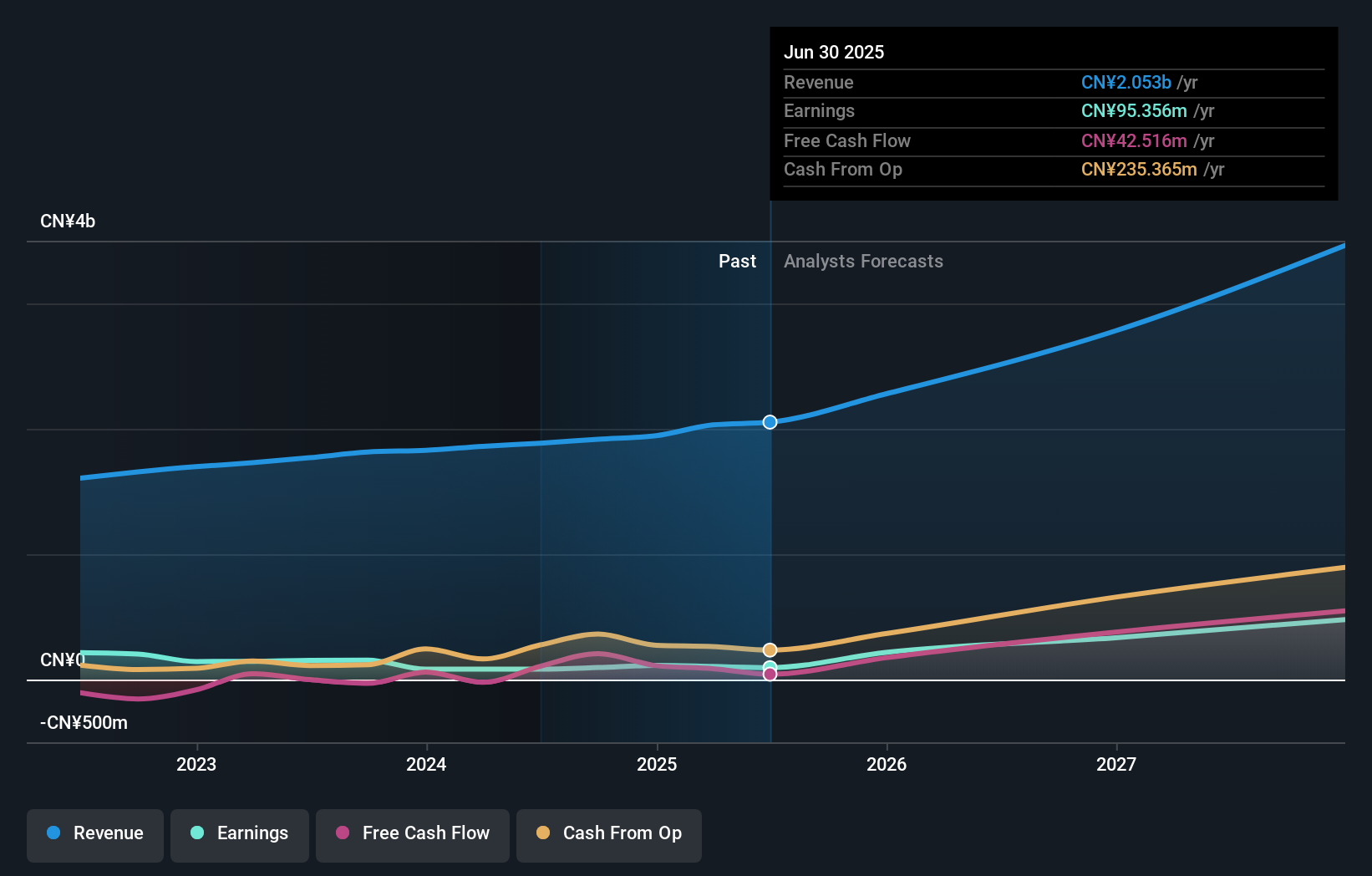

Servyou Software Group has shown a robust financial performance with a steady increase in quarterly and annual revenues, reaching CNY 362.7 million in Q1 2024 and CNY 1.83 billion for the full year of 2023. Despite higher revenues, net income slightly declined to CNY 83.39 million from the previous year's CNY 143.9 million, reflecting lower profit margins now at 4.5% compared to last year’s 8.4%. Analysts predict significant potential with an expected price rise of approximately 52% and earnings forecasted to grow by about 48.75% annually, outpacing the broader Chinese market expectations significantly.

- Dive into the specifics of Servyou Software Group here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential undervaluation of Servyou Software Group shares in the market.

Changsha Jingjia Microelectronics (SZSE:300474)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Changsha Jingjia Microelectronics Co., Ltd. is a company specializing in the development and manufacturing of microelectronics, with a market capitalization of approximately CN¥32.07 billion.

Operations: The revenue segments for the company are not specified in the provided text.

Insider Ownership: 39%

Revenue Growth Forecast: 37.1% p.a.

Changsha Jingjia Microelectronics has demonstrated a promising growth trajectory with its revenue forecast to expand by 37.1% annually, outpacing the broader Chinese market's expected growth. Despite recent improvements in earnings, reducing a substantial net loss from CNY 70.68 million to CNY 11.54 million year-over-year, profit margins remain under pressure at 8.4%, down from last year’s 25%. The company maintains high insider ownership but lacks recent insider buying or selling activity, suggesting stable internal confidence amidst governance adjustments and consistent dividend affirmations.

- Get an in-depth perspective on Changsha Jingjia Microelectronics' performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Changsha Jingjia Microelectronics' current price could be inflated.

Chroma ATE (TWSE:2360)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chroma ATE Inc. operates globally, specializing in the design, manufacture, and maintenance of software and hardware for various electronic test systems and power supplies, with a market capitalization of approximately NT$136.65 billion.

Operations: The company generates revenue primarily from its Measuring Instruments Business, which brought in NT$28.49 billion, and its Automated Transport Engineering segment, contributing NT$1.57 billion.

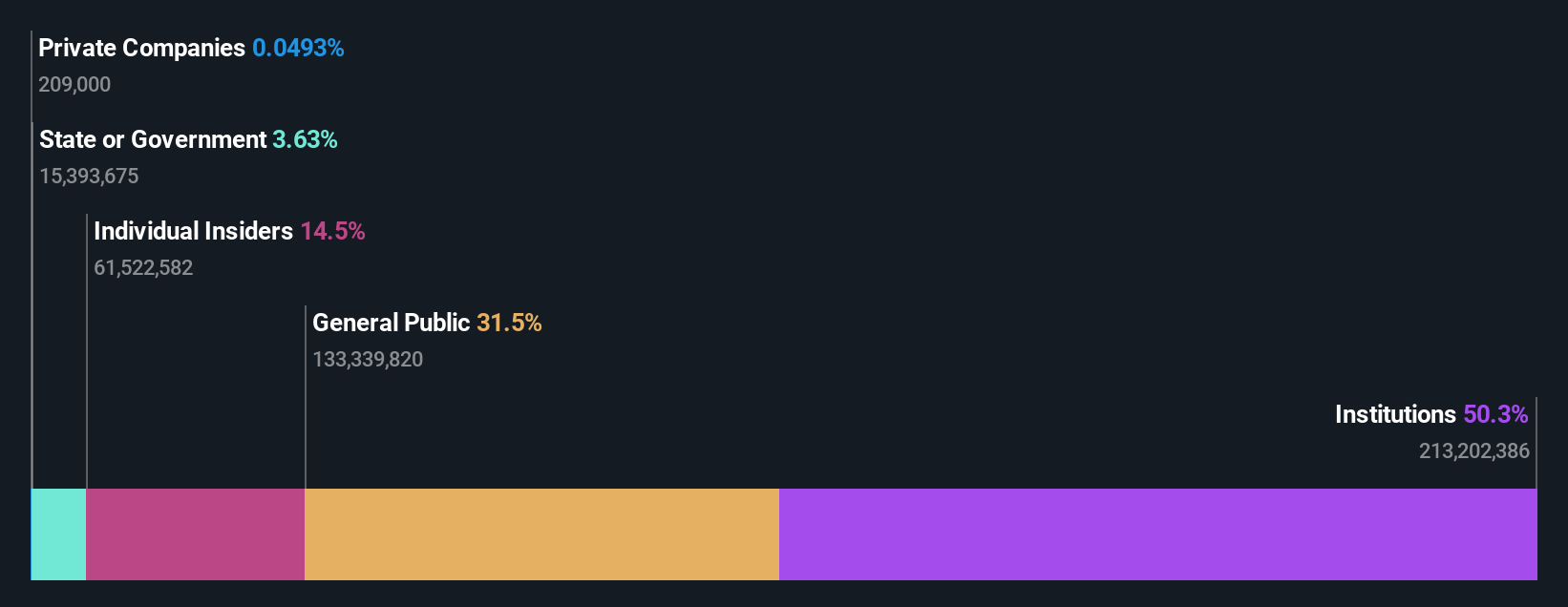

Insider Ownership: 14.5%

Revenue Growth Forecast: 14.0% p.a.

Chroma ATE, a company with significant insider ownership, is set to outperform the Taiwan market with its revenue and earnings growth forecasted at 14% and 19.7% per year, respectively. However, its dividend coverage by cash flows remains weak. Recent activities include presentations at multiple tech conferences and a reported increase in quarterly sales from TWD 56 million to TWD 73 million, alongside slight improvements in net income and earnings per share.

- Click here to discover the nuances of Chroma ATE with our detailed analytical future growth report.

- According our valuation report, there's an indication that Chroma ATE's share price might be on the expensive side.

Next Steps

- Gain an insight into the universe of 1443 Fast Growing Companies With High Insider Ownership by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Chroma ATE is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2360

Chroma ATE

Designs, assembles, manufactures, sells, repairs, and maintains software/hardware for computers and peripherals, computerized automatic test systems, electronic test instruments, signal generators, power supplies, and telecom power supplies in Taiwan, China, the United States, and internationally.

Flawless balance sheet with reasonable growth potential.