Stock Analysis

- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2360

High Growth Tech Stocks To Watch For Potential Investment

Reviewed by Simply Wall St

In recent weeks, global markets have experienced significant movements as U.S. stocks rallied on growth and tax hopes following a major election, with the small-cap Russell 2000 Index leading gains despite not reaching record highs. As investors navigate these dynamic conditions, identifying high-growth tech stocks that align with current market trends can be crucial for those seeking potential investment opportunities amidst evolving economic policies and fiscal changes.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.65% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.66% | ★★★★★★ |

| Travere Therapeutics | 31.19% | 72.58% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1284 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

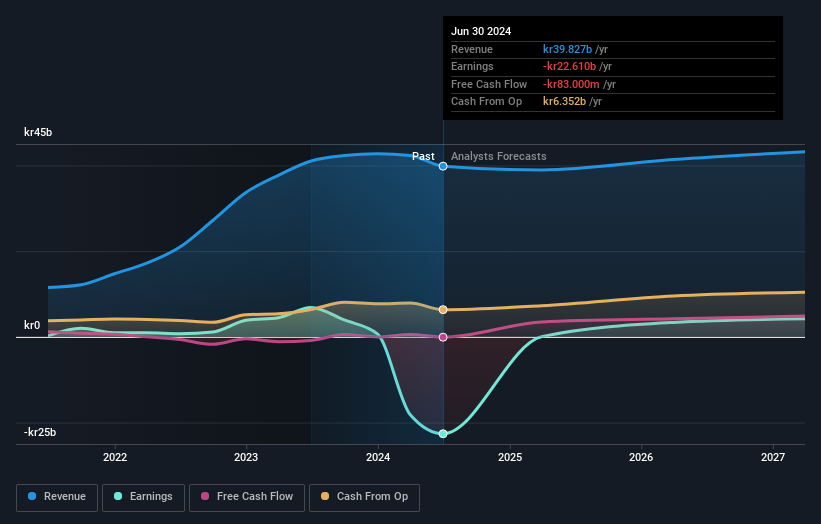

Embracer Group (OM:EMBRAC B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Embracer Group AB (publ) is a global gaming company that develops and publishes games across PC, console, mobile, VR, and board game platforms with a market capitalization of approximately SEK36.58 billion.

Operations: Embracer Group AB generates revenue primarily from PC/console games, tabletop games, mobile games, and entertainment & services. The largest revenue segment is tabletop games at SEK14.65 billion, followed by PC/console games at SEK13.10 billion.

Embracer Group's recent financial performance shows a challenging landscape with a significant shift from a net income of SEK 2.25 billion to a net loss of SEK 2.18 billion year-over-year. Despite these hurdles, the company's strategic R&D investments remain robust, aligning with its commitment to innovation in gaming and entertainment—a sector where technological advancement is crucial. Remarkably, Embracer's earnings are projected to surge by an impressive 104.16% annually, showcasing potential recovery and growth dynamics that could reshape its market stance. The company’s focus on research and development is evident from its financial strategy, which prioritizes reinvestment in technology and content creation over immediate profitability. This approach may well position Embracer as a resilient player in the tech-driven entertainment industry, especially considering its revenue growth forecast at 3.1% per year—outpacing the broader Swedish market significantly at 0.1%. As it navigates through current financial challenges, Embracer's ongoing investment in R&D could be pivotal for long-term success amidst rapidly evolving digital landscapes.

- Navigate through the intricacies of Embracer Group with our comprehensive health report here.

Assess Embracer Group's past performance with our detailed historical performance reports.

JMDC (TSE:4483)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JMDC Inc. offers medical statistics data services in Japan and has a market cap of ¥281.98 billion.

Operations: JMDC Inc. generates revenue primarily from Healthcare-Big Data services, contributing ¥30.73 billion, and Tele-Medicine, which brings in ¥5.90 billion. The company's Dispensing Pharmacy Support segment adds an additional ¥1.25 billion to its revenue streams.

JMDC's strategic focus on R&D is reflected in its robust allocation of funds, signaling a commitment to innovation despite a challenging financial landscape. With an R&D expense trend showing significant investment, the company has earmarked these resources to propel future technologies. This approach is underscored by an anticipated revenue growth of 17.6% annually, slightly under the high-growth threshold but still outpacing the broader Japanese market's 4.2%. Moreover, JMDC's earnings are expected to surge by 24.9% per year, showcasing potential resilience and adaptability in its sector. Recent board discussions on share subscription rights further indicate proactive governance aimed at sustaining growth and shareholder value amidst market volatilities.

- Click here to discover the nuances of JMDC with our detailed analytical health report.

Review our historical performance report to gain insights into JMDC's's past performance.

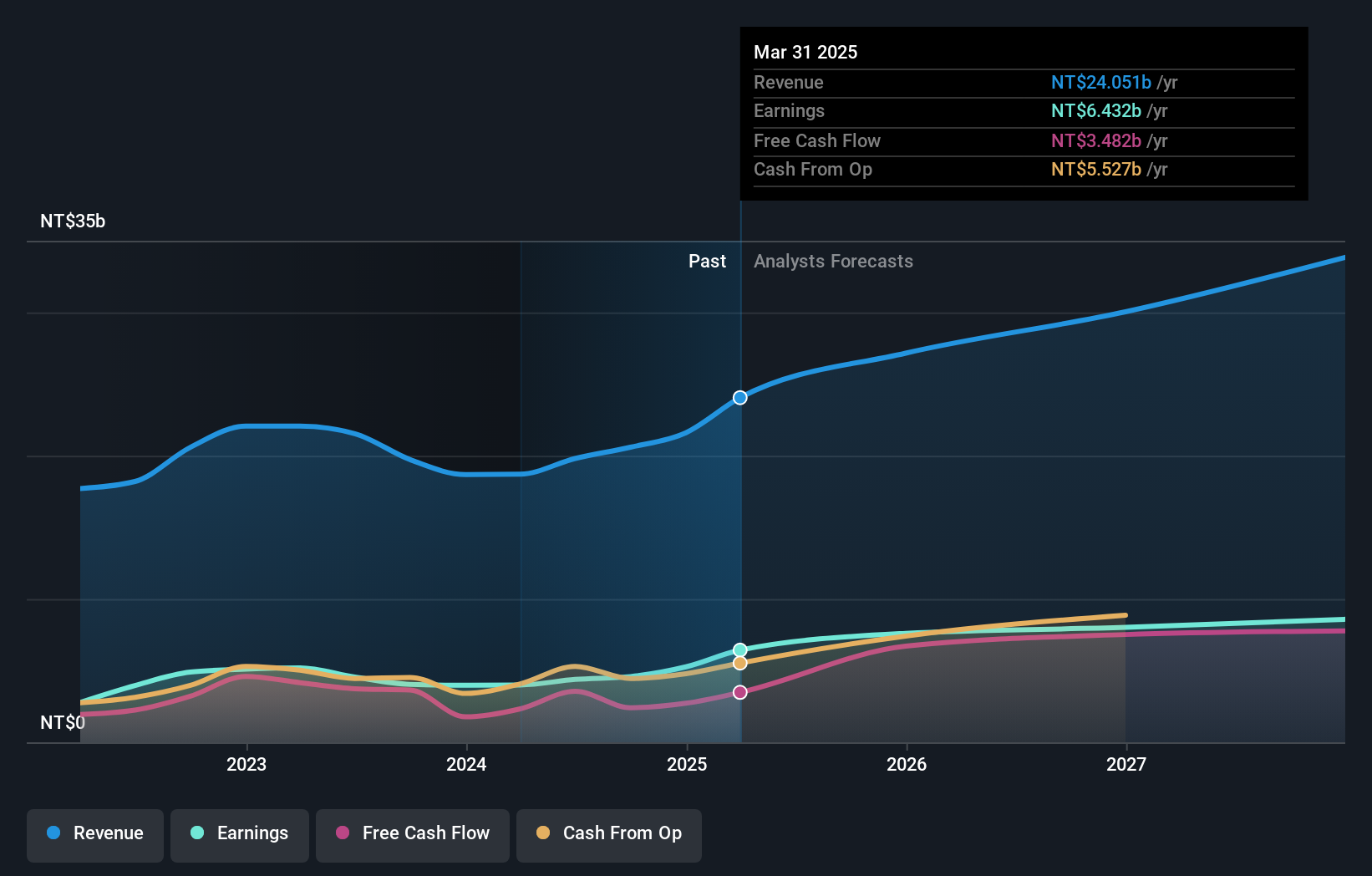

Chroma ATE (TWSE:2360)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chroma ATE Inc. operates in the design, assembly, manufacturing, sales, repair, and maintenance of software/hardware for computers and peripherals as well as various electronic testing systems and power supplies across Taiwan, China, the United States, and internationally with a market cap of NT$186.20 billion.

Operations: The company generates revenue through the design, assembly, and sale of computerized automatic test systems and electronic test instruments. It also provides signal generators and power supplies to a diverse international market.

Chroma ATE's recent performance underscores its robust position in the tech sector, with third-quarter sales surging to TWD 78 million from TWD 55 million year-over-year and net income climbing to TWD 1,426 million. This financial upswing is part of a broader trend, where the company's annual revenue growth is projected at 16.3%, notably surpassing Taiwan's market average of 12.8%. Furthermore, Chroma ATE is not just enhancing its bottom line but also investing heavily in innovation; R&D expenditures have been pivotal in driving these gains, aligning with anticipated earnings growth of 25% per annum. This strategic emphasis on research not only fuels current advancements but sets a solid groundwork for sustained technological leadership.

- Click to explore a detailed breakdown of our findings in Chroma ATE's health report.

Gain insights into Chroma ATE's past trends and performance with our Past report.

Make It Happen

- Click through to start exploring the rest of the 1281 High Growth Tech and AI Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2360

Chroma ATE

Designs, assembles, manufactures, sells, repairs, and maintains software/hardware for computers and peripherals, computerized automatic test systems, electronic test instruments, signal generators, power supplies, and telecom power supplies in Taiwan, China, the United States, and internationally.