Stock Analysis

- United States

- /

- Entertainment

- /

- NYSE:SE

High Growth Tech Highlights Three Promising Stocks

Reviewed by Simply Wall St

As global markets experience fluctuations, with U.S. indices reaching new highs amid mixed economic signals and inflation concerns, the tech sector continues to capture attention due to its potential for rapid growth and innovation. In this context, identifying promising stocks involves evaluating companies that not only demonstrate strong earnings prospects but also possess the agility to navigate evolving market dynamics effectively.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| Sarepta Therapeutics | 23.67% | 43.83% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 27.18% | 69.88% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1271 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Pharma Mar (BME:PHM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pharma Mar, S.A. is a biopharmaceutical company focused on the research, development, production, and commercialization of bio-active principles for oncology applications across various international markets including Europe and the United States, with a market cap of approximately €1.16 billion.

Operations: Pharma Mar's primary revenue stream is derived from its oncology segment, generating approximately €194.09 million. The company operates across multiple international markets, including Europe and the United States.

Pharma Mar's recent clinical trial results for Zepzelca® in combination with atezolizumab show promising potential, indicating a significant improvement in survival rates for lung cancer patients, which could enhance its market position upon European approval. Despite a slight dip in half-year sales to €42.02 million from €44.53 million, the company's revenue remained stable at €80.84 million. Looking ahead, Pharma Mar is poised for growth with earnings expected to surge by 55.1% annually and R&D expenses consistently fueling innovation, aligning with an anticipated profitability within three years and a robust return on equity forecasted at 35.5%.

- Take a closer look at Pharma Mar's potential here in our health report.

Explore historical data to track Pharma Mar's performance over time in our Past section.

Sea (NYSE:SE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sea Limited operates in digital entertainment, e-commerce, and digital financial services across Southeast Asia, Latin America, and other international markets with a market cap of $55.61 billion.

Operations: Sea Limited generates revenue through its digital entertainment, e-commerce, and digital financial services operations across various international markets. The company focuses on delivering a diverse range of services in these sectors to cater to the needs of its global customer base.

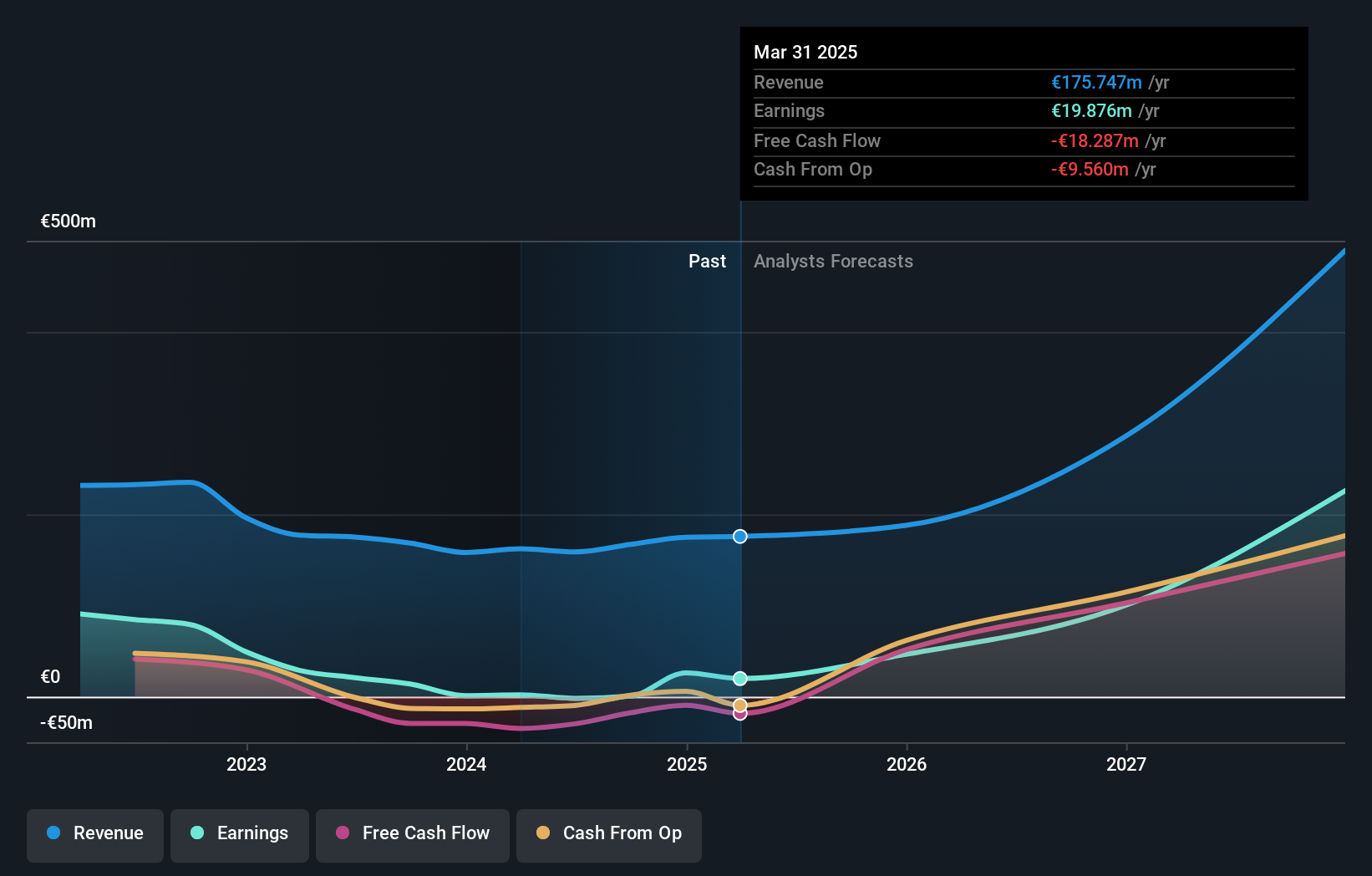

Despite recent challenges, Sea Limited is navigating through a transformative phase with strategic board changes and robust R&D investments. The company's revenue growth forecast at 12.6% annually signals a steady climb, albeit slower than some high-flying sectors. Notably, earnings are projected to surge by 49.8% per year, positioning Sea for future profitability. This growth trajectory is supported by an aggressive R&D focus which saw expenses of $200 million last quarter alone, underscoring their commitment to innovation and market expansion.

- Click to explore a detailed breakdown of our findings in Sea's health report.

Review our historical performance report to gain insights into Sea's's past performance.

Chroma ATE (TWSE:2360)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chroma ATE Inc. is involved in designing, assembling, manufacturing, selling, repairing, and maintaining software and hardware for computers and peripherals as well as various electronic test instruments and power supplies across Taiwan, China, the United States, and internationally with a market cap of NT$169.47 billion.

Operations: Chroma ATE Inc. primarily generates revenue from its Measuring Instruments Business, contributing NT$29.52 billion, alongside its Automated Transport Engineering segment at NT$1.58 billion. The company operates in Taiwan, China, the United States, and internationally, focusing on the design and manufacturing of various electronic test instruments and power supplies.

Chroma ATE is distinguishing itself in the tech sector with a robust commitment to innovation, as evidenced by its R&D spending which aligns closely with its revenue growth. With an impressive 14.1% annual revenue increase and earnings projected to grow by 21.7% each year, Chroma ATE is effectively leveraging its research initiatives to stay ahead in competitive markets. This strategy is further validated during their recent presentations at major industry conferences, signaling strong future prospects through continuous engagement and visibility within the tech community. Their recent financial performance underscores this trajectory, with second-quarter revenues up significantly from the previous year to TWD 5.52 billion and net income rising to TWD 1.41 billion, reflecting a strategic alignment of R&D expenditures that fuel growth and innovation.

Make It Happen

- Gain an insight into the universe of 1271 High Growth Tech and AI Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SE

Sea

Engages in the digital entertainment, e-commerce, and digital financial service businesses in Southeast Asia, Latin America, rest of Asia, and internationally.