- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2317

Here's Why Hon Hai Precision Industry (TWSE:2317) Has Caught The Eye Of Investors

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Hon Hai Precision Industry (TWSE:2317). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Hon Hai Precision Industry

Hon Hai Precision Industry's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So EPS growth can certainly encourage an investor to take note of a stock. Over the last year, Hon Hai Precision Industry increased its EPS from NT$10.25 to NT$10.99. That's a modest gain of 7.2%.

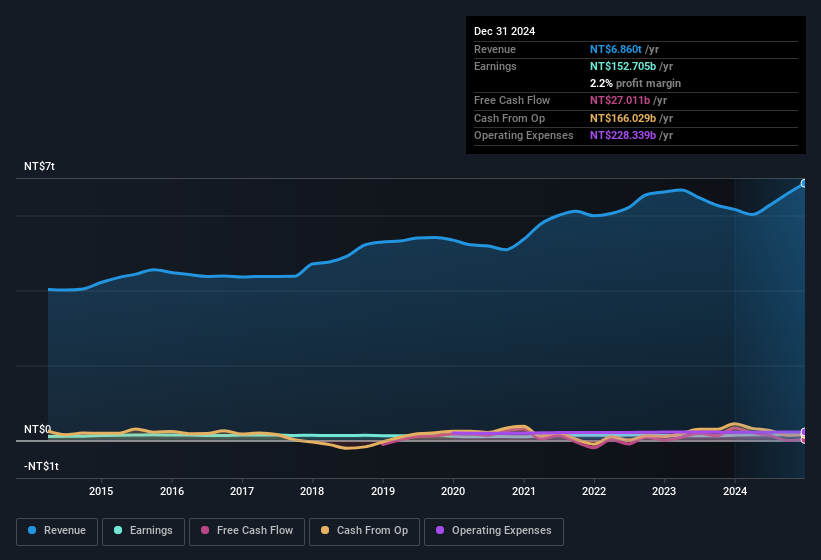

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for Hon Hai Precision Industry remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 11% to NT$6.9t. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Hon Hai Precision Industry's future profits.

Are Hon Hai Precision Industry Insiders Aligned With All Shareholders?

Since Hon Hai Precision Industry has a market capitalisation of NT$2.3t, we wouldn't expect insiders to hold a large percentage of shares. But we do take comfort from the fact that they are investors in the company. We note that their impressive stake in the company is worth NT$286b. This totals to 13% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

Should You Add Hon Hai Precision Industry To Your Watchlist?

One important encouraging feature of Hon Hai Precision Industry is that it is growing profits. To add an extra spark to the fire, significant insider ownership in the company is another highlight. These two factors are a huge highlight for the company which should be a strong contender your watchlists. What about risks? Every company has them, and we've spotted 1 warning sign for Hon Hai Precision Industry you should know about.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Taiwanese companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hon Hai Precision Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2317

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives