Stock Analysis

- United Arab Emirates

- /

- Construction

- /

- DIFX:OC

Examining 3 Leading Dividend Stocks Yielding Up To 7.9%

Reviewed by Simply Wall St

As global markets show signs of resilience, with major U.S. indices like the Dow Jones and S&P 500 reaching new heights amidst moderating inflation concerns, investors may find solace in dividend stocks which provide potential income stability. In this context, examining leading dividend stocks yielding up to 7.9% could be particularly appealing for those looking to balance growth with income generation in their investment portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.09% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 8.65% | ★★★★★★ |

| Globeride (TSE:7990) | 4.02% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.41% | ★★★★★★ |

| Sonae SGPS (ENXTLS:SON) | 5.84% | ★★★★★★ |

| Allianz (XTRA:ALV) | 5.23% | ★★★★★★ |

| HITO-Communications HoldingsInc (TSE:4433) | 3.52% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.63% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.41% | ★★★★★★ |

| Innotech (TSE:9880) | 4.05% | ★★★★★★ |

Click here to see the full list of 1895 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Orascom Construction (DIFX:OC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orascom Construction PLC is an engineering and construction contractor serving public and private clients across the United States, the Middle East, Africa, and Central Asia, with a market capitalization of approximately $636.11 million.

Operations: Orascom Construction PLC generates its revenues by providing engineering and construction services across various regions including the United States, the Middle East, Africa, and Central Asia.

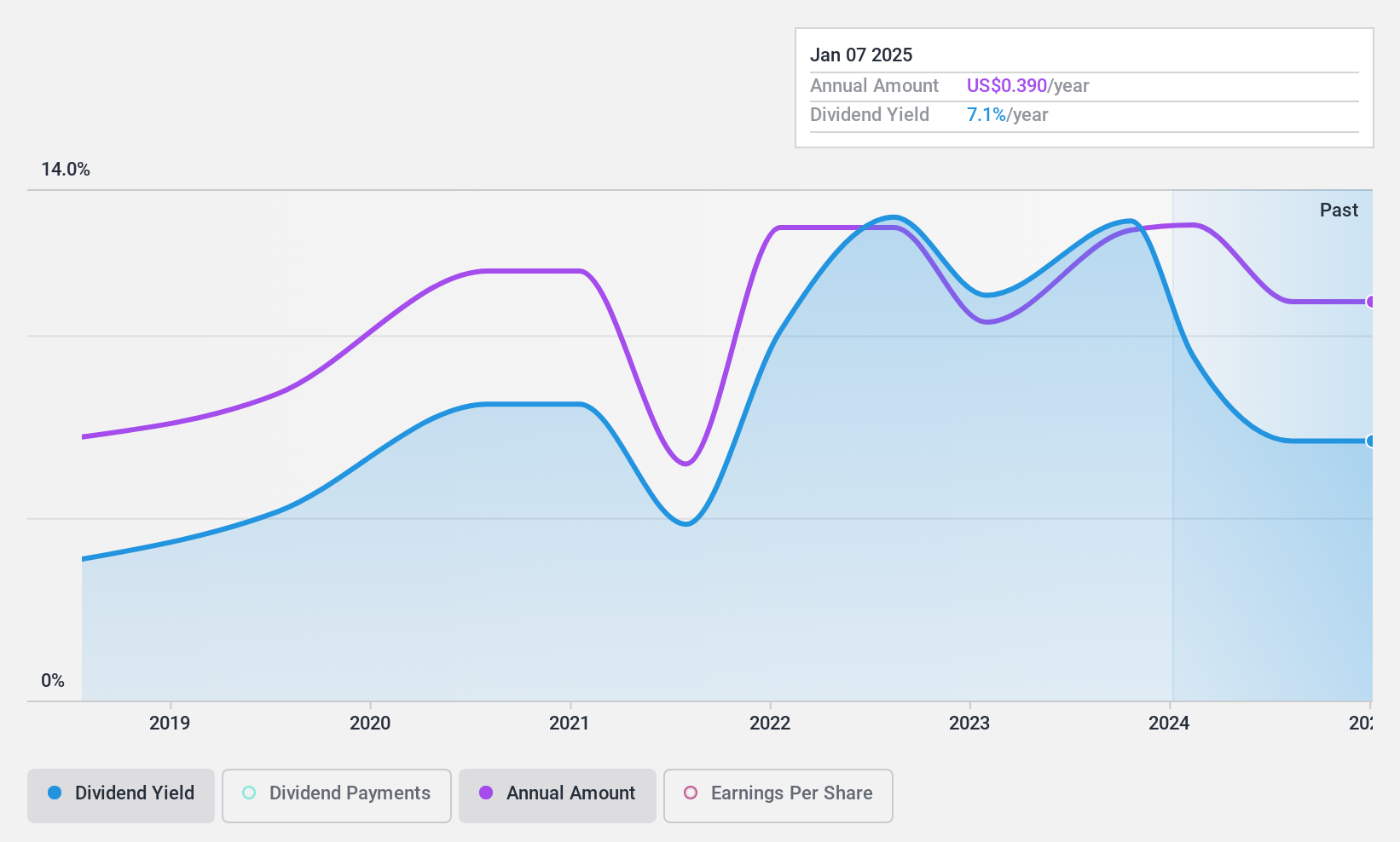

Dividend Yield: 8%

Orascom Construction's dividend, yielding 7.97%, ranks in the top 25% of its market, supported by a low payout ratio of 27.8% and a cash payout ratio of 9.4%, indicating strong coverage by both earnings and cash flow. Despite this, the company has a history of unstable dividends over its six years of payments with volatility noted in annual distributions. Recent financials show an increase in net income to US$46.1 million for Q1 2024 from US$36.1 million year-over-year, suggesting some earnings strength despite forecasts predicting an average earnings decline of 12.4% annually over the next three years.

- Unlock comprehensive insights into our analysis of Orascom Construction stock in this dividend report.

- According our valuation report, there's an indication that Orascom Construction's share price might be on the cheaper side.

Planet Technology (TPEX:6263)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Planet Technology Corporation specializes in IP-based networking products and solutions for various business scales and network infrastructures across Europe, the United States, Asia, and globally, with a market capitalization of NT$11.13 billion.

Operations: Planet Technology Corporation generates revenue primarily through the sale of IP-based networking products and solutions across Europe, the United States, Asia, and other global markets.

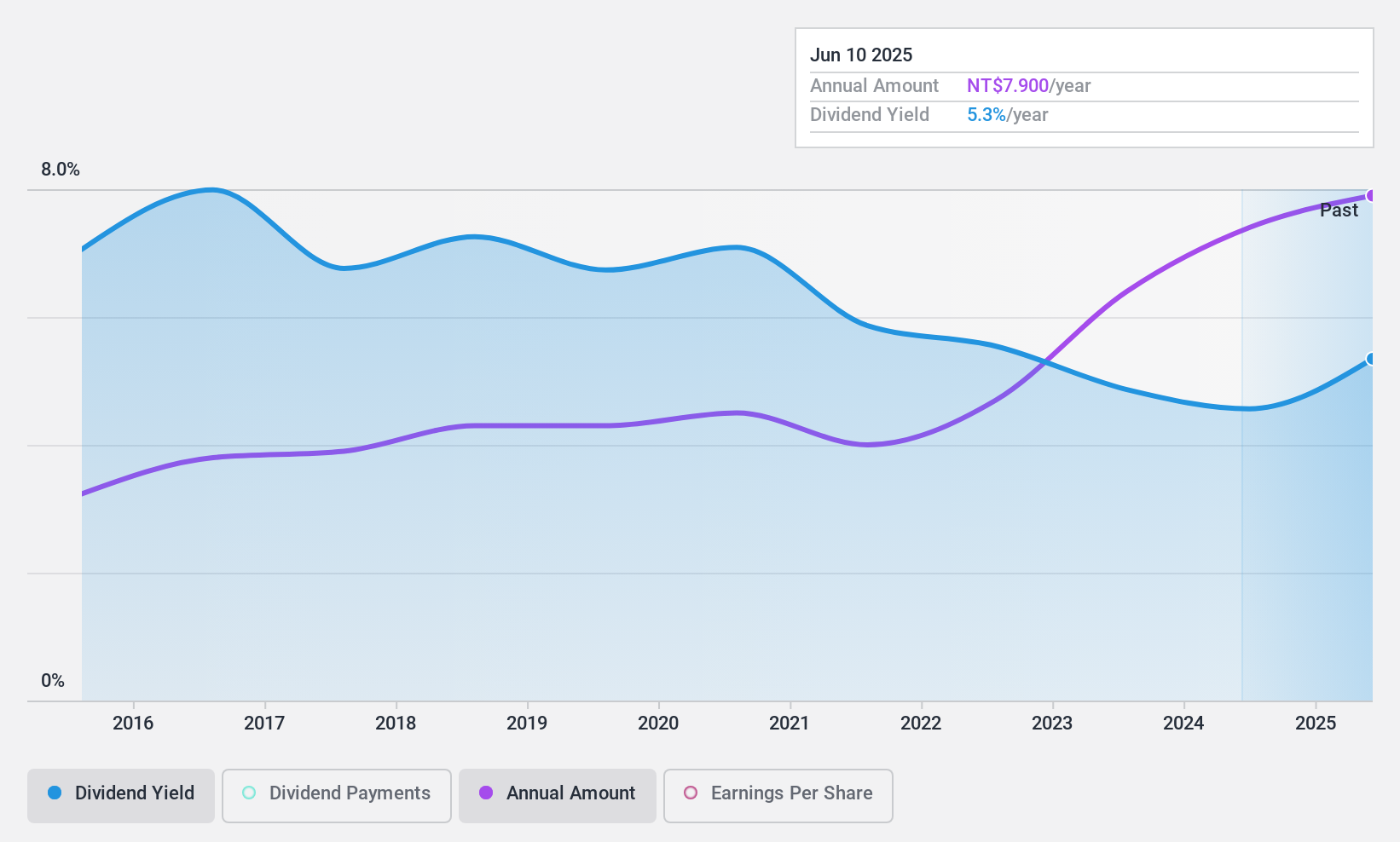

Dividend Yield: 3.6%

Planet Technology offers a consistent dividend yield of 3.6%, with dividends well-covered by both earnings and cash flow, showcasing payout ratios of 76.4% and 81.3% respectively. Despite its lower yield relative to the top quartile in the TW market, the company has demonstrated a decade-long commitment to growing and stabilizing dividends, recently proposing a TWD 7.4 per share dividend for FY2023, totaling TWD 462.51 million in payouts to shareholders.

- Take a closer look at Planet Technology's potential here in our dividend report.

- The valuation report we've compiled suggests that Planet Technology's current price could be inflated.

Lite-On Technology (TWSE:2301)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lite-On Technology Corporation operates in the research, design, development, manufacture, and sale of modules and system solutions, with a market capitalization of approximately NT$257.66 billion.

Operations: Lite-On Technology Corporation generates revenue primarily through three segments: Cloud and IoT, which brought in NT$49.83 billion; Optoelectronic at NT$29.77 billion; and Information and Consumer Electronics, contributing NT$64.73 billion.

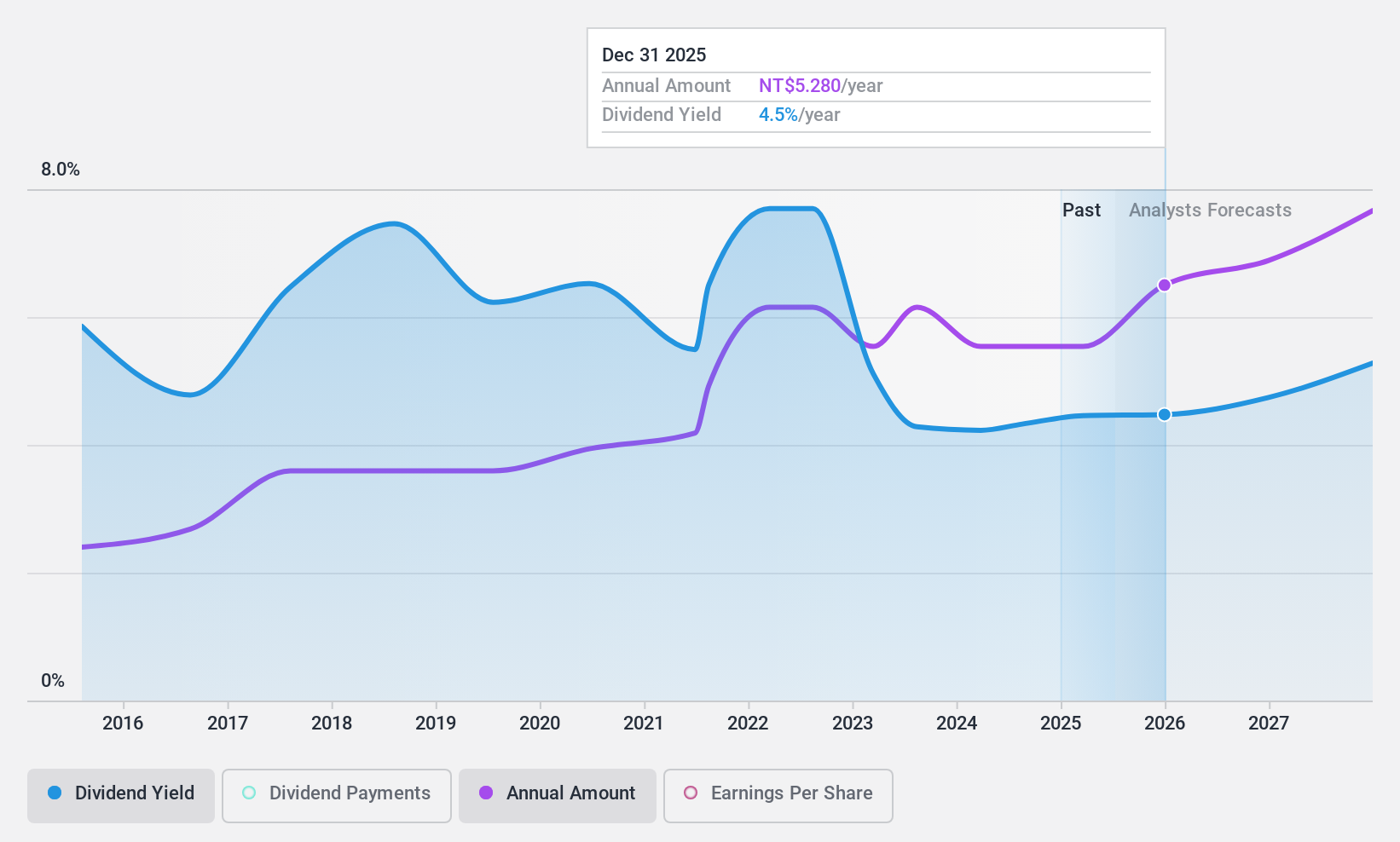

Dividend Yield: 3.9%

Lite-On Technology Corporation has experienced a slight increase in net income and earnings per share in Q1 2024 compared to the previous year, despite a decline in sales and revenue. The company's dividends, with a recent substantial payout from retained earnings, are covered by cash flows (Cash Payout Ratio: 58.7%) but have shown volatility over the past decade. Lite-On is trading at an attractive Price-To-Earnings ratio of 18x, below the Taiwan market average of 22.2x, but its dividend yield of 3.93% is lower than the top quartile of Taiwanese dividend payers at 4.37%. Recent strategic expansions and partnerships indicate potential for future growth avenues.

- Click to explore a detailed breakdown of our findings in Lite-On Technology's dividend report.

- Our valuation report here indicates Lite-On Technology may be undervalued.

Turning Ideas Into Actions

- Unlock our comprehensive list of 1895 Top Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Orascom Construction is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DIFX:OC

Orascom Construction

Operates as an engineering and construction contractor in the United States, the Middle East, Africa, and Central Asia for public and private clients.

Solid track record with excellent balance sheet and pays a dividend.