- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:8105

Health Check: How Prudently Does Giantplus Technology (TPE:8105) Use Debt?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Giantplus Technology Co., Ltd. (TPE:8105) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Giantplus Technology

What Is Giantplus Technology's Net Debt?

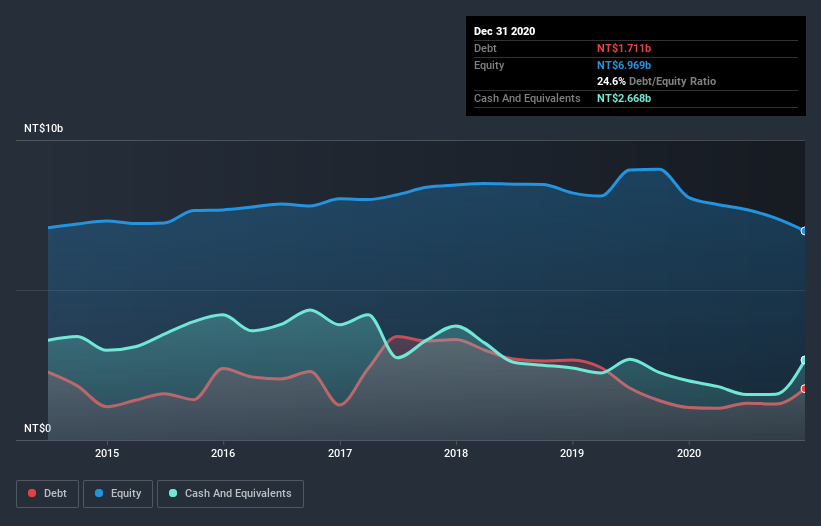

The image below, which you can click on for greater detail, shows that at December 2020 Giantplus Technology had debt of NT$1.71b, up from NT$1.08b in one year. But it also has NT$2.67b in cash to offset that, meaning it has NT$956.4m net cash.

A Look At Giantplus Technology's Liabilities

The latest balance sheet data shows that Giantplus Technology had liabilities of NT$3.78b due within a year, and liabilities of NT$767.2m falling due after that. On the other hand, it had cash of NT$2.67b and NT$1.40b worth of receivables due within a year. So it has liabilities totalling NT$482.2m more than its cash and near-term receivables, combined.

Of course, Giantplus Technology has a market capitalization of NT$6.69b, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. Despite its noteworthy liabilities, Giantplus Technology boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But it is Giantplus Technology's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Giantplus Technology made a loss at the EBIT level, and saw its revenue drop to NT$7.2b, which is a fall of 19%. We would much prefer see growth.

So How Risky Is Giantplus Technology?

Statistically speaking companies that lose money are riskier than those that make money. And we do note that Giantplus Technology had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of NT$98m and booked a NT$1.1b accounting loss. Given it only has net cash of NT$956.4m, the company may need to raise more capital if it doesn't reach break-even soon. Overall, we'd say the stock is a bit risky, and we're usually very cautious until we see positive free cash flow. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. We've identified 1 warning sign with Giantplus Technology , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade Giantplus Technology, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:8105

Giantplus Technology

Engages in the research, development, production, and sale of liquid crystal displays in Taiwan, China, Hong Kong, Macau, Europe, Japan, the United States, and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026