- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6449

Returns On Capital At Apaq Technology (TPE:6449) Paint An Interesting Picture

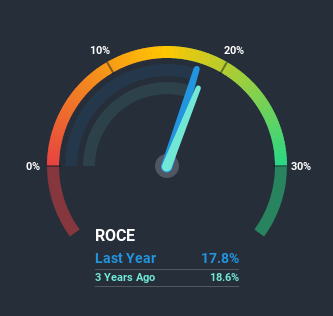

What trends should we look for it we want to identify stocks that can multiply in value over the long term? Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. With that in mind, the ROCE of Apaq Technology (TPE:6449) looks decent, right now, so lets see what the trend of returns can tell us.

Return On Capital Employed (ROCE): What is it?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Apaq Technology is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.18 = NT$368m ÷ (NT$3.9b - NT$1.8b) (Based on the trailing twelve months to September 2020).

Thus, Apaq Technology has an ROCE of 18%. In absolute terms, that's a satisfactory return, but compared to the Electronic industry average of 10% it's much better.

View our latest analysis for Apaq Technology

In the above chart we have measured Apaq Technology's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Apaq Technology.

How Are Returns Trending?

While the returns on capital are good, they haven't moved much. The company has consistently earned 18% for the last five years, and the capital employed within the business has risen 58% in that time. Since 18% is a moderate ROCE though, it's good to see a business can continue to reinvest at these decent rates of return. Over long periods of time, returns like these might not be too exciting, but with consistency they can pay off in terms of share price returns.

On a separate but related note, it's important to know that Apaq Technology has a current liabilities to total assets ratio of 47%, which we'd consider pretty high. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.The Key Takeaway

To sum it up, Apaq Technology has simply been reinvesting capital steadily, at those decent rates of return. On top of that, the stock has rewarded shareholders with a remarkable 149% return to those who've held over the last five years. So while investors seem to be recognizing these promising trends, we still believe the stock deserves further research.

On a final note, we found 2 warning signs for Apaq Technology (1 is a bit unpleasant) you should be aware of.

While Apaq Technology isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

When trading Apaq Technology or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:6449

Apaq Technology

Researches, develops, manufactures, and sells electronic components in China and Taiwan.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives