- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:5215

Will Ko Ja (Cayman) (TPE:5215) Repeat Its Return Growth Of The Past?

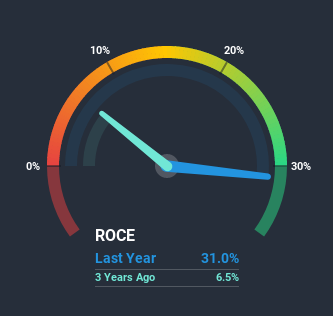

If you're looking for a multi-bagger, there's a few things to keep an eye out for. One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. Speaking of which, we noticed some great changes in Ko Ja (Cayman)'s (TPE:5215) returns on capital, so let's have a look.

Return On Capital Employed (ROCE): What is it?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Ko Ja (Cayman):

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.31 = NT$844m ÷ (NT$3.7b - NT$1.0b) (Based on the trailing twelve months to September 2020).

So, Ko Ja (Cayman) has an ROCE of 31%. That's a fantastic return and not only that, it outpaces the average of 10% earned by companies in a similar industry.

See our latest analysis for Ko Ja (Cayman)

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Ko Ja (Cayman)'s past further, check out this free graph of past earnings, revenue and cash flow.

What The Trend Of ROCE Can Tell Us

Ko Ja (Cayman) has not disappointed with their ROCE growth. More specifically, while the company has kept capital employed relatively flat over the last five years, the ROCE has climbed 185% in that same time. Basically the business is generating higher returns from the same amount of capital and that is proof that there are improvements in the company's efficiencies. The company is doing well in that sense, and it's worth investigating what the management team has planned for long term growth prospects.

The Bottom Line On Ko Ja (Cayman)'s ROCE

As discussed above, Ko Ja (Cayman) appears to be getting more proficient at generating returns since capital employed has remained flat but earnings (before interest and tax) are up. Since the stock has returned a staggering 338% to shareholders over the last five years, it looks like investors are recognizing these changes. In light of that, we think it's worth looking further into this stock because if Ko Ja (Cayman) can keep these trends up, it could have a bright future ahead.

If you want to know some of the risks facing Ko Ja (Cayman) we've found 3 warning signs (1 is concerning!) that you should be aware of before investing here.

If you'd like to see other companies earning high returns, check out our free list of companies earning high returns with solid balance sheets here.

If you decide to trade Ko Ja (Cayman), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Ko Ja (Cayman) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:5215

Ko Ja (Cayman)

Designs and manufactures service of membrane touch switches, back light modules, light guide plates and silicone rubber domes in Mainland China, Taiwan, and internationally.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Industrialist of the Skies – Scaling with "Automotive DNA

The "End-to-End" Space Prime – The Only Real Competitor to SpaceX

De-Risked Production Ramp with Exceptional Silver Price Leverage

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026