- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3049

HannsTouch Solution (TPE:3049) Takes On Some Risk With Its Use Of Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies HannsTouch Solution Incorporated (TPE:3049) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for HannsTouch Solution

What Is HannsTouch Solution's Debt?

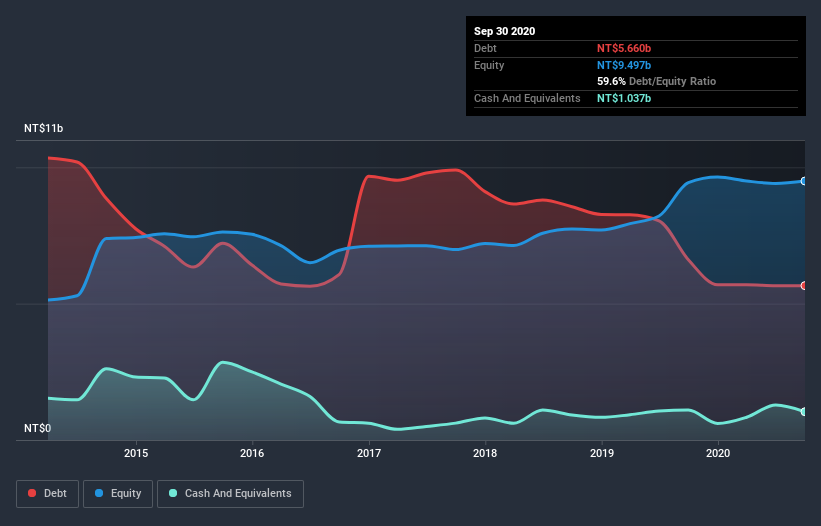

The image below, which you can click on for greater detail, shows that HannsTouch Solution had debt of NT$5.66b at the end of September 2020, a reduction from NT$6.61b over a year. However, because it has a cash reserve of NT$1.04b, its net debt is less, at about NT$4.62b.

How Healthy Is HannsTouch Solution's Balance Sheet?

The latest balance sheet data shows that HannsTouch Solution had liabilities of NT$647.2m due within a year, and liabilities of NT$5.86b falling due after that. Offsetting these obligations, it had cash of NT$1.04b as well as receivables valued at NT$309.4m due within 12 months. So it has liabilities totalling NT$5.16b more than its cash and near-term receivables, combined.

HannsTouch Solution has a market capitalization of NT$9.00b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

HannsTouch Solution has a debt to EBITDA ratio of 3.3 and its EBIT covered its interest expense 4.3 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Worse, HannsTouch Solution's EBIT was down 53% over the last year. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. There's no doubt that we learn most about debt from the balance sheet. But it is HannsTouch Solution's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, HannsTouch Solution actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

Neither HannsTouch Solution's ability to grow its EBIT nor its net debt to EBITDA gave us confidence in its ability to take on more debt. But its conversion of EBIT to free cash flow tells a very different story, and suggests some resilience. When we consider all the factors discussed, it seems to us that HannsTouch Solution is taking some risks with its use of debt. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 3 warning signs for HannsTouch Solution you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade HannsTouch Solution, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if HannsTouch Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:3049

HannsTouch Holdings

Manufactures and sells touch sensors in Taiwan, South Korea, China, and Europe.

Imperfect balance sheet and overvalued.

Market Insights

Community Narratives