- Taiwan

- /

- Tech Hardware

- /

- TWSE:2301

Investors Don't See Light At End Of Lite-On Technology Corporation's (TPE:2301) Tunnel

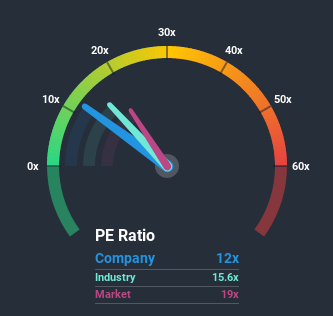

With a price-to-earnings (or "P/E") ratio of 12x Lite-On Technology Corporation (TPE:2301) may be sending bullish signals at the moment, given that almost half of all companies in Taiwan have P/E ratios greater than 19x and even P/E's higher than 35x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Lite-On Technology certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Lite-On Technology

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Lite-On Technology's is when the company's growth is on track to lag the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 9.8% last year. The latest three year period has also seen an excellent 256% overall rise in EPS, aided somewhat by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the ten analysts covering the company suggest earnings should grow by 5.1% over the next year. That's shaping up to be materially lower than the 24% growth forecast for the broader market.

With this information, we can see why Lite-On Technology is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Lite-On Technology's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 1 warning sign for Lite-On Technology that we have uncovered.

If you're unsure about the strength of Lite-On Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you’re looking to trade Lite-On Technology, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:2301

Lite-On Technology

Engages in the research, design, development, manufacture, and sale of modules and system solutions.

Flawless balance sheet, undervalued and pays a dividend.