- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:8069

Three High Growth Tech Stocks in Asia to Watch

Reviewed by Simply Wall St

Amid escalating geopolitical tensions and fluctuating trade dynamics, Asian markets have been navigating a complex landscape, with mixed performances across key indices such as the Nikkei 225 and China's CSI 300. In this environment, identifying high-growth tech stocks requires careful consideration of companies that demonstrate resilience and innovation in response to shifting economic conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.78% | 30.32% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 24.47% | 25.73% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Linklogis (SEHK:9959)

Simply Wall St Growth Rating: ★★★★☆☆

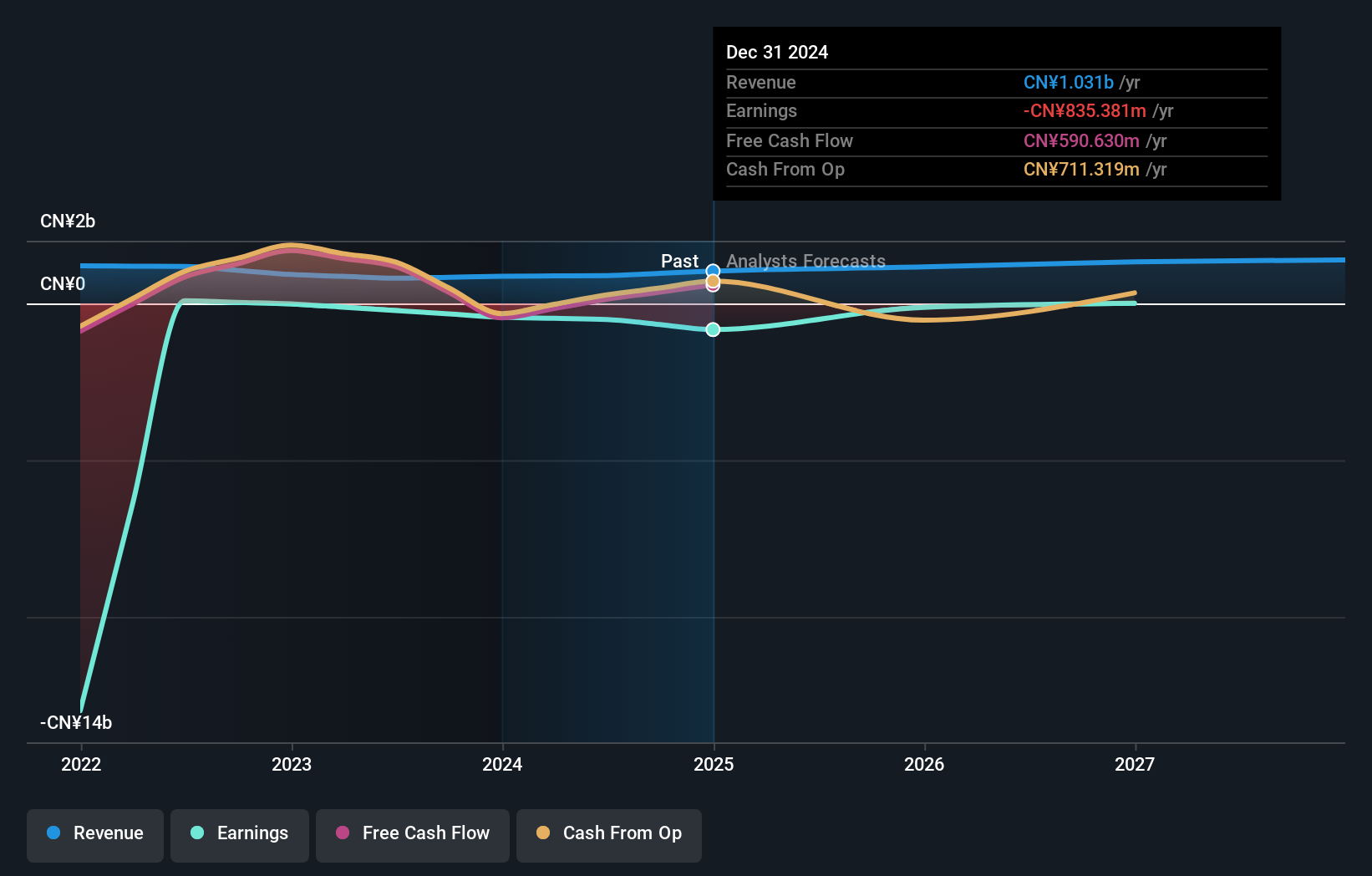

Overview: Linklogis Inc. is an investment holding company that provides supply chain finance technology and data-driven emerging solutions in the People’s Republic of China, with a market capitalization of HK$4.28 billion.

Operations: The company's primary revenue streams are derived from its Supply Chain Finance Technology Solutions, with Anchor Cloud contributing CN¥663.66 million and FI Cloud generating CN¥306.89 million. Emerging Solutions add to the revenue through Cross-Border Cloud at CN¥51.06 million and SME Credit Tech Solutions at CN¥9.57 million, highlighting a diverse income model within the supply chain finance sector in China.

Linklogis, despite its recent challenges with a net loss reported for the year ended December 31, 2024, is poised for significant transformation. The company's revenue growth is outpacing the Hong Kong market average at 10.6% annually, indicating robust potential in its operational strategy. Moreover, anticipated amendments to corporate governance and bylaws align with modern regulatory standards and could enhance investor confidence. With an expected shift to profitability within three years and a special dividend announcement signaling shareholder value focus, Linklogis appears strategically positioned to leverage its tech advancements in the competitive landscape.

Wuhan Dameng Database (SHSE:688692)

Simply Wall St Growth Rating: ★★★★☆☆

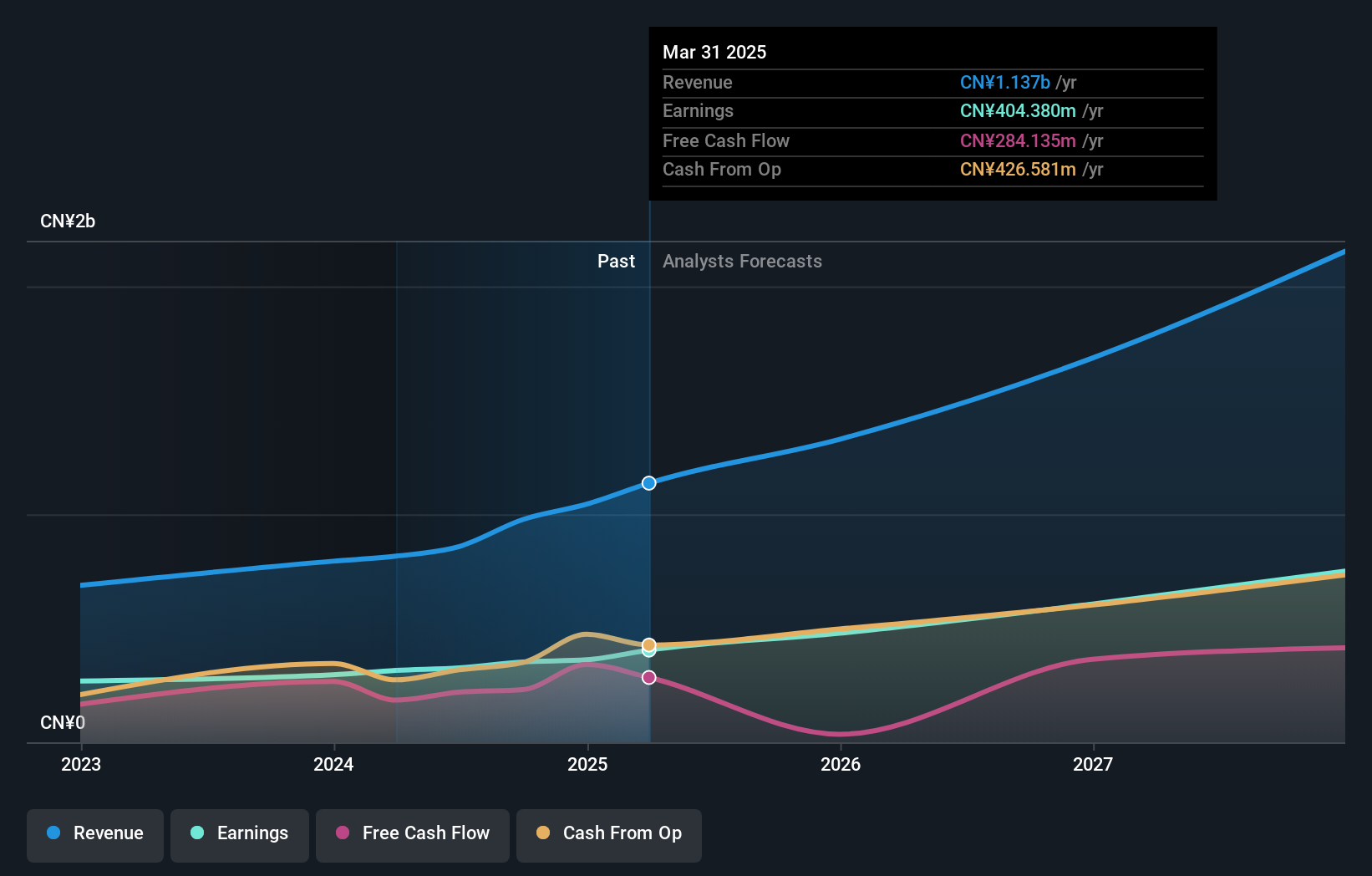

Overview: Wuhan Dameng Database Company Limited specializes in database product development services within China and has a market cap of CN¥24.60 billion.

Operations: The company generates revenue primarily from data processing services, amounting to CN¥1.14 billion.

Wuhan Dameng Database is distinguishing itself in Asia's high-tech sector, particularly with its robust annual revenue growth at 23.1% and earnings expansion of 22.2%. The company's commitment to innovation is evident from its R&D spending, which significantly bolsters its technological capabilities— a strategic move reflecting in their recent first-quarter revenue surge to CNY 258.13 million from CNY 165.88 million year-over-year. Moreover, the approval of a major financial cooperation agreement promises to enhance Wuhan Dameng's market positioning further, aligning with broader industry shifts towards more integrated tech-financial services solutions.

- Click to explore a detailed breakdown of our findings in Wuhan Dameng Database's health report.

Explore historical data to track Wuhan Dameng Database's performance over time in our Past section.

E Ink Holdings (TPEX:8069)

Simply Wall St Growth Rating: ★★★★★★

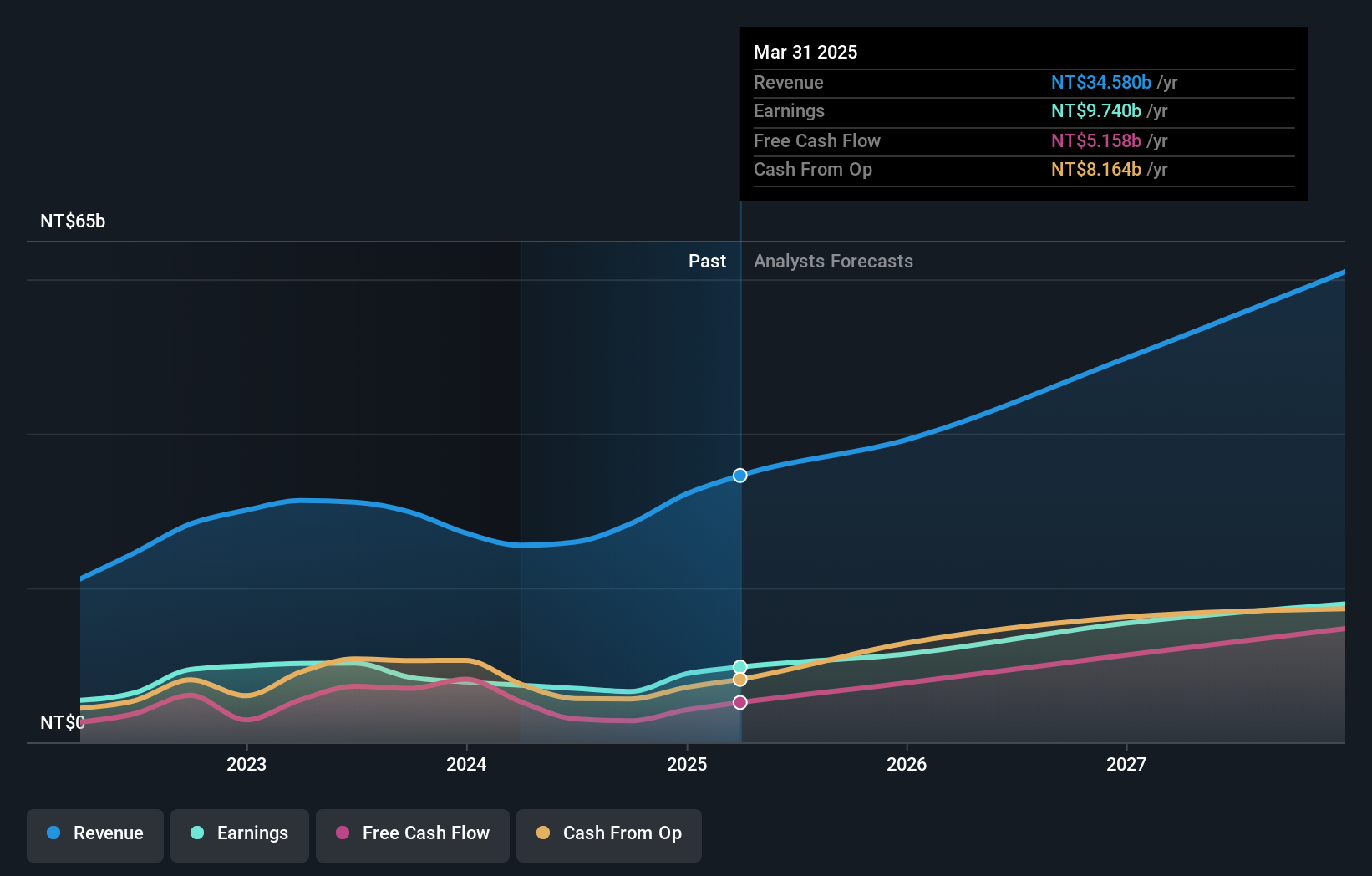

Overview: E Ink Holdings Inc. specializes in the research, development, manufacturing, and sale of electronic paper display panels on a global scale with a market capitalization of approximately NT$248.95 billion.

Operations: The company generates revenue primarily from the sale of electronic components and parts, totaling NT$34.58 billion. Its business operations focus on the global market for electronic paper display panels.

E Ink Holdings has demonstrated significant strides in the high-growth tech landscape of Asia, particularly with its innovative ePaper technologies. In Q1 2025, the company reported a robust sales increase to TWD 8.06 billion from TWD 5.64 billion year-over-year, while net income surged to TWD 2.20 billion from TWD 1.32 billion, reflecting a strong earnings growth of approximately 66%. This financial upswing is backed by strategic expansions such as the recent approval for new large-format mold production equipment and collaborations aimed at enhancing its ePaper display capabilities across various applications. These initiatives not only underscore E Ink's commitment to technological advancement but also align with industry trends towards sustainable and energy-efficient solutions, positioning the company well for future growth in digital display markets.

- Click here to discover the nuances of E Ink Holdings with our detailed analytical health report.

Understand E Ink Holdings' track record by examining our Past report.

Next Steps

- Dive into all 488 of the Asian High Growth Tech and AI Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if E Ink Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:8069

E Ink Holdings

Researches, develops, manufactures, and sells electronic paper display panels worldwide.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives