- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6284

Undiscovered Gems Promising Stocks To Watch In November 2024

Reviewed by Simply Wall St

As global markets approach record highs with smaller-cap indexes outperforming large-caps, investors are closely watching economic indicators such as the recent drop in U.S. initial jobless claims and stabilizing mortgage rates, which have bolstered positive sentiment. In this dynamic environment, identifying promising stocks often involves looking for companies that demonstrate resilience and potential for growth amidst broader market trends and geopolitical uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Mobile Telecommunications | NA | 4.98% | 0.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Watt's | 73.27% | 7.85% | -1.33% | ★★★★★☆ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Gulf Insurance Group (SASE:8250)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Gulf Insurance Group offers a range of insurance and reinsurance products and services in Saudi Arabia, with a market cap of SAR1.58 billion.

Operations: The company generates revenue primarily through its insurance and reinsurance segments. It focuses on managing costs related to claims, underwriting, and operations to optimize profitability. The net profit margin has shown variability over recent periods without a consistent trend.

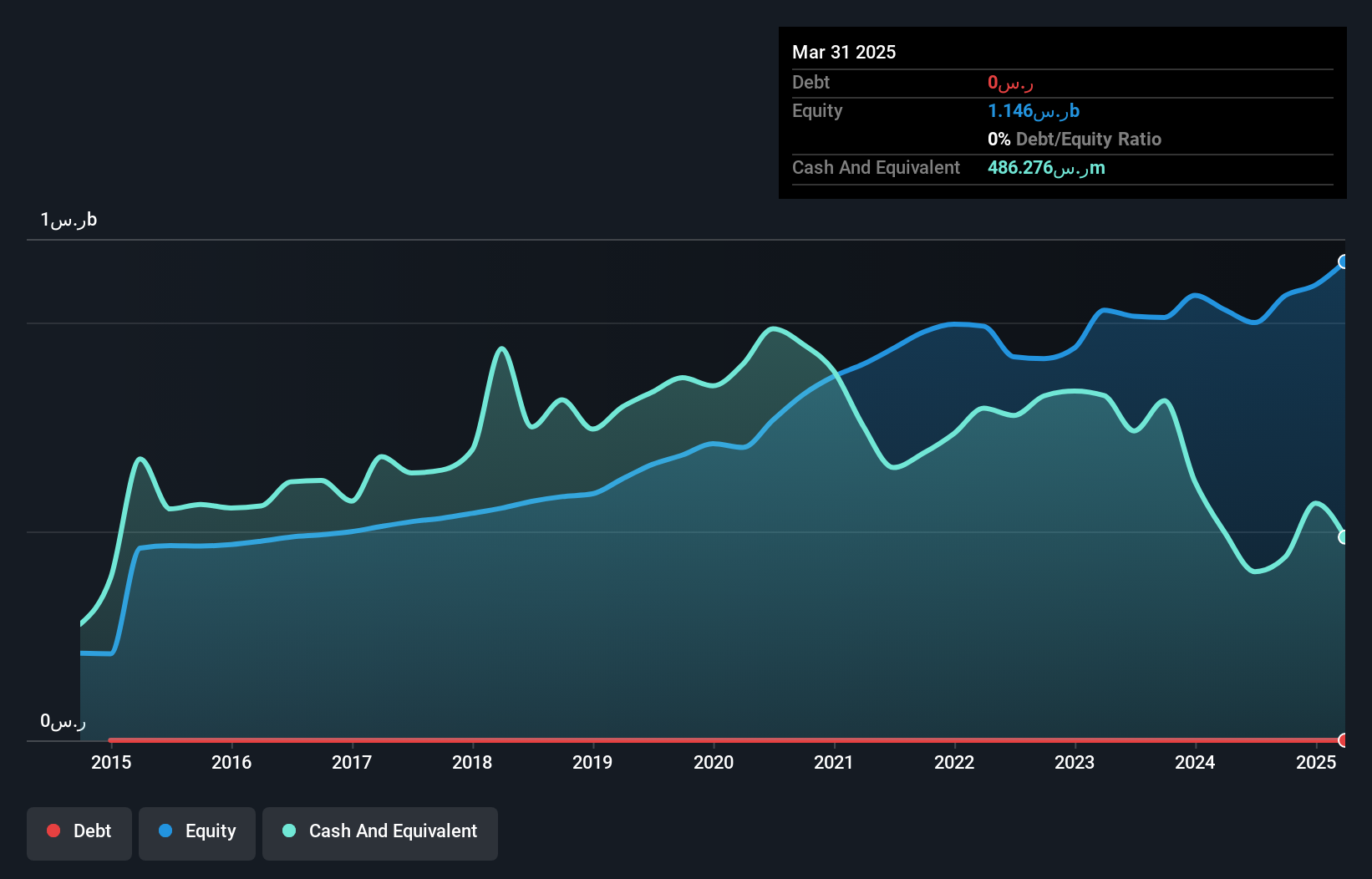

Gulf Insurance Group, a relatively small player in the insurance sector, has shown signs of financial resilience. Recently, it reported a net income of SAR 5.36 million for Q3 2024, reversing a net loss from the previous year. The company also achieved profitability this year despite earnings declining by an average of 13% annually over five years. With a debt-to-equity ratio rising to 13.5%, its financial leverage has increased but remains manageable given its cash position exceeding total debt. Its price-to-earnings ratio stands attractively at 12x compared to the broader market's 24x, indicating potential undervaluation in the Saudi Arabian context.

- Unlock comprehensive insights into our analysis of Gulf Insurance Group stock in this health report.

Sichuan Mingxing Electric Power (SHSE:600101)

Simply Wall St Value Rating: ★★★★★★

Overview: Sichuan Mingxing Electric Power Co., Ltd. operates in the electric power industry with a market capitalization of CN¥5.10 billion.

Operations: Sichuan Mingxing Electric Power generates revenue primarily from its operations in the electric power industry. The company has a market capitalization of CN¥5.10 billion.

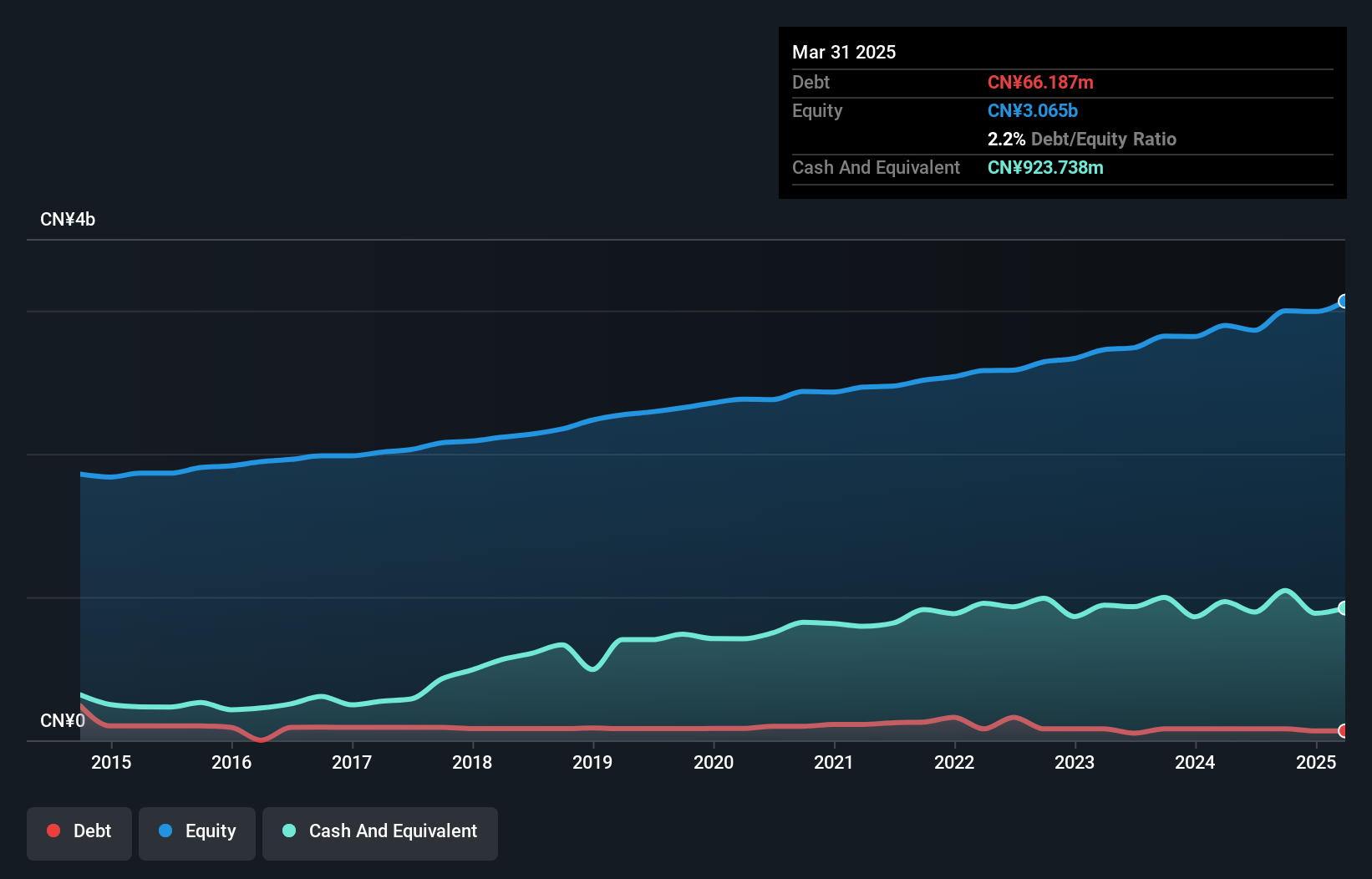

Sichuan Mingxing Electric Power, a smaller player in the electric utilities sector, has demonstrated consistent earnings growth of 20.1% annually over the past five years, although recent growth at 11.9% slightly lags behind the industry average of 13%. The company reported CNY 2.13 billion in sales for the first nine months of 2024, up from CNY 2.01 billion last year, with net income rising to CNY 223.81 million from CNY 184.31 million previously. Its price-to-earnings ratio stands attractively at 23x compared to the broader CN market's average of nearly 35x, suggesting potential value for investors seeking opportunities in this space.

INPAQ Technology (TPEX:6284)

Simply Wall St Value Rating: ★★★★★☆

Overview: INPAQ Technology Co., Ltd. specializes in providing circuit protection components and antenna products for various sectors including computing, communication, consumer electronics, and automotive electronics across Taiwan, China, Hong Kong, and international markets with a market cap of NT$11.94 billion.

Operations: INPAQ Technology generates revenue through its circuit protection components and antenna products, serving sectors such as computing, communication, consumer electronics, and automotive electronics. The company's market capitalization stands at NT$11.94 billion.

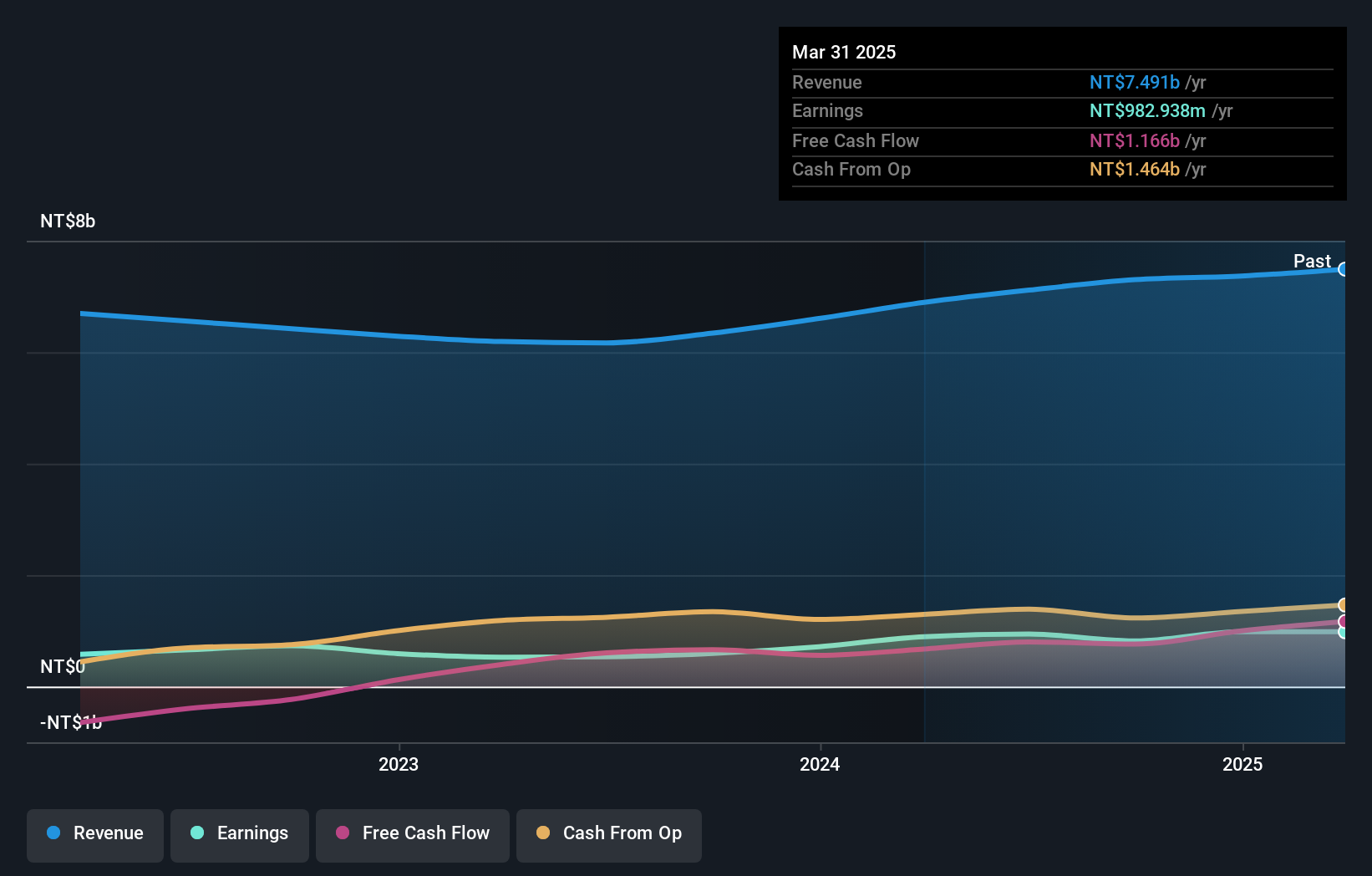

INPAQ Technology, a small cap player in the electronics sector, has shown solid growth with its earnings rising 37.6% over the past year, outpacing the industry average of 9%. The company’s price-to-earnings ratio stands at 14.6x, notably below the TW market's 21.2x, suggesting potential undervaluation. Despite an increase in debt to equity from 7.1% to 48.3% over five years, its net debt to equity ratio remains satisfactory at 32.7%. Recent earnings reports indicate mixed results with third-quarter sales up to TWD 1,980 million but net income down compared to last year; however, nine-month figures show improved sales and net income year-over-year. Additionally, INPAQ announced a share repurchase program aimed at employee incentives worth TWD 5 billion for up to 250k shares by January next year.

- Click here and access our complete health analysis report to understand the dynamics of INPAQ Technology.

Understand INPAQ Technology's track record by examining our Past report.

Make It Happen

- Investigate our full lineup of 4636 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6284

INPAQ Technology

Provides circuit protection components and antenna products for computing, communication, consumer electronics, and automotive electronics primarily in Taiwan, China, Hong Kong, and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives