- Taiwan

- /

- Tech Hardware

- /

- TPEX:6143

Top Asian Dividend Stocks To Consider In September 2025

Reviewed by Simply Wall St

As the Asian markets navigate a landscape marked by mixed economic signals and evolving monetary policies, investors are increasingly seeking stability through dividend stocks. In this context, a good dividend stock is often characterized by its ability to offer consistent returns and withstand market volatility, making it an appealing option for those looking to balance growth with income in uncertain times.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.93% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.30% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.84% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.94% | ★★★★★★ |

| NCD (TSE:4783) | 4.53% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 3.93% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.13% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Daicel (TSE:4202) | 4.34% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

Click here to see the full list of 1025 stocks from our Top Asian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

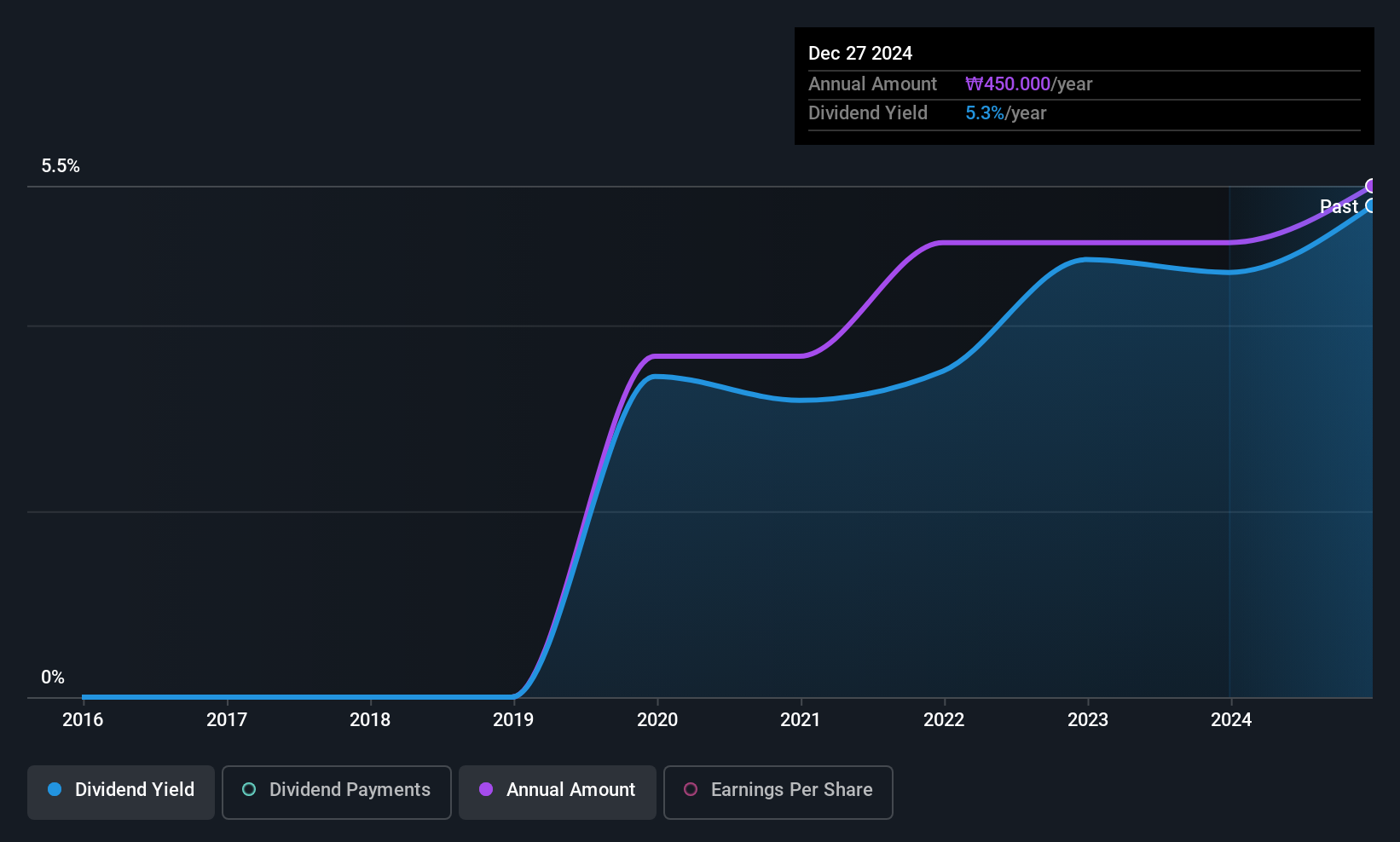

Motonic (KOSE:A009680)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Motonic Corporation manufactures and sells automotive components globally with a market cap of ₩228.17 billion.

Operations: Motonic Corporation generates its revenue primarily from the automobile parts manufacturing segment, which accounts for ₩286.67 billion.

Dividend Yield: 5.7%

Motonic's dividend yield ranks in the top 25% of Korean market payers, offering a compelling option for income-focused investors. The company's dividends are well supported by both earnings and cash flows, with payout ratios around 42%. Despite only a six-year history of dividend payments, these have grown consistently with minimal volatility. However, its relatively short track record may be a consideration for those seeking long-term stability.

- Unlock comprehensive insights into our analysis of Motonic stock in this dividend report.

- According our valuation report, there's an indication that Motonic's share price might be on the cheaper side.

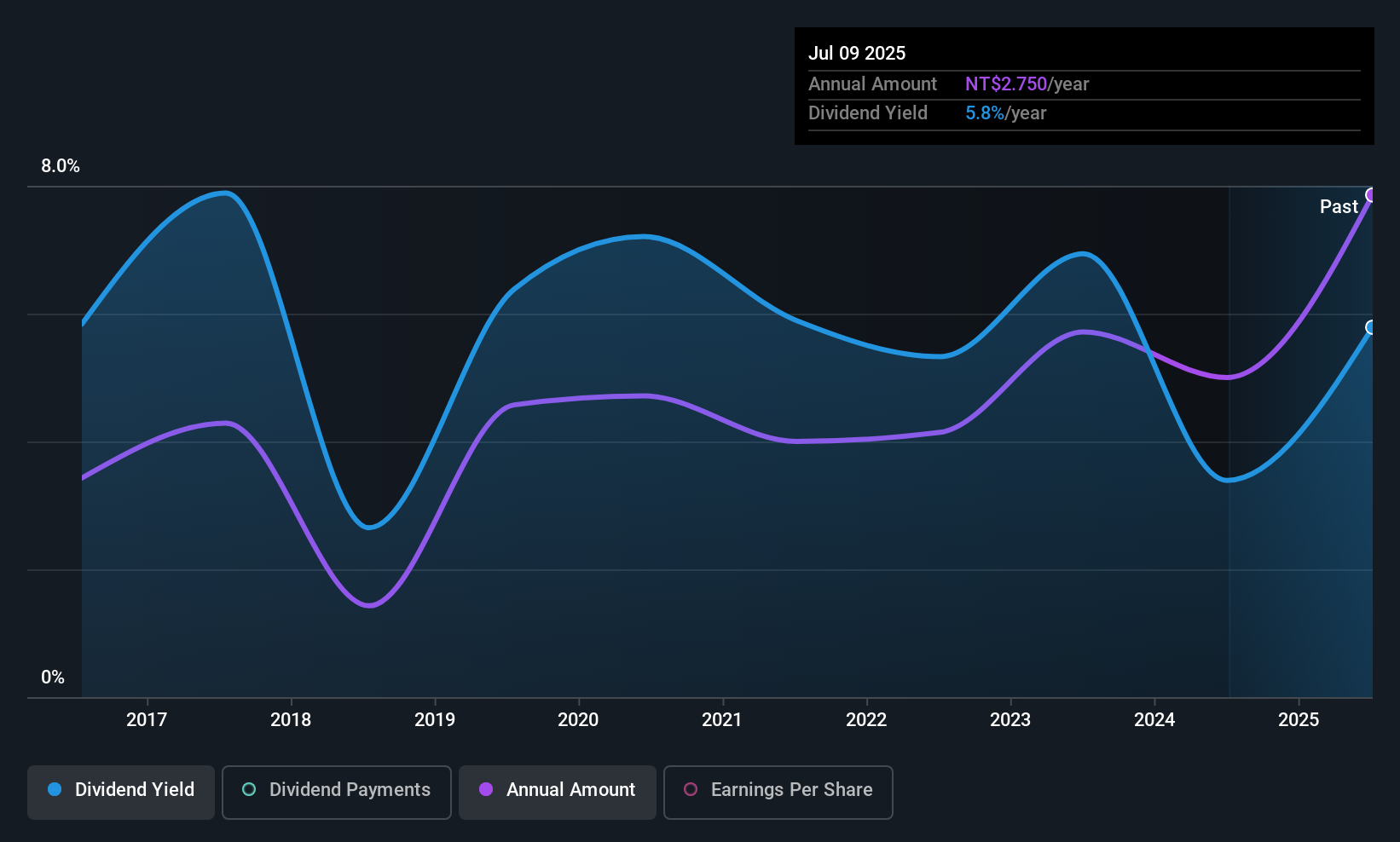

Univacco Technology (TPEX:3303)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Univacco Technology Inc. operates in the stamping foil industry under the UNIVACCO brand both in Taiwan and internationally, with a market cap of NT$4.78 billion.

Operations: Univacco Technology Inc. generates revenue primarily from its Vacuum-Evaporated Thin Films and Optoelectronic Materials segment, amounting to NT$3.09 billion.

Dividend Yield: 5.4%

Univacco Technology offers a notable dividend yield, ranking in the top 25% of Taiwanese market payers. The company's dividends are covered by earnings with a payout ratio of 65.4%, though cash flow coverage is tighter at 88.7%. Recent earnings growth and increased dividend payments reflect positive momentum, yet the dividend history shows volatility over the past decade. A recent cash dividend distribution of TWD 2.75 per share underscores its commitment to returning value to shareholders amidst fluctuating performance stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Univacco Technology.

- The analysis detailed in our Univacco Technology valuation report hints at an inflated share price compared to its estimated value.

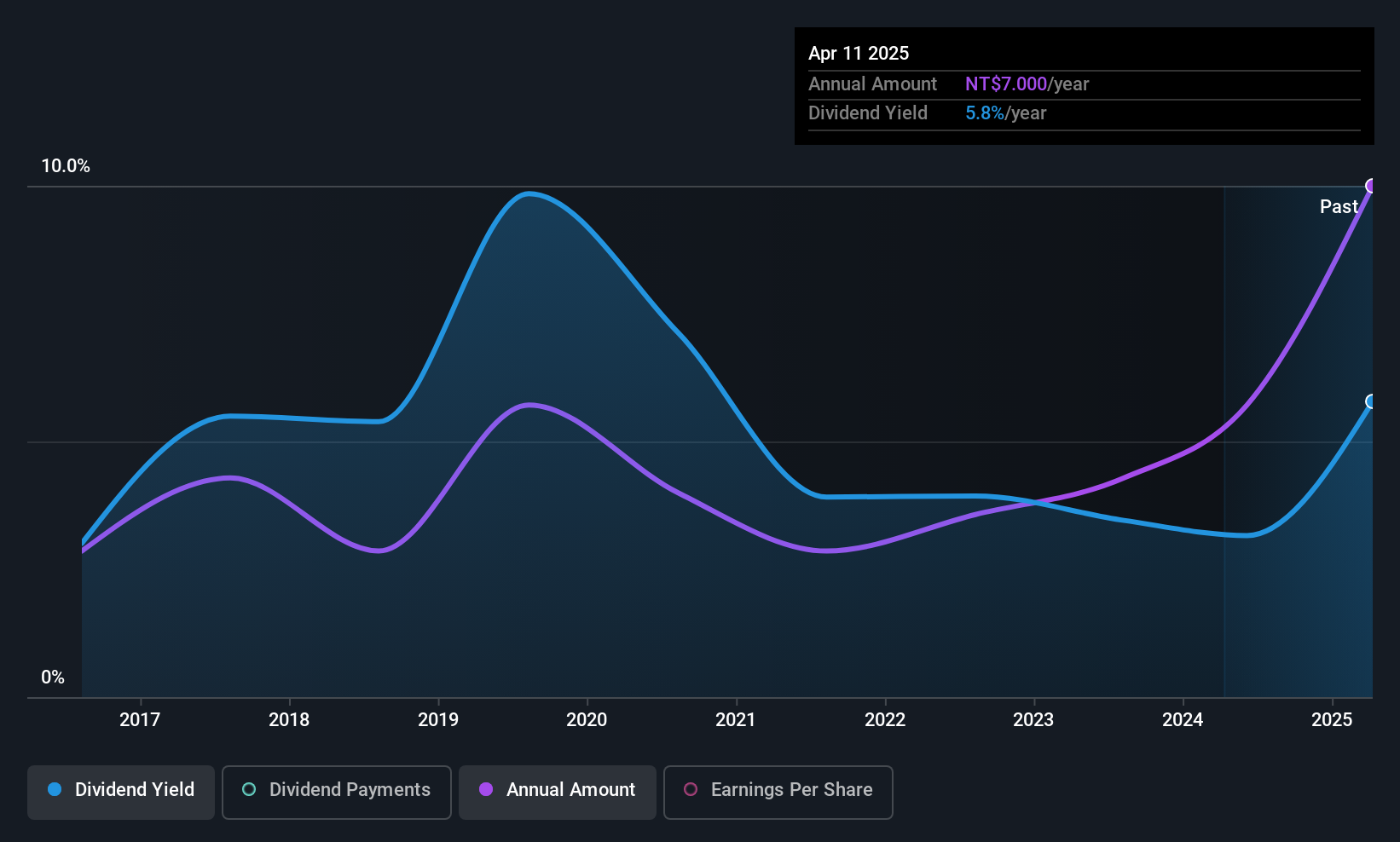

Netronix (TPEX:6143)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Netronix, Inc. designs and manufactures network and e-Reader products both in Taiwan and internationally, with a market cap of NT$10.84 billion.

Operations: Netronix, Inc. generates revenue primarily from its Consumer Electronics Division, which contributes NT$6.16 billion, and its Computer Interface Equipment Division, which adds NT$1.21 billion.

Dividend Yield: 5.6%

Netronix's dividend yield is among the top 25% in Taiwan, yet its sustainability is questionable due to a high payout ratio of 133%, indicating dividends are not covered by earnings. Despite being well-covered by cash flows, the company's dividend history has been volatile over the past decade. Recent earnings show a decline in net income and profit margins compared to last year, highlighting potential challenges for consistent future dividends.

- Navigate through the intricacies of Netronix with our comprehensive dividend report here.

- According our valuation report, there's an indication that Netronix's share price might be on the expensive side.

Turning Ideas Into Actions

- Access the full spectrum of 1025 Top Asian Dividend Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netronix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6143

Netronix

Designs and manufactures network and e-Reader products in Taiwan and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives