- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:5356

3 Dividend Stocks With Yields Up To 6.8% For Your Portfolio

Reviewed by Simply Wall St

As global markets experience broad-based gains and U.S. indexes approach record highs, investors are navigating through a landscape marked by geopolitical tensions and economic uncertainties. Amidst this backdrop, dividend stocks with attractive yields can offer a reliable income stream, making them an appealing choice for those looking to balance growth with stability in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.01% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.44% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.72% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.25% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.90% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.45% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.35% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.06% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.80% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.77% | ★★★★★★ |

Click here to see the full list of 1955 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

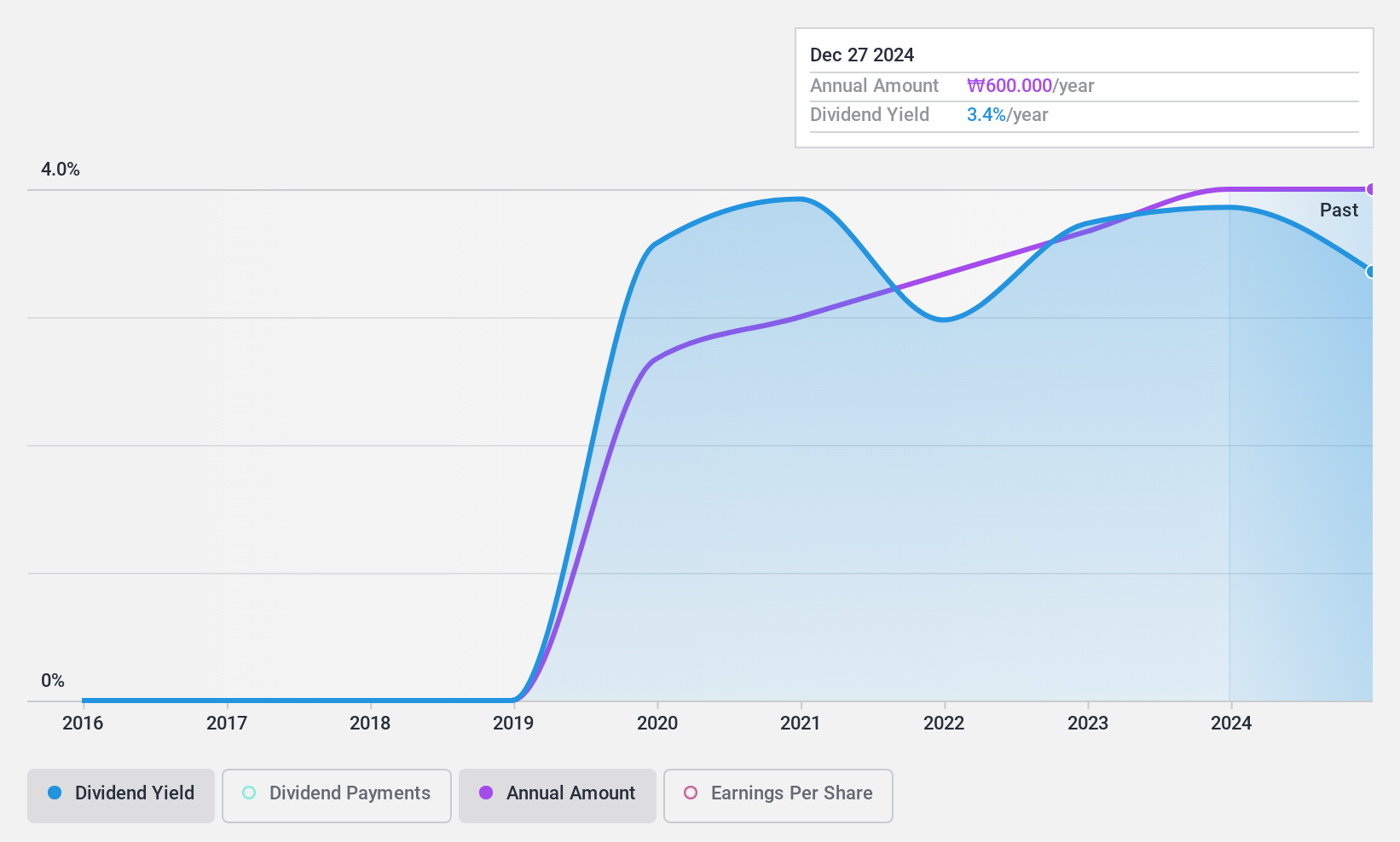

HANYANG ENGLtd (KOSDAQ:A045100)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hanyang ENG Co., Ltd specializes in the construction of semiconductor facilities both in South Korea and internationally, with a market cap of ₩287.94 billion.

Operations: Hanyang ENG Co., Ltd generates revenue primarily from its involvement in the construction of semiconductor facilities across domestic and international markets.

Dividend Yield: 3.5%

HANYANG ENG Co., Ltd offers a reliable dividend yield of 3.49%, supported by a low payout ratio of 11.6% and stable cash flows, ensuring sustainability. Dividends have been stable and growing over the past decade, though the yield is lower than top-tier payers in Korea. Recent earnings reports show significant growth, with Q3 sales at KRW 248.69 billion and net income at KRW 18.37 million, enhancing its financial position for continued dividend payments amidst ongoing share repurchase efforts to stabilize stock value.

- Unlock comprehensive insights into our analysis of HANYANG ENGLtd stock in this dividend report.

- In light of our recent valuation report, it seems possible that HANYANG ENGLtd is trading behind its estimated value.

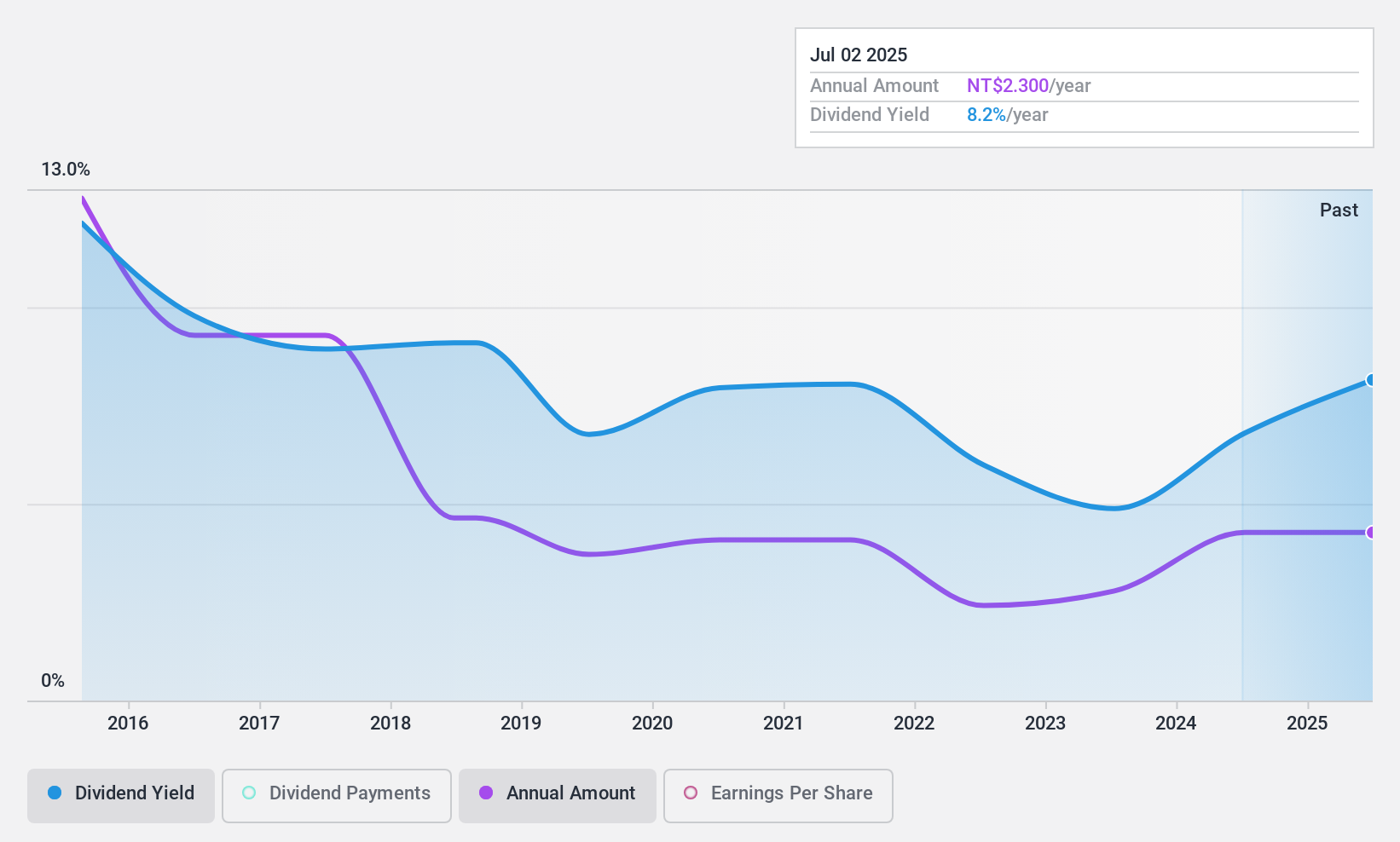

Sirtec InternationalLtd (TPEX:5356)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sirtec International Co., Ltd. designs, manufactures, and sells electronic product assemblies and plastic injection and molding products in Taiwan and China, with a market cap of NT$3.49 billion.

Operations: Sirtec International Ltd. generates its revenue through the design, manufacture, and sale of electronic product assemblies and plastic injection and molding products across Taiwan and China.

Dividend Yield: 6.8%

Sirtec International Ltd. offers a high dividend yield of 6.82%, ranking in the top 25% of Taiwan's market, with dividends covered by earnings (payout ratio: 33.5%) and cash flows (cash payout ratio: 79.9%). However, its dividend history is marked by volatility and declines over the past decade, raising sustainability concerns despite recent earnings growth—sales reached TWD 1.10 billion in Q3 with net income at TWD 10.4 million—indicating improved financial health.

- Click here and access our complete dividend analysis report to understand the dynamics of Sirtec InternationalLtd.

- Insights from our recent valuation report point to the potential undervaluation of Sirtec InternationalLtd shares in the market.

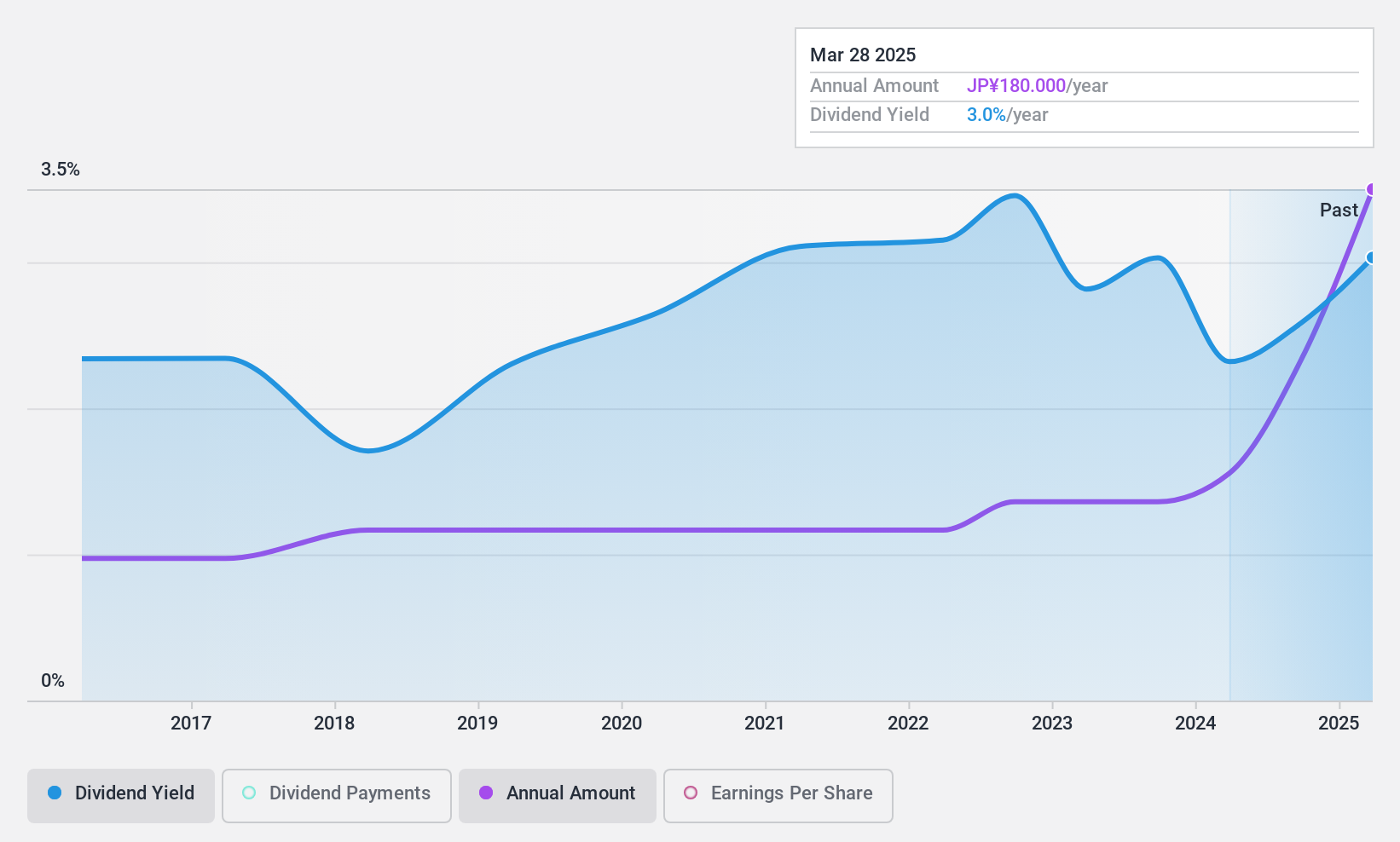

Kurabo Industries (TSE:3106)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kurabo Industries Ltd. operates in the textile, chemical, technology, food and service, and real estate sectors both in Japan and internationally, with a market cap of ¥94.79 billion.

Operations: Kurabo Industries Ltd. generates revenue from several segments, including Chemical Products (¥64.67 billion), Textile Business (¥50.12 billion), Environmental Mechatronics Business (¥22.39 billion), Food and Services (¥9.95 billion), and Real Estate (¥4.20 billion).

Dividend Yield: 3.3%

Kurabo Industries recently increased its dividend to ¥60.00 per share, with a projected annual dividend of ¥90.00 for FY 2025, up from ¥60.00 last year. Despite a lower yield of 3.35% compared to top payers in Japan, dividends are reliably covered by earnings (28.3% payout ratio) and cash flows (44.4% cash payout). The company also initiated a buyback program for up to 1.3 million shares, enhancing shareholder returns and capital efficiency amidst volatile share prices but stable long-term dividends.

- Dive into the specifics of Kurabo Industries here with our thorough dividend report.

- The analysis detailed in our Kurabo Industries valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Unlock our comprehensive list of 1955 Top Dividend Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5356

Sirtec InternationalLtd

Designs, manufactures, and sells electronic product assemblies, and plastic injection and molding products in Taiwan and China.

Flawless balance sheet with low risk.

Market Insights

Community Narratives