- Taiwan

- /

- Communications

- /

- TPEX:4979

High Growth Tech Stocks Including Guangzhou Hexin InstrumentLtd And Two More

Reviewed by Simply Wall St

Amidst a backdrop of record highs for key indices like the Dow Jones Industrial Average and S&P 500, small-cap stocks have joined their larger peers in reaching new heights, as evidenced by the Russell 2000 Index's recent performance. This buoyant market environment, coupled with geopolitical developments and economic indicators such as rising personal income and spending, sets an intriguing stage for exploring high-growth tech stocks like Guangzhou Hexin Instrument Ltd., where investors often seek companies with robust innovation potential and adaptability to navigate both opportunities and challenges presented by current global trends.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Fine M-TecLTD | 36.23% | 131.08% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1286 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Guangzhou Hexin InstrumentLtd (SHSE:688622)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Hexin Instrument Ltd. specializes in the research, development, production, sale, and technical services of mass spectrometry products in China with a market cap of CN¥3.99 billion.

Operations: Hexin Instrument focuses on the mass spectrometer business, generating revenue of CN¥266.19 million from this segment.

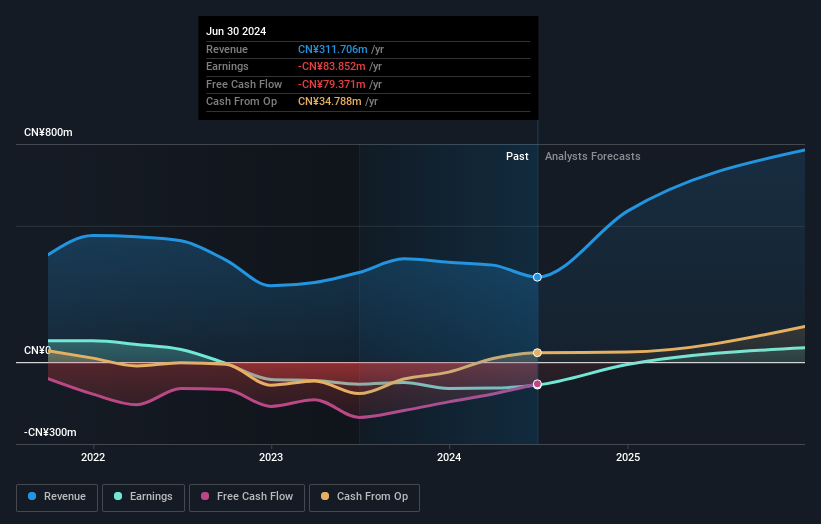

Despite currently being unprofitable, Guangzhou Hexin Instrument Co., Ltd. is poised for significant growth, with revenue expected to increase by 67% annually. This growth rate outpaces the broader Chinese market's forecast of 13.8% per year and reflects a robust expansion strategy in a challenging electronic industry environment where average earnings growth is just 1.8%. Furthermore, the company's commitment to innovation is evident from its substantial R&D investments, which are crucial for sustaining long-term competitiveness in technology sectors. Recent strategic moves include a private placement aimed at specific investors, signaling confidence from both management and incoming stakeholders about future profitability and stability. This financial maneuver follows an earnings report showing improved year-over-year losses—CNY 22.15 million compared to CNY 55 million—indicating effective cost management and operational adjustments amid rapid scaling efforts. With earnings projected to surge by over 201%, Hexin's trajectory suggests it could soon transition from high potential to high performance within its industry niche.

- Dive into the specifics of Guangzhou Hexin InstrumentLtd here with our thorough health report.

Learn about Guangzhou Hexin InstrumentLtd's historical performance.

LuxNet (TPEX:4979)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LuxNet Corporation, along with its subsidiaries, is engaged in the manufacturing, processing, and sale of electric and optical communication components in Taiwan, with a market capitalization of NT$27.32 billion.

Operations: LuxNet focuses on the production and sale of electric and optical communication components. The company operates primarily in Taiwan, leveraging its expertise in manufacturing to cater to the communication sector.

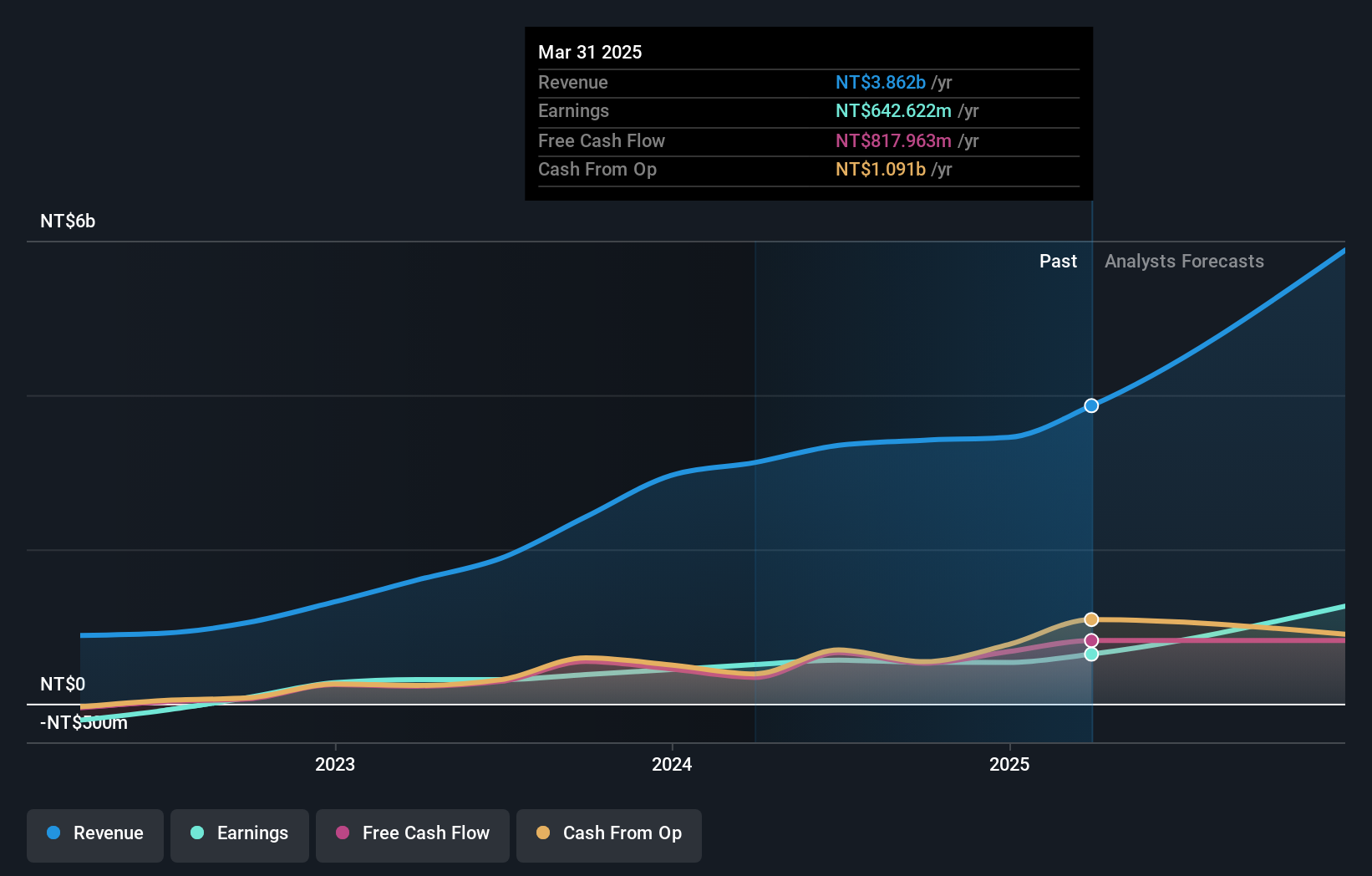

LuxNet's recent performance underscores a promising trajectory in the tech sector, with third-quarter sales rising to TWD 945.63 million from TWD 879.88 million year-over-year, despite a slight dip in net income. This growth is part of a broader trend where LuxNet's annual revenue growth rate stands at an impressive 26%, outpacing the Taiwan market average of 12.2%. Moreover, the company's commitment to innovation is reflected in its R&D spending trends, which are crucial for maintaining competitive advantage and fueling future growth. This focus on research has propelled earnings growth by 41.9% over the past year, significantly ahead of the industry's decline of 9.2%. With earnings expected to grow by another 29.5% annually, LuxNet is well-positioned to capitalize on expanding market opportunities and technological advancements.

- Get an in-depth perspective on LuxNet's performance by reading our health report here.

Review our historical performance report to gain insights into LuxNet's's past performance.

Fositek (TWSE:6805)

Simply Wall St Growth Rating: ★★★★★★

Overview: Fositek Corp. is involved in the manufacture and wholesale of electronic materials and components, with a market capitalization of NT$63.41 billion.

Operations: The company's primary revenue stream is derived from its electronic components and parts segment, generating NT$7.20 billion.

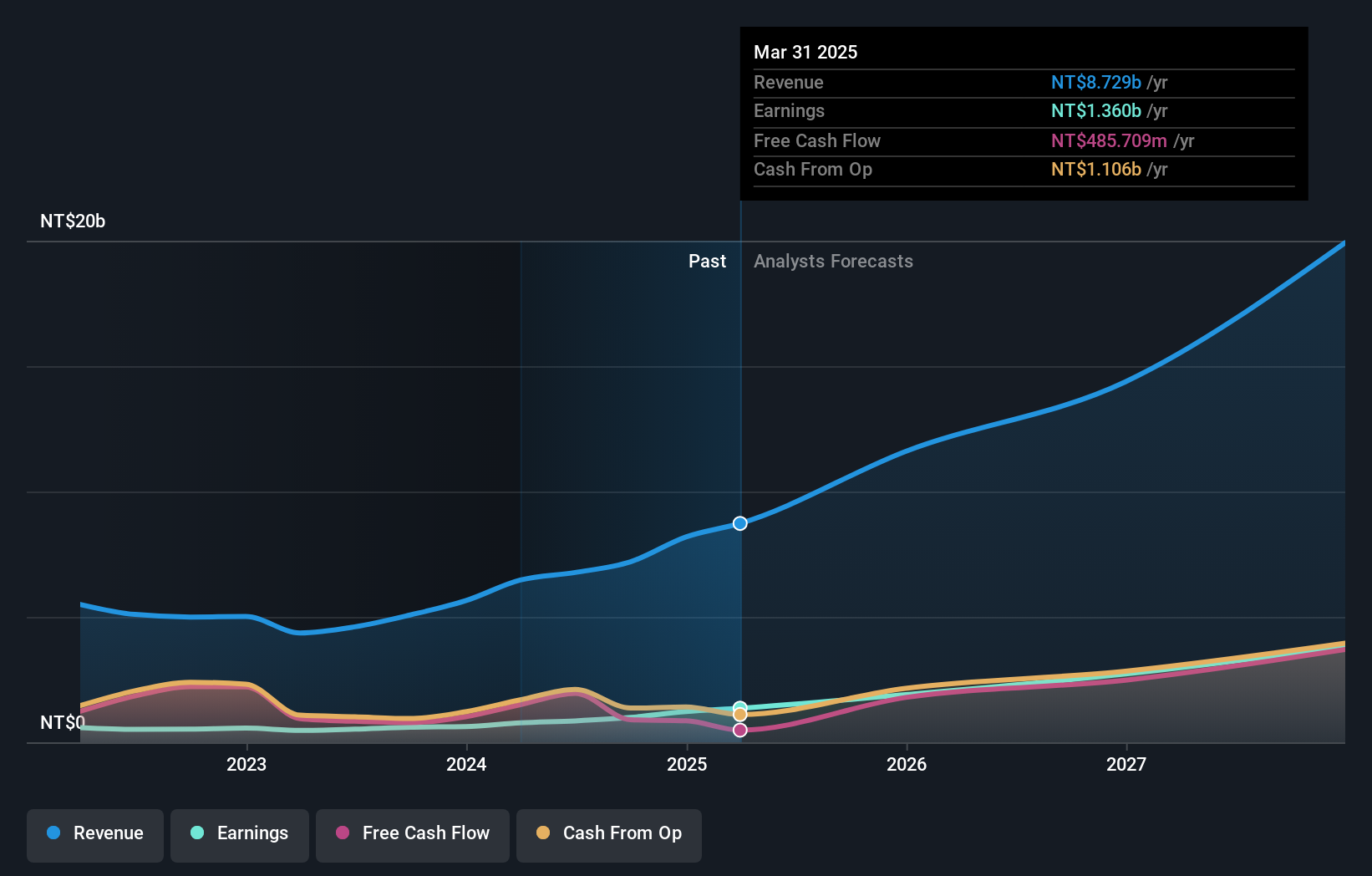

Fositek's recent earnings report highlights a robust upward trajectory, with third-quarter sales surging to TWD 1.99 billion, up from TWD 1.56 billion the previous year, reflecting a growth rate of 47.4%. This performance is underpinned by a significant increase in net income to TWD 334.16 million, nearly doubling from TWD 197.82 million, showcasing an impressive earnings growth forecast of 53.3% annually over the next three years—far outpacing the broader TW market's expectations of 19.3%. Fositek's strategic emphasis on R&D investment is pivotal here; this focus not only fuels innovation but also positions the company to leverage emerging technological trends effectively, ensuring sustained long-term growth in a competitive landscape.

- Click here to discover the nuances of Fositek with our detailed analytical health report.

Gain insights into Fositek's past trends and performance with our Past report.

Next Steps

- Delve into our full catalog of 1286 High Growth Tech and AI Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:4979

LuxNet

Manufactures, processes, and sells electric and optical communication components in Taiwan.

Flawless balance sheet with high growth potential.