- Taiwan

- /

- Tech Hardware

- /

- TPEX:3611

Exploring High Growth Tech Stocks With Promising Potential

Reviewed by Simply Wall St

Amid a backdrop of global market fluctuations driven by tariff uncertainties and mixed economic indicators, investors are closely monitoring the technology sector for opportunities. In this environment, high growth tech stocks with strong fundamentals and innovative potential may offer promising avenues for those seeking to navigate the current landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1212 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

TSC Auto ID Technology (TPEX:3611)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TSC Auto ID Technology Co., Ltd. specializes in the global manufacture and service of auto-identification systems and products, with a market cap of NT$10.18 billion.

Operations: The company generates revenue primarily from selling barcode printers and their spare parts, contributing NT$4.86 billion, and various label papers and consumables for printers at NT$3.47 billion.

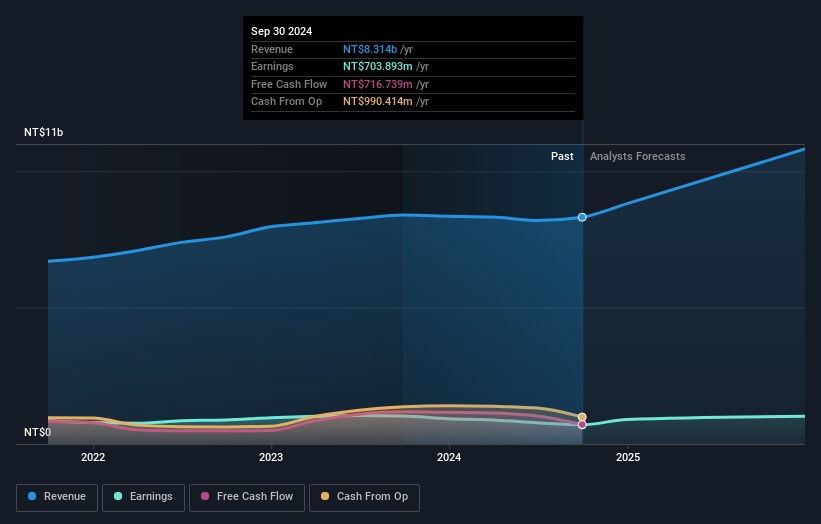

TSC Auto ID Technology, amidst a challenging year with a net earnings drop to TWD 533.77 million from TWD 756.75 million, still projects robust future growth with expected annual revenue and earnings increases of 21.5% and 24.1%, respectively—both outpacing the Taiwan market averages of 11.3% and 17.8%. Despite recent executive changes signaling potential strategic shifts, the company's sustained investment in R&D, which remains integral at maintaining its competitive edge in tech innovation, underscores its commitment to reclaiming stronger market positions. This focus on continuous development could be pivotal as it navigates recovering profit margins and intensifying global tech competition.

- Take a closer look at TSC Auto ID Technology's potential here in our health report.

Assess TSC Auto ID Technology's past performance with our detailed historical performance reports.

JMDC (TSE:4483)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JMDC Inc. is a company that offers medical statistics data services in Japan, with a market capitalization of ¥215.89 billion.

Operations: JMDC Inc. generates revenue primarily from its Healthcare-Big Data segment, contributing ¥33.44 billion, followed by Tele-Medicine and Pharmacy Support with ¥6.04 billion and ¥1.28 billion respectively.

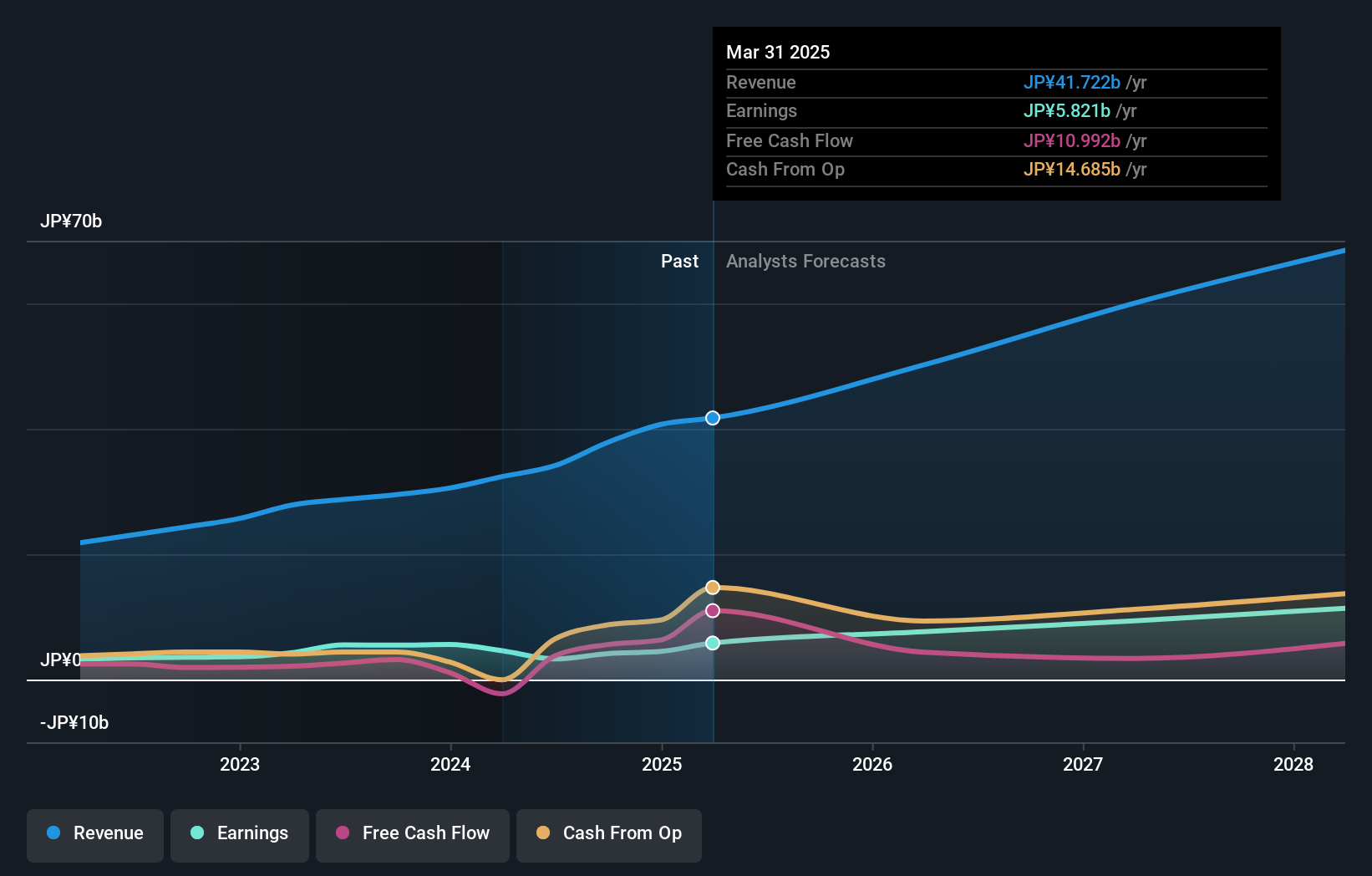

JMDC, navigating through a competitive landscape, has demonstrated a robust commitment to growth and innovation. With an impressive annual revenue increase of 17.2% and earnings growth forecast at 25.5%, the company outstrips the JP market's average growth rates significantly. This performance is bolstered by strategic initiatives like the upcoming merger with its subsidiary, cotree Co., Ltd., aiming to streamline operations effective March 2025. Moreover, JMDC's dedication to research and development is evident from its R&D spending trends which are crucial for maintaining its technological edge in a rapidly evolving industry. These factors collectively underscore JMDC’s potential in not just sustaining but also enhancing its market position amidst dynamic industry shifts.

- Navigate through the intricacies of JMDC with our comprehensive health report here.

Explore historical data to track JMDC's performance over time in our Past section.

Oracle Corporation Japan (TSE:4716)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Oracle Corporation Japan focuses on developing and selling software and hardware products and solutions within the Japanese market, with a market capitalization of ¥1.82 trillion.

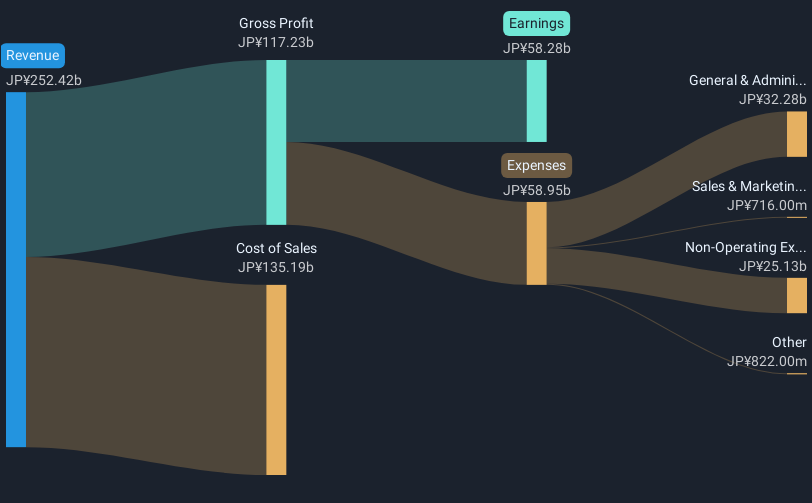

Operations: Oracle Corporation Japan generates revenue primarily through its software and hardware product offerings in the Japanese market. The company operates with a focus on delivering integrated technology solutions to meet diverse customer needs.

Oracle Corporation Japan, set to report Q2 2025 results on December 20, 2024, illustrates a nuanced trajectory in the tech landscape. Despite its earnings growth of 6.9% lagging behind the software industry's 11.6%, the company maintains a positive free cash flow and anticipates an impressive return on equity at 29.9% in three years. With R&D expenses aligned strategically to foster innovation, Oracle Japan’s commitment is clear as it aims to outpace the JP market's average revenue growth of 4.3% with its own forecast at 7.4%. This positions Oracle Japan uniquely as it leverages robust financial health and strategic foresight in navigating a competitive sector.

- Click here to discover the nuances of Oracle Corporation Japan with our detailed analytical health report.

Gain insights into Oracle Corporation Japan's past trends and performance with our Past report.

Summing It All Up

- Navigate through the entire inventory of 1212 High Growth Tech and AI Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if TSC Auto ID Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3611

TSC Auto ID Technology

Engages in the manufacture and service of auto-identification systems/products worldwide.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)