- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:8240

Wah Hong Industrial (GTSM:8240) Could Easily Take On More Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Wah Hong Industrial Corp. (GTSM:8240) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Wah Hong Industrial

How Much Debt Does Wah Hong Industrial Carry?

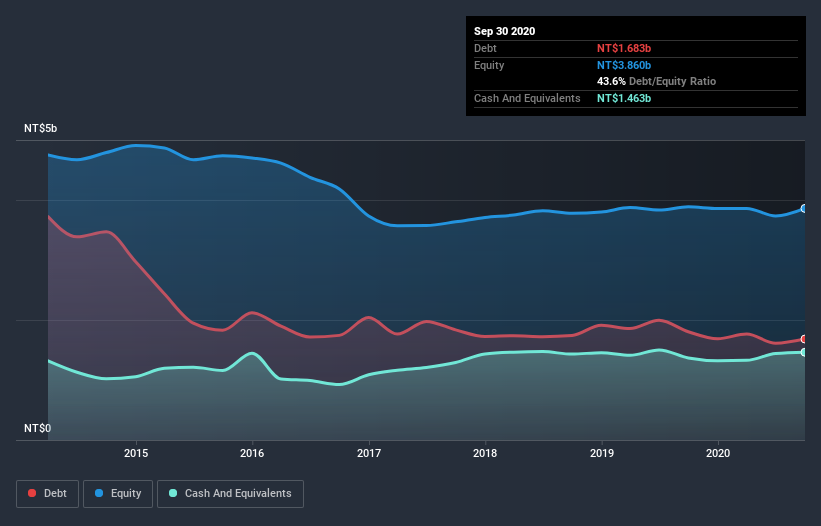

As you can see below, Wah Hong Industrial had NT$1.68b of debt at September 2020, down from NT$1.81b a year prior. However, it also had NT$1.46b in cash, and so its net debt is NT$219.9m.

A Look At Wah Hong Industrial's Liabilities

We can see from the most recent balance sheet that Wah Hong Industrial had liabilities of NT$3.91b falling due within a year, and liabilities of NT$909.9m due beyond that. Offsetting this, it had NT$1.46b in cash and NT$3.67b in receivables that were due within 12 months. So it actually has NT$317.1m more liquid assets than total liabilities.

This surplus suggests that Wah Hong Industrial has a conservative balance sheet, and could probably eliminate its debt without much difficulty.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Wah Hong Industrial has a low net debt to EBITDA ratio of only 0.38. And its EBIT covers its interest expense a whopping 13.4 times over. So we're pretty relaxed about its super-conservative use of debt. In addition to that, we're happy to report that Wah Hong Industrial has boosted its EBIT by 71%, thus reducing the spectre of future debt repayments. When analysing debt levels, the balance sheet is the obvious place to start. But it is Wah Hong Industrial's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Wah Hong Industrial actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

Wah Hong Industrial's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And the good news does not stop there, as its conversion of EBIT to free cash flow also supports that impression! It looks Wah Hong Industrial has no trouble standing on its own two feet, and it has no reason to fear its lenders. For investing nerds like us its balance sheet is almost charming. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Take risks, for example - Wah Hong Industrial has 2 warning signs we think you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading Wah Hong Industrial or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wah Hong Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:8240

Wah Hong Industrial

Engages in the development, production, and sale of composite materials and advanced plastic compounds in Taiwan and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026