Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Nam Liong Global Corporation (GTSM:5450) does carry debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Nam Liong Global

What Is Nam Liong Global's Debt?

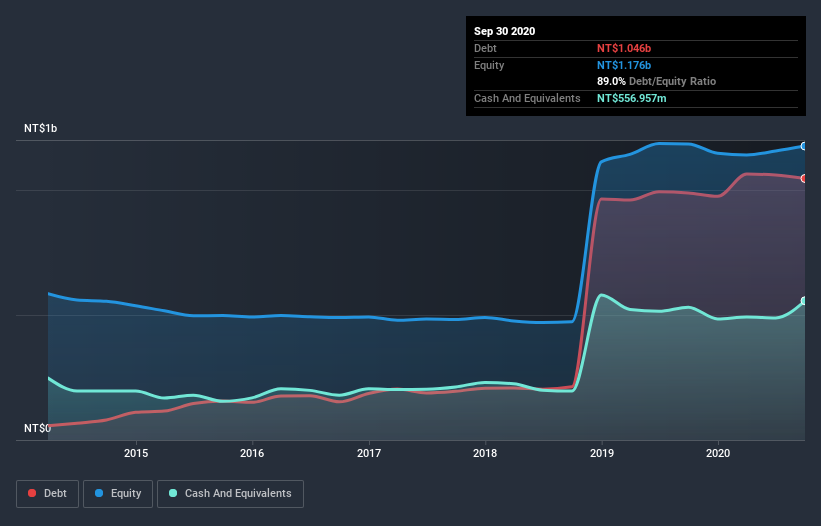

The image below, which you can click on for greater detail, shows that at September 2020 Nam Liong Global had debt of NT$1.05b, up from NT$988.5m in one year. However, because it has a cash reserve of NT$557.0m, its net debt is less, at about NT$489.1m.

How Strong Is Nam Liong Global's Balance Sheet?

The latest balance sheet data shows that Nam Liong Global had liabilities of NT$1.02b due within a year, and liabilities of NT$756.8m falling due after that. Offsetting this, it had NT$557.0m in cash and NT$567.6m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by NT$653.2m.

Nam Liong Global has a market capitalization of NT$1.98b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Nam Liong Global has a debt to EBITDA ratio of 2.7 and its EBIT covered its interest expense 5.1 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Importantly, Nam Liong Global's EBIT fell a jaw-dropping 25% in the last twelve months. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. There's no doubt that we learn most about debt from the balance sheet. But it is Nam Liong Global's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Nam Liong Global recorded negative free cash flow, in total. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

Mulling over Nam Liong Global's attempt at (not) growing its EBIT, we're certainly not enthusiastic. Having said that, its ability to cover its interest expense with its EBIT isn't such a worry. Looking at the bigger picture, it seems clear to us that Nam Liong Global's use of debt is creating risks for the company. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 5 warning signs for Nam Liong Global you should be aware of, and 1 of them doesn't sit too well with us.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you decide to trade Nam Liong Global, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Nam Liong Global might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:5450

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success