- Taiwan

- /

- Tech Hardware

- /

- TPEX:5386

Albatron Technology (GTSM:5386) Takes On Some Risk With Its Use Of Debt

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Albatron Technology Co., Ltd (GTSM:5386) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Albatron Technology

What Is Albatron Technology's Debt?

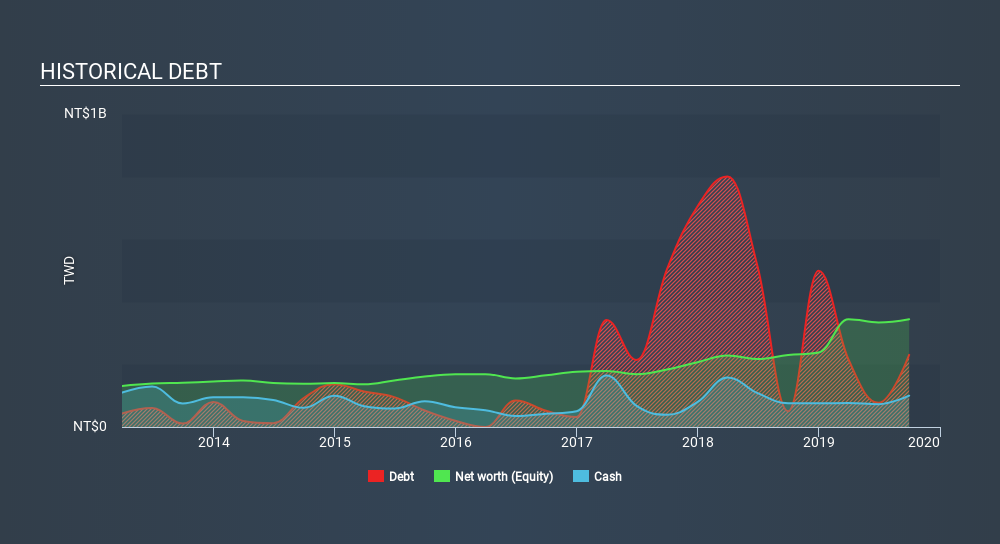

As you can see below, at the end of September 2019, Albatron Technology had NT$230.4m of debt, up from NT$50.0m a year ago. Click the image for more detail. However, because it has a cash reserve of NT$100.0m, its net debt is less, at about NT$130.4m.

A Look At Albatron Technology's Liabilities

The latest balance sheet data shows that Albatron Technology had liabilities of NT$473.5m due within a year, and liabilities of NT$157.0k falling due after that. Offsetting this, it had NT$100.0m in cash and NT$499.9m in receivables that were due within 12 months. So it can boast NT$126.2m more liquid assets than total liabilities.

It's good to see that Albatron Technology has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Because it has plenty of assets, it is unlikely to have trouble with its lenders.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With a net debt to EBITDA ratio of 8.1, it's fair to say Albatron Technology does have a significant amount of debt. But the good news is that it boasts fairly comforting interest cover of 2.6 times, suggesting it can responsibly service its obligations. Even worse, Albatron Technology saw its EBIT tank 73% over the last 12 months. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Albatron Technology's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Albatron Technology saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

To be frank both Albatron Technology's conversion of EBIT to free cash flow and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. But at least it's pretty decent at staying on top of its total liabilities; that's encouraging. Looking at the bigger picture, it seems clear to us that Albatron Technology's use of debt is creating risks for the company. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Like risks, for instance. Every company has them, and we've spotted 5 warning signs for Albatron Technology (of which 2 shouldn't be ignored!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TPEX:5386

Albatron Technology

Manufactures and sells memory modules, motherboards, graphics cards, and other electronic components and electronic materials in Asia, Europe, North America, and internationally.

Slight with acceptable track record.

Market Insights

Community Narratives