As global markets navigate a complex economic landscape, with inflationary pressures and cautious monetary policies shaping investor sentiment, Asian markets remain a focal point for those seeking stability and growth. In this context, dividend stocks in Asia present an intriguing opportunity, offering potential income streams amid broader market uncertainties.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.22% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.72% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.22% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.83% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.90% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| Daicel (TSE:4202) | 4.45% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.48% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.59% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.40% | ★★★★★★ |

Click here to see the full list of 1049 stocks from our Top Asian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

TK Group (Holdings) (SEHK:2283)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TK Group (Holdings) Limited is an investment holding company involved in the manufacture, sale, subcontracting, fabrication, and modification of molds and plastic components with a market cap of HK$2.12 billion.

Operations: TK Group (Holdings) Limited generates revenue from two primary segments: Mold Fabrication, contributing HK$893.09 million, and Plastic Components Manufacturing, contributing HK$1.62 billion.

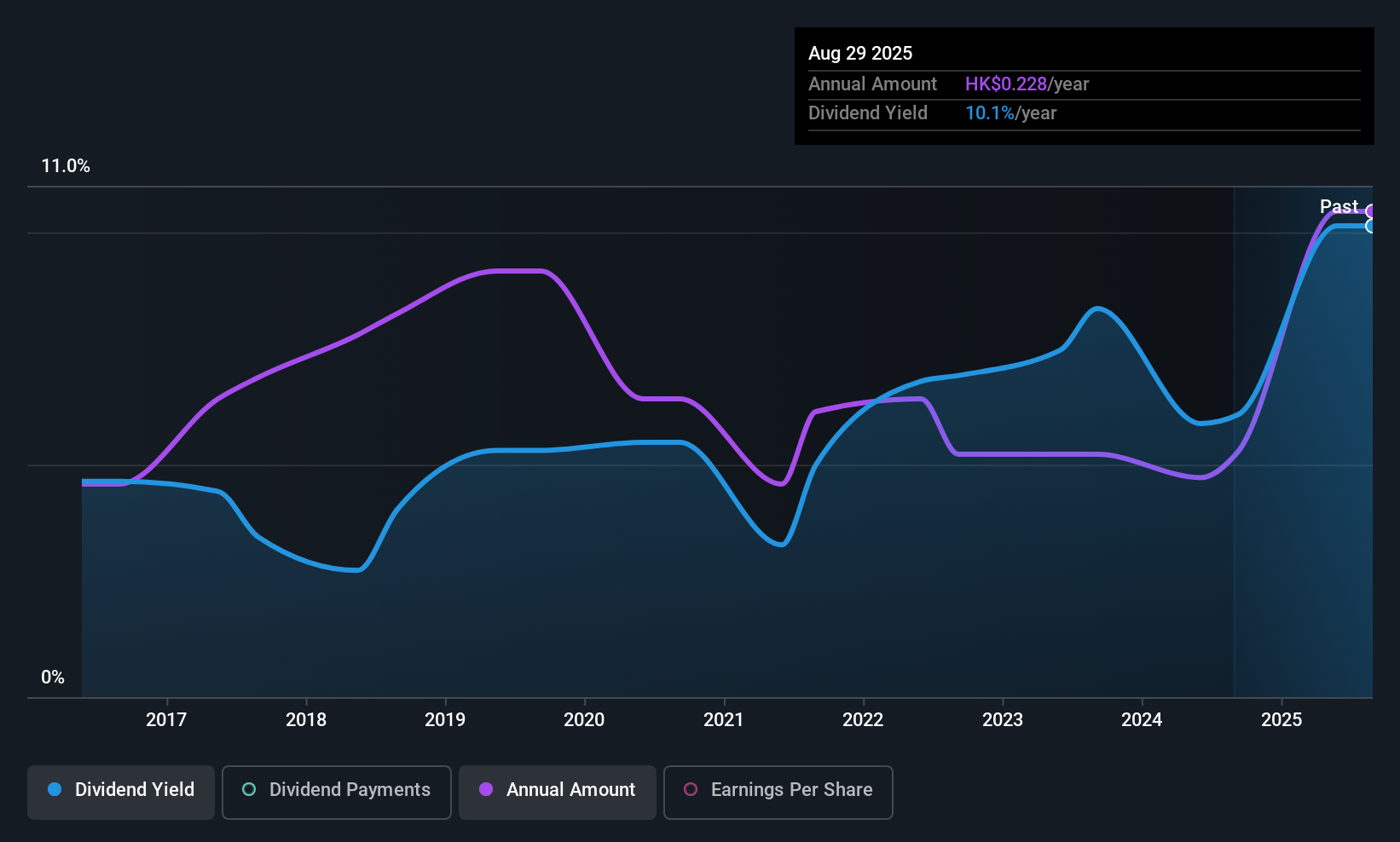

Dividend Yield: 9.1%

TK Group (Holdings) recently announced an interim dividend of HK$0.043 per share, reflecting its robust earnings growth with net income rising to HK$86.77 million for the first half of 2025. Despite a volatile dividend history, current payments are well-covered by earnings and cash flows, with a payout ratio of 40.4% and cash payout ratio at 74.8%. Trading at good value compared to peers, its dividend yield is among the top in Hong Kong's market.

- Get an in-depth perspective on TK Group (Holdings)'s performance by reading our dividend report here.

- The analysis detailed in our TK Group (Holdings) valuation report hints at an deflated share price compared to its estimated value.

Guangdong South New MediaLtd (SZSE:300770)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Guangdong Southern New Media Co., Ltd. operates in China, offering IPTV, internet audio-visual, and content copyright services with a market cap of CN¥10.85 billion.

Operations: Guangdong Southern New Media Co., Ltd.'s revenue primarily comes from its Information Dissemination Industry segment, which generated CN¥1.60 billion.

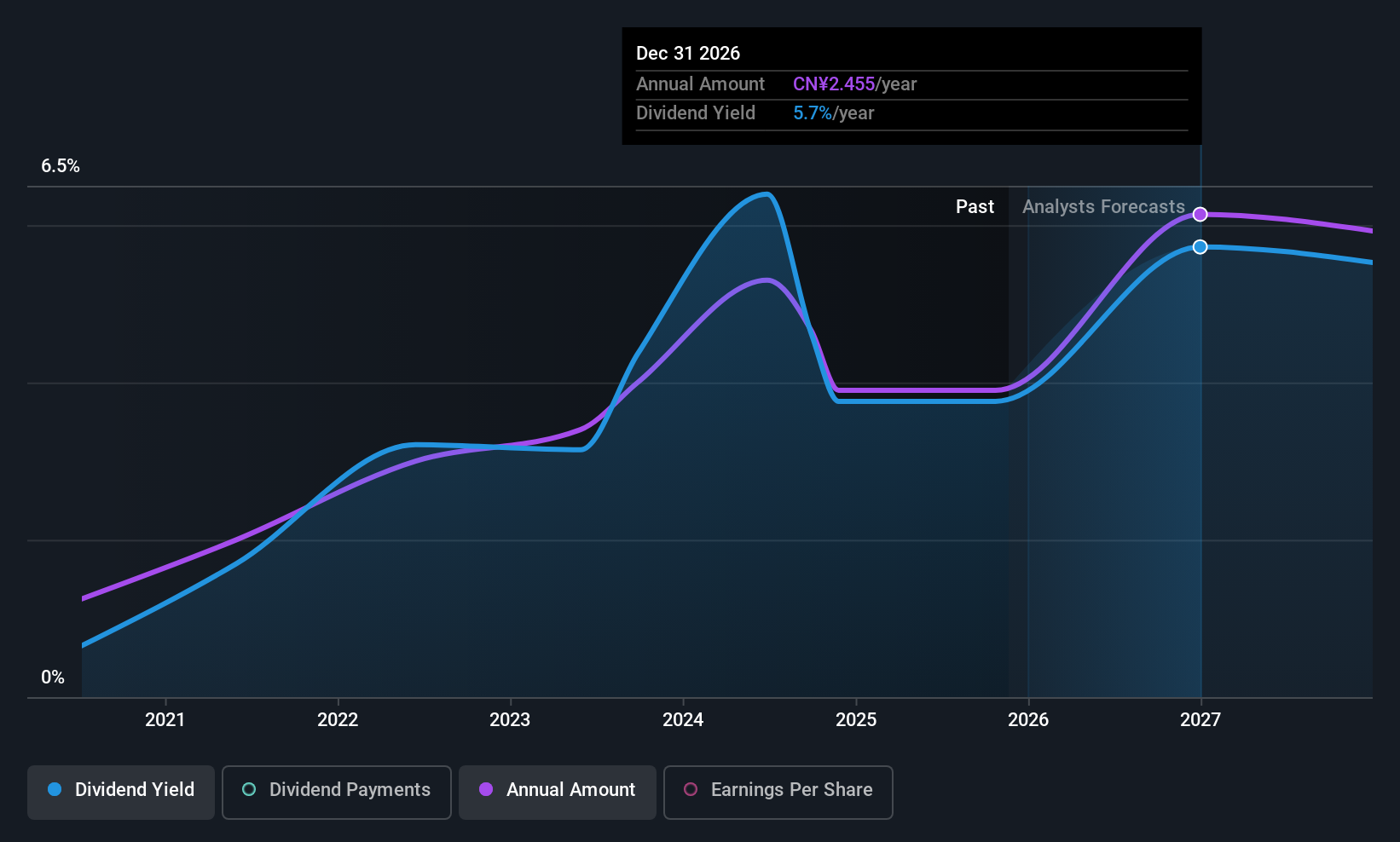

Dividend Yield: 3.3%

Guangdong South New Media's dividend payments have increased over the past five years, supported by a payout ratio of 55.5% and cash payout ratio of 45.5%, indicating good coverage by earnings and cash flows. Despite this, dividends have been volatile, with an unstable track record. Recent earnings growth and a proposed CNY 10 dividend per 10 shares suggest potential stability improvements, although historical volatility remains a concern for investors seeking consistent income streams.

- Click here to discover the nuances of Guangdong South New MediaLtd with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Guangdong South New MediaLtd is trading behind its estimated value.

WITS (TPEX:4953)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: WITS Corp., along with its subsidiaries, offers information technology services across Taiwan, Mainland China, Japan, the United States, and other international markets, with a market cap of NT$8.45 billion.

Operations: WITS Corp.'s revenue primarily comes from its Computer Services segment, which generated NT$10.69 billion.

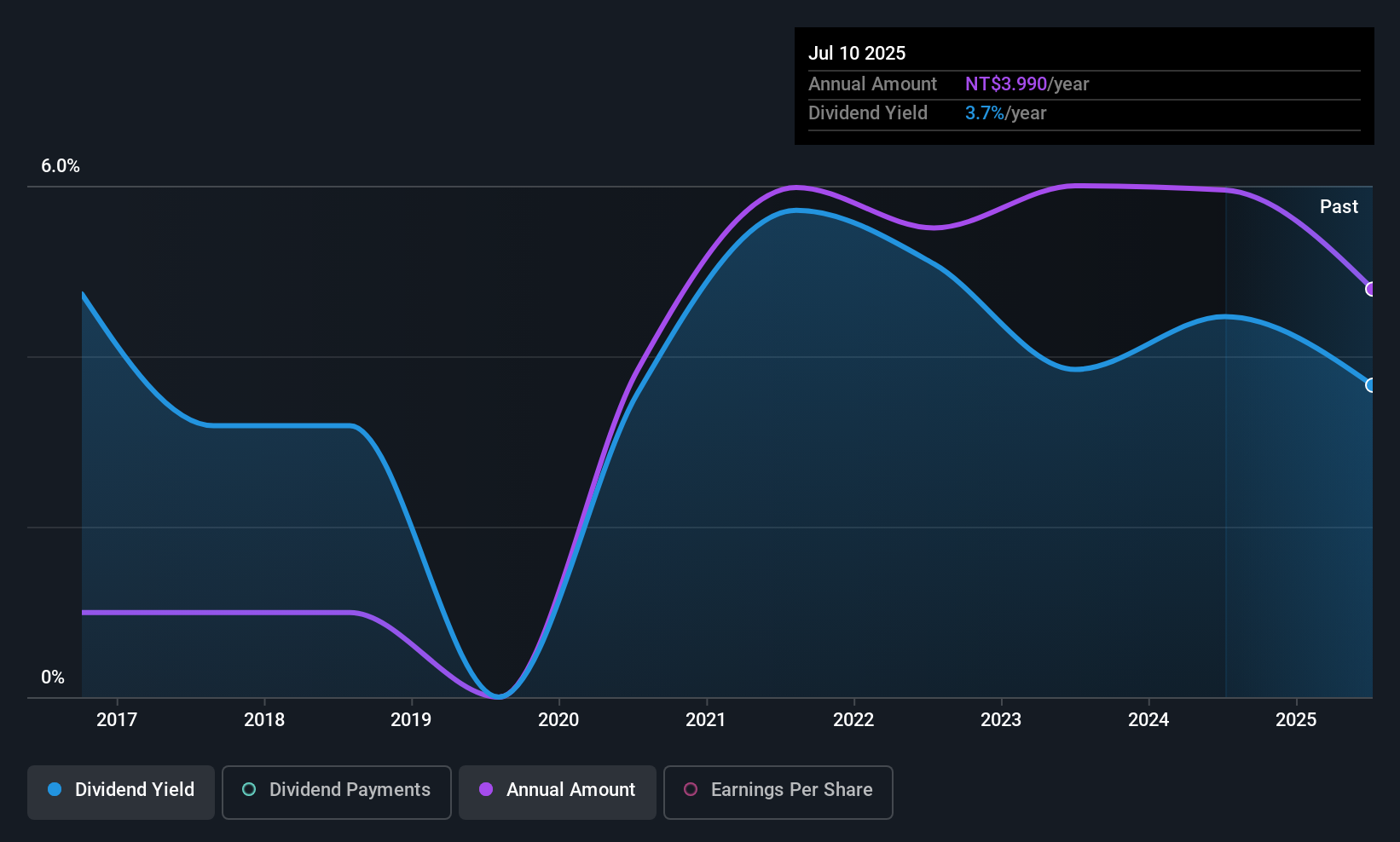

Dividend Yield: 3.5%

WITS Corp. offers stable and growing dividends, supported by a payout ratio of 68.2% and a cash payout ratio of 52.7%, ensuring coverage by earnings and cash flows. Despite recent lower profit margins, dividends remain reliable with consistent growth over the past decade. Trading at 18.1% below fair value estimates, the dividend yield is 3.45%, which is less attractive compared to top-tier payers in Taiwan's market but still provides steady income potential for investors.

- Click to explore a detailed breakdown of our findings in WITS' dividend report.

- The valuation report we've compiled suggests that WITS' current price could be quite moderate.

Where To Now?

- Click this link to deep-dive into the 1049 companies within our Top Asian Dividend Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300770

Guangdong South New MediaLtd

Guangdong Southern New Media Co.,Ltd. provides IPTV, internet audio-visual, and content copyright services in China.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives