As global markets navigate through a landscape marked by lower-than-expected inflation in the U.S., robust business activity in Europe, and economic policy shifts in Asia, investors are increasingly looking towards dividend stocks as a potential source of steady income amid market volatility. In this context, identifying strong dividend stocks involves assessing their ability to maintain consistent payouts and resilience across diverse economic conditions.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 3.70% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.97% | ★★★★★★ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.90% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.81% | ★★★★★★ |

| NCD (TSE:4783) | 4.47% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.55% | ★★★★★★ |

| Daicel (TSE:4202) | 4.52% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.68% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.58% | ★★★★★★ |

Click here to see the full list of 1360 stocks from our Top Global Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Banco del Bajío Institución de Banca Múltiple (BMV:BBAJIO O)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banco del Bajío, S.A., Institución de Banca Múltiple offers a range of banking products and services in Mexico with a market cap of MX$56.81 billion.

Operations: Banco del Bajío, S.A., Institución de Banca Múltiple generates revenue through its diverse banking products and services in Mexico.

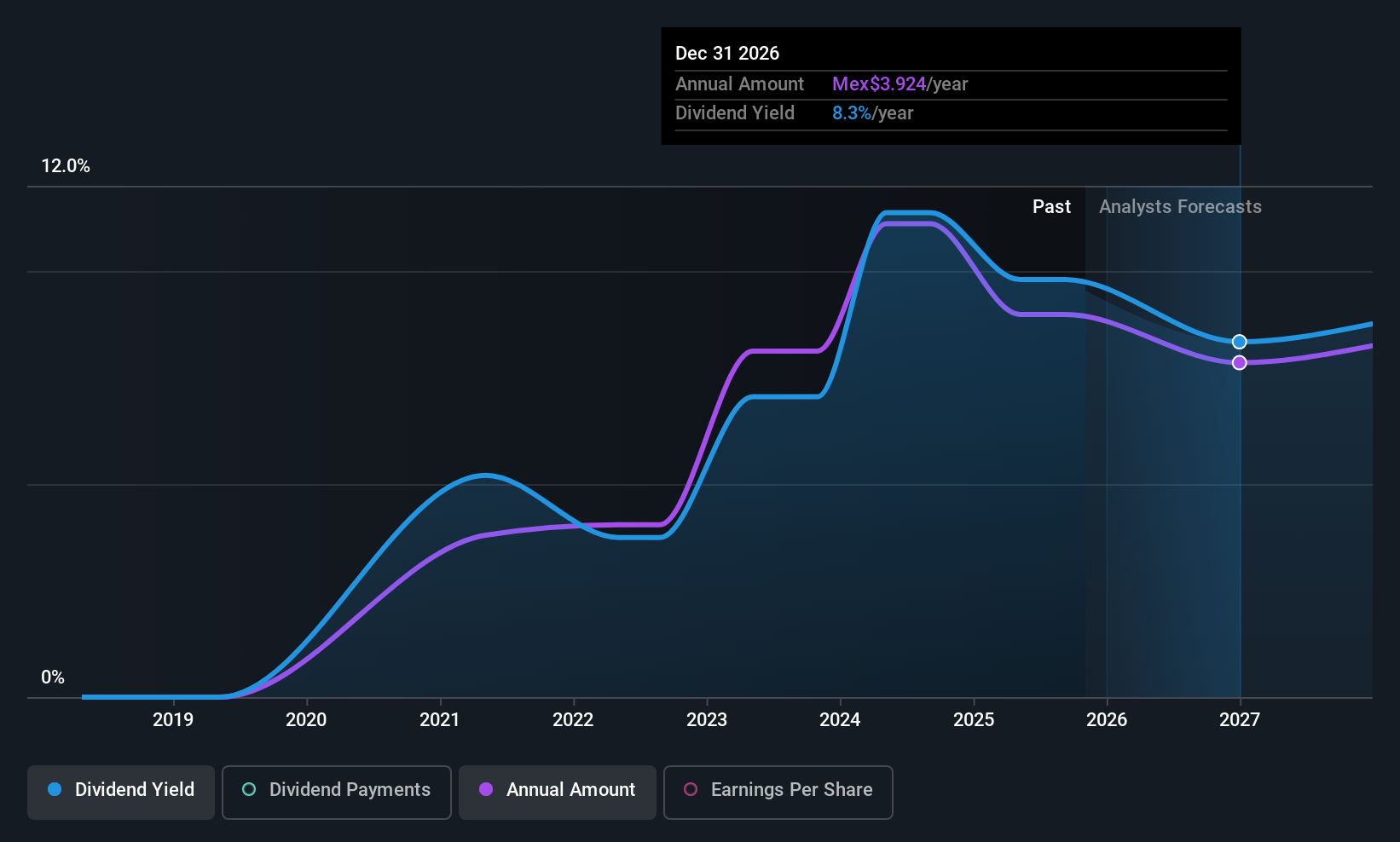

Dividend Yield: 9.4%

Banco del Bajío's dividend yield of 9.41% is among the top 25% in Mexico, supported by a reasonable payout ratio of 55.2%. Despite this, its dividend history is less than a decade old and marked by volatility and unreliability over the past five years. The company's recent earnings report shows net income at MX$6.92 billion, down from MX$8.15 billion year-over-year, potentially impacting future dividend stability despite forecasts suggesting sustainable coverage in three years.

- Navigate through the intricacies of Banco del Bajío Institución de Banca Múltiple with our comprehensive dividend report here.

- Our valuation report unveils the possibility Banco del Bajío Institución de Banca Múltiple's shares may be trading at a discount.

Jiangsu Guotai International Group (SZSE:002091)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jiangsu Guotai International Group Co., Ltd. operates in the import and export industry, with a market cap of CN¥14.31 billion.

Operations: The company's revenue segments are not explicitly detailed in the provided text, so a specific summary cannot be created without additional information.

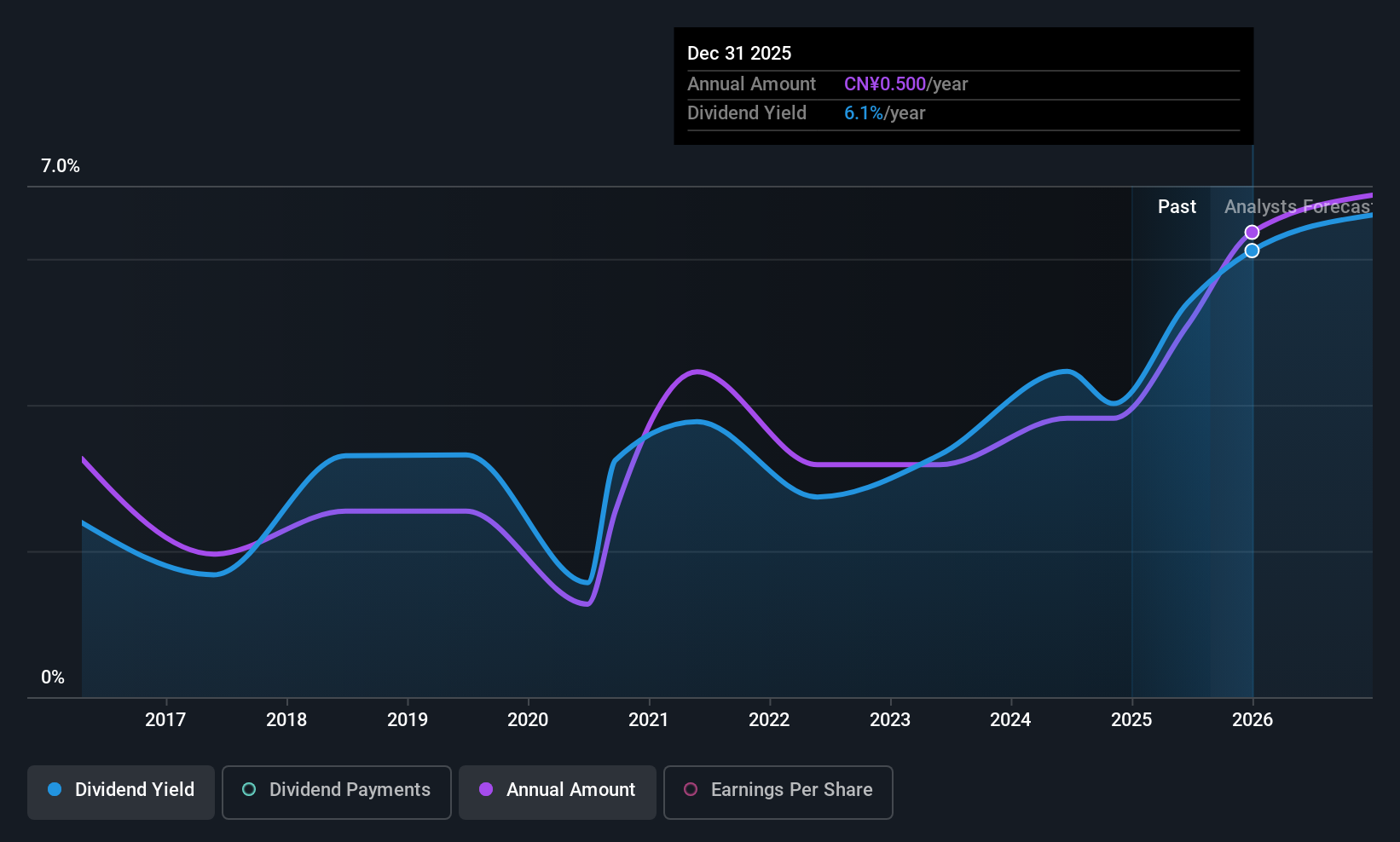

Dividend Yield: 4.3%

Jiangsu Guotai International Group's dividend yield is among the top 25% in China, with a payout ratio of 56.3%, indicating coverage by earnings and cash flows. Recent shareholder approval to redefine the dividend return plan for 2025-2027 may enhance future payouts. However, past dividends have been volatile and unreliable over the last decade. The company's recent earnings report shows modest growth in net income to CNY 935.45 million, supporting its current dividend strategy amidst market fluctuations.

- Click here and access our complete dividend analysis report to understand the dynamics of Jiangsu Guotai International Group.

- The valuation report we've compiled suggests that Jiangsu Guotai International Group's current price could be quite moderate.

Topco ScientificLtd (TWSE:5434)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Topco Scientific Co., Ltd. operates globally, supplying precision materials, manufacturing equipment, and components with a market cap of NT$61.13 billion.

Operations: Topco Scientific Co., Ltd. generates revenue primarily from its Semiconductor and Electronic Materials Business Department, which accounts for NT$57.20 billion, followed by the Environmental Engineering Division at NT$6.40 billion.

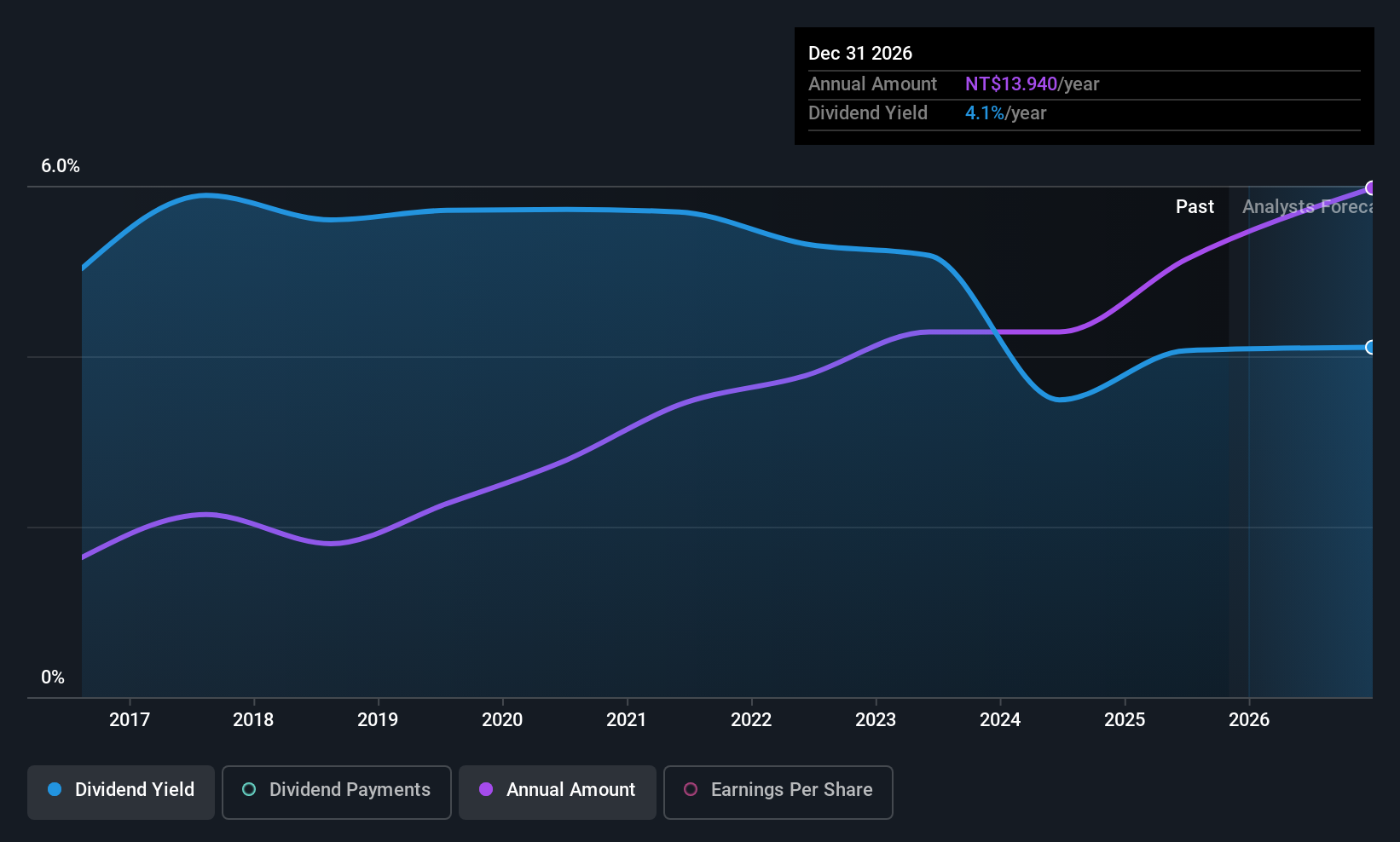

Dividend Yield: 3.5%

Topco Scientific Ltd. offers a stable dividend yield of 3.49%, though it falls short of the top 25% in Taiwan's market. The company's dividends are well-covered by both earnings and cash flows, with payout ratios of 61.6% and 60.3%, respectively, ensuring sustainability. Over the past decade, Topco's dividends have been reliable and growing steadily, supported by recent earnings growth of 15.3%. Its current P/E ratio suggests good value relative to the TW market average.

- Delve into the full analysis dividend report here for a deeper understanding of Topco ScientificLtd.

- According our valuation report, there's an indication that Topco ScientificLtd's share price might be on the cheaper side.

Make It Happen

- Reveal the 1360 hidden gems among our Top Global Dividend Stocks screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banco del Bajío Institución de Banca Múltiple might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:BBAJIO O

Banco del Bajío Institución de Banca Múltiple

Provides banking products and services in Mexico.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives