- Turkey

- /

- Industrials

- /

- IBSE:SISE

Three Stocks That May Be Priced Below Estimated Value In December 2024

Reviewed by Simply Wall St

As global markets continue to reach record highs, driven by robust trading activity and geopolitical developments, investors are keeping a keen eye on potential policy shifts that could impact economic stability. Amidst this environment of growth and uncertainty, identifying stocks that may be undervalued can present opportunities for those looking to capitalize on discrepancies between current prices and estimated intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥16.34 | CN¥33.16 | 50.7% |

| Pan African Resources (AIM:PAF) | £0.3735 | £0.75 | 49.9% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1116.10 | ₹2222.42 | 49.8% |

| Iguatemi (BOVESPA:IGTI3) | R$2.25 | R$4.49 | 49.8% |

| Elekta (OM:EKTA B) | SEK61.50 | SEK122.95 | 50% |

| Adtraction Group (OM:ADTR) | SEK38.40 | SEK76.45 | 49.8% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| Privia Health Group (NasdaqGS:PRVA) | US$21.66 | US$43.17 | 49.8% |

| Sands China (SEHK:1928) | HK$20.40 | HK$40.58 | 49.7% |

| Energy One (ASX:EOL) | A$5.40 | A$10.52 | 48.7% |

Let's uncover some gems from our specialized screener.

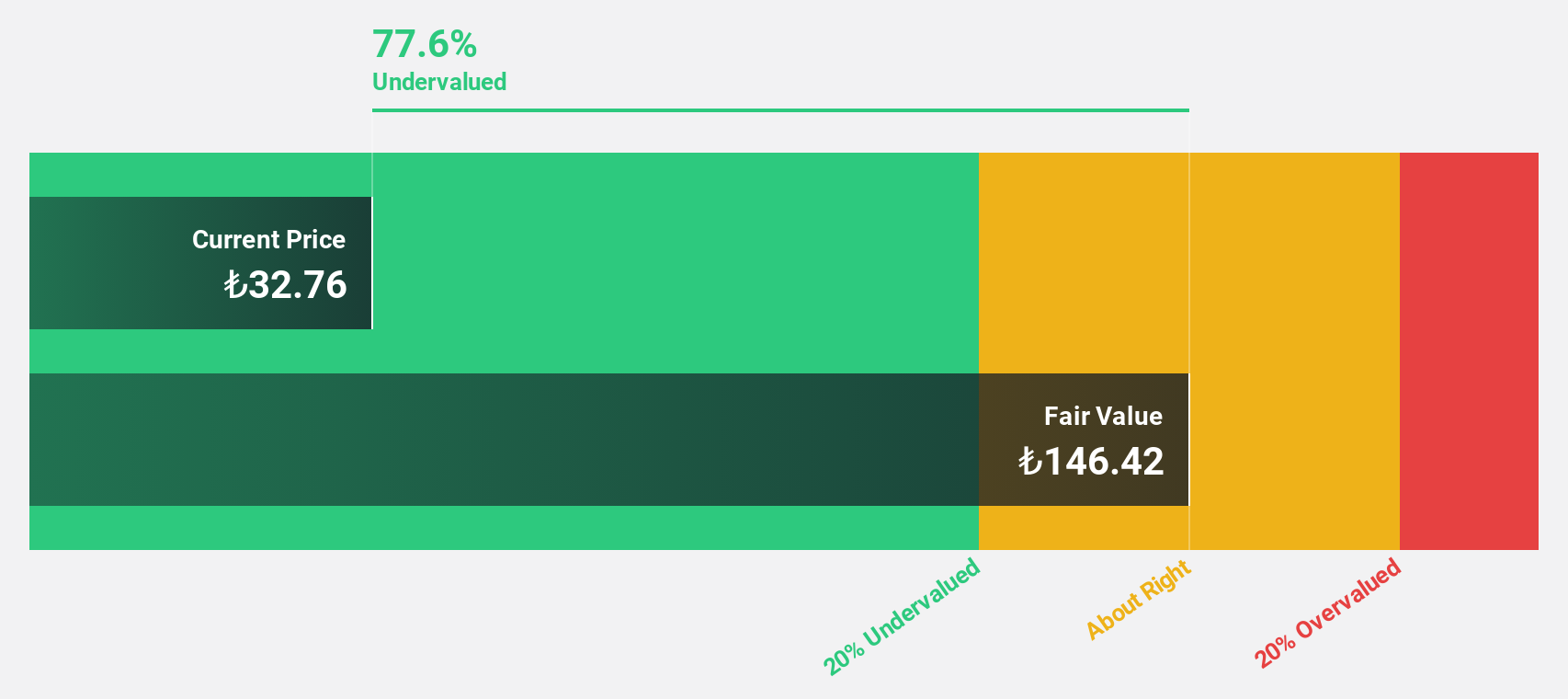

Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE)

Overview: Türkiye Sise Ve Cam Fabrikalari A.S. is a company that manufactures and sells glass products in Turkey and internationally, with a market cap of TRY125.90 billion.

Operations: Türkiye Sise Ve Cam Fabrikalari's revenue segments include Energy (TRY17.19 billion), Chemicals (TRY32.58 billion), Glass Packaging (TRY26.02 billion), Industrial Glasses (TRY14.38 billion), Architectural Glasses (TRY30.33 billion), and Glass Household Goods (TRY15.95 billion).

Estimated Discount To Fair Value: 49.3%

Türkiye Sise Ve Cam Fabrikalari is trading at TRY41.1, significantly below its fair value estimate of TRY81.12, indicating strong undervaluation based on discounted cash flows. Analysts forecast earnings growth of 41.6% annually, outpacing the Turkish market's 38.2%. Despite a volatile dividend history and low future return on equity (9.1%), recent earnings showed improvement with net income rising to TRY795.39 million in Q3 2024 from a loss last year, underscoring potential for recovery and growth.

- Our growth report here indicates Türkiye Sise Ve Cam Fabrikalari may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Türkiye Sise Ve Cam Fabrikalari.

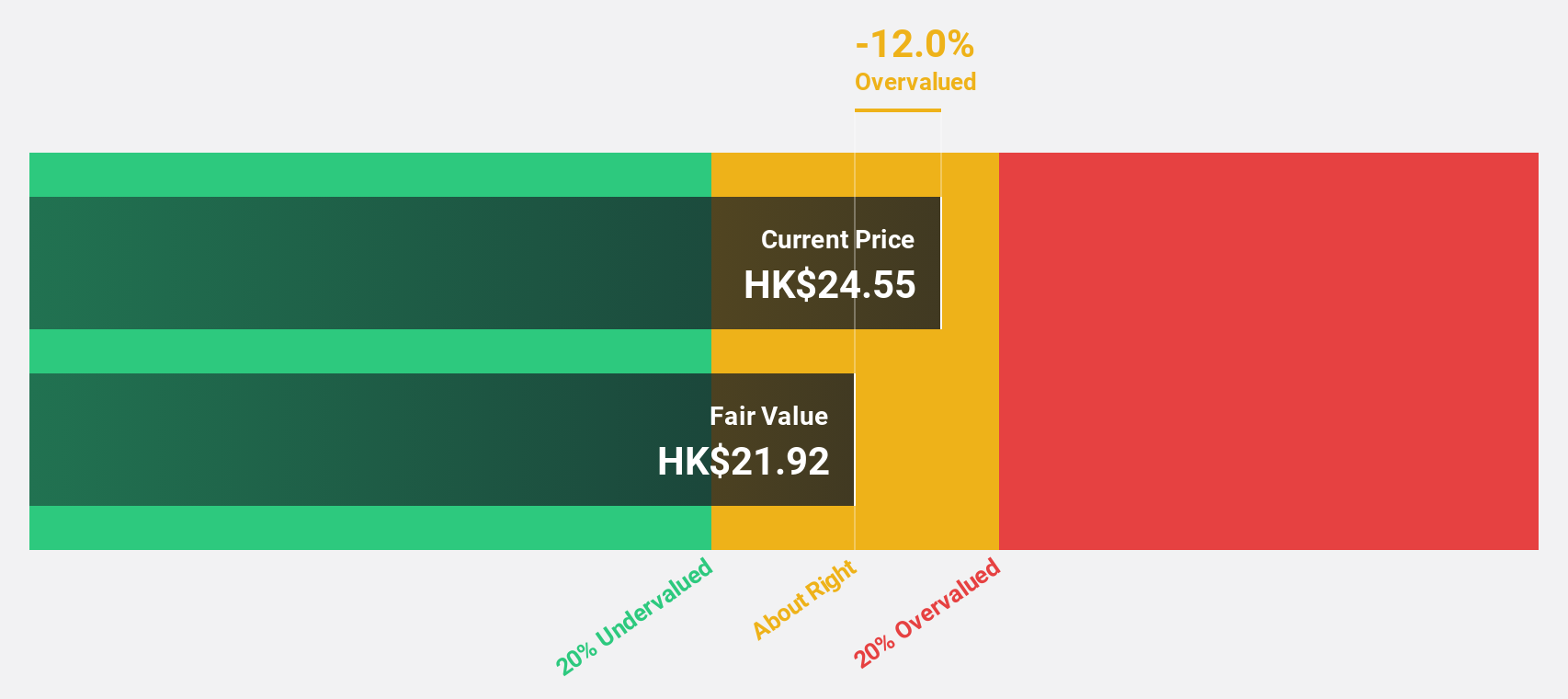

Binjiang Service Group (SEHK:3316)

Overview: Binjiang Service Group Co. Ltd. offers property management and related services in the People’s Republic of China, with a market cap of HK$5.12 billion.

Operations: Revenue segments for Binjiang Service Group Co. Ltd. include property management and related services in the People’s Republic of China, with a market cap of HK$5.12 billion.

Estimated Discount To Fair Value: 29.6%

Binjiang Service Group, trading at HK$18.52, is undervalued with a fair value estimate of HK$26.3, based on discounted cash flows. Revenue and earnings are expected to grow faster than the Hong Kong market at 16.4% and 15% annually, respectively. Despite an unstable dividend history, the company has shown robust profit growth of 16.4% over the past year with a high projected return on equity of 35.6% in three years.

- According our earnings growth report, there's an indication that Binjiang Service Group might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Binjiang Service Group.

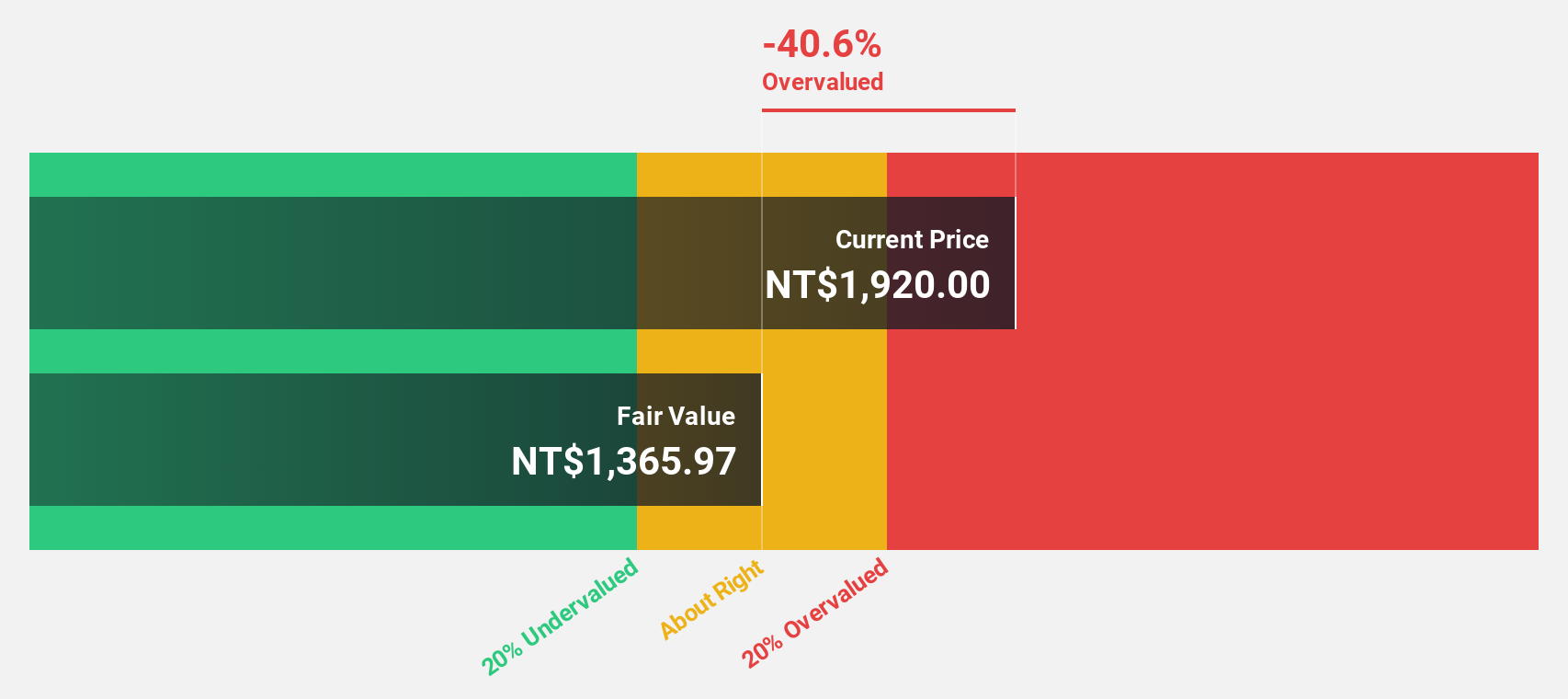

ASMedia Technology (TWSE:5269)

Overview: ASMedia Technology Inc. is a fabless IC design company specializing in high-speed analogue circuit products, with operations spanning the United States, Taiwan, China, Southeast Asia, Northeast Asia, and other international markets; it has a market cap of approximately NT$122.82 billion.

Operations: The company's revenue is primarily derived from its high-speed analogue electric circuit segment, amounting to NT$7.89 billion.

Estimated Discount To Fair Value: 10.7%

ASMedia Technology, trading at NT$1,725, is priced below its fair value estimate of NT$1,931.07. The company reported strong Q3 2024 results with sales of TWD 2.13 billion and net income of TWD 974.19 million, reflecting significant year-over-year growth. Earnings are projected to grow at an annual rate of 32.88%, outpacing the Taiwan market average. Despite recent shareholder dilution and share price volatility, the robust earnings trajectory highlights potential undervaluation based on cash flows.

- Upon reviewing our latest growth report, ASMedia Technology's projected financial performance appears quite optimistic.

- Take a closer look at ASMedia Technology's balance sheet health here in our report.

Seize The Opportunity

- Click here to access our complete index of 891 Undervalued Stocks Based On Cash Flows.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Türkiye Sise Ve Cam Fabrikalari might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:SISE

Türkiye Sise Ve Cam Fabrikalari

Manufactures and sells glass products in Turkey, the United States, Russia, Ukraine, Georgia, Europe, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives