Stock Analysis

- Taiwan

- /

- Semiconductors

- /

- TWSE:3588

Leadtrend Technology's (TWSE:3588) five-year total shareholder returns outpace the underlying earnings growth

Leadtrend Technology Corporation (TWSE:3588) shareholders have seen the share price descend 13% over the month. But that doesn't change the fact that the returns over the last half decade have been spectacular. Indeed, the share price is up a whopping 307% in that time. So it might be that some shareholders are taking profits after good performance. But the real question is whether the business fundamentals can improve over the long term.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

Check out our latest analysis for Leadtrend Technology

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

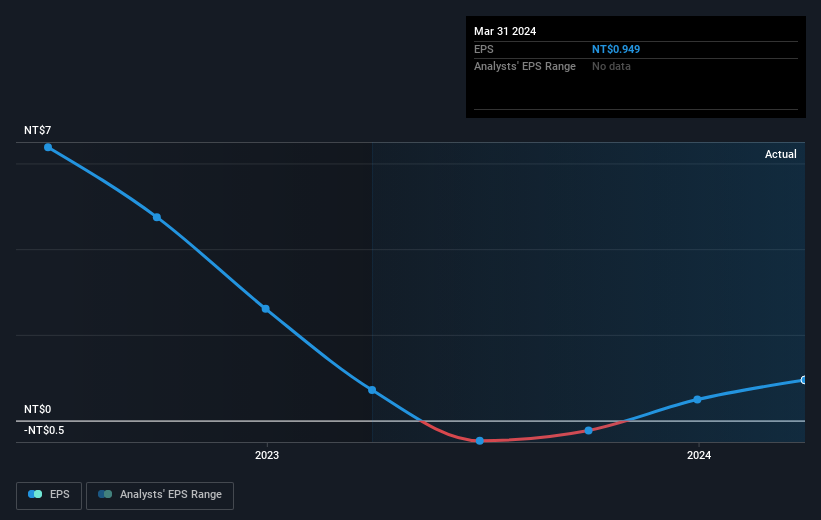

During five years of share price growth, Leadtrend Technology achieved compound earnings per share (EPS) growth of 9.5% per year. This EPS growth is lower than the 32% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. That's not necessarily surprising considering the five-year track record of earnings growth. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 84.82.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Leadtrend Technology, it has a TSR of 364% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that Leadtrend Technology has rewarded shareholders with a total shareholder return of 42% in the last twelve months. That's including the dividend. That gain is better than the annual TSR over five years, which is 36%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Is Leadtrend Technology cheap compared to other companies? These 3 valuation measures might help you decide.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3588

Leadtrend Technology

Operates as a fabless company for AC-DC mid and high-power application solutions primarily in Taiwan.

Flawless balance sheet with solid track record.