- Taiwan

- /

- Semiconductors

- /

- TWSE:3450

Elite Advanced Laser Corporation (TWSE:3450) Held Back By Insufficient Growth Even After Shares Climb 30%

The Elite Advanced Laser Corporation (TWSE:3450) share price has done very well over the last month, posting an excellent gain of 30%. Looking back a bit further, it's encouraging to see the stock is up 90% in the last year.

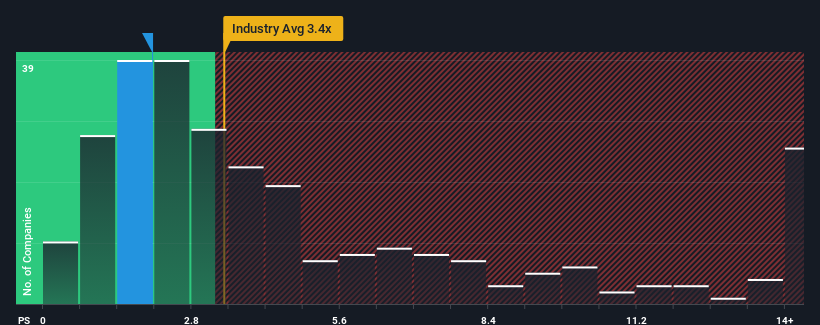

Even after such a large jump in price, Elite Advanced Laser's price-to-sales (or "P/S") ratio of 2.1x might still make it look like a buy right now compared to the Semiconductor industry in Taiwan, where around half of the companies have P/S ratios above 3.4x and even P/S above 7x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Elite Advanced Laser

How Elite Advanced Laser Has Been Performing

As an illustration, revenue has deteriorated at Elite Advanced Laser over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on Elite Advanced Laser will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Elite Advanced Laser, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Elite Advanced Laser's Revenue Growth Trending?

In order to justify its P/S ratio, Elite Advanced Laser would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 22% decrease to the company's top line. As a result, revenue from three years ago have also fallen 7.9% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 22% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we are not surprised that Elite Advanced Laser is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Final Word

The latest share price surge wasn't enough to lift Elite Advanced Laser's P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Elite Advanced Laser confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Before you settle on your opinion, we've discovered 2 warning signs for Elite Advanced Laser (1 is potentially serious!) that you should be aware of.

If you're unsure about the strength of Elite Advanced Laser's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Elite Advanced Laser might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3450

Elite Advanced Laser

Provides electronic manufacturing services in Taiwan.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives