- Taiwan

- /

- Semiconductors

- /

- TWSE:3189

Why Investors Shouldn't Be Surprised By Kinsus Interconnect Technology Corp.'s (TWSE:3189) Low P/S

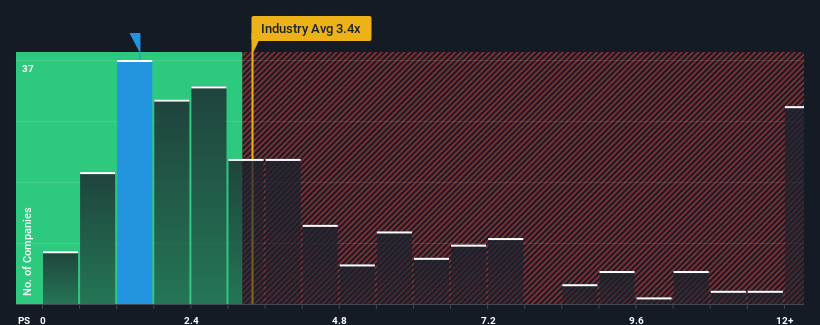

With a price-to-sales (or "P/S") ratio of 1.6x Kinsus Interconnect Technology Corp. (TWSE:3189) may be sending bullish signals at the moment, given that almost half of all the Semiconductor companies in Taiwan have P/S ratios greater than 3.4x and even P/S higher than 7x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Kinsus Interconnect Technology

How Has Kinsus Interconnect Technology Performed Recently?

Kinsus Interconnect Technology has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market isn't expecting future revenue performance to improve, which has kept the P/S suppressed. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Keen to find out how analysts think Kinsus Interconnect Technology's future stacks up against the industry? In that case, our free report is a great place to start.How Is Kinsus Interconnect Technology's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Kinsus Interconnect Technology's is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 37%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 14% per year over the next three years. That's shaping up to be materially lower than the 18% each year growth forecast for the broader industry.

With this information, we can see why Kinsus Interconnect Technology is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Kinsus Interconnect Technology's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Kinsus Interconnect Technology's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you settle on your opinion, we've discovered 1 warning sign for Kinsus Interconnect Technology that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Kinsus Interconnect Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3189

Kinsus Interconnect Technology

Engages in the manufacture and sale of electronic products in Taiwan and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives