- Taiwan

- /

- Semiconductors

- /

- TWSE:2481

Not Many Are Piling Into Panjit International Inc. (TWSE:2481) Stock Yet As It Plummets 28%

Panjit International Inc. (TWSE:2481) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 35% in that time.

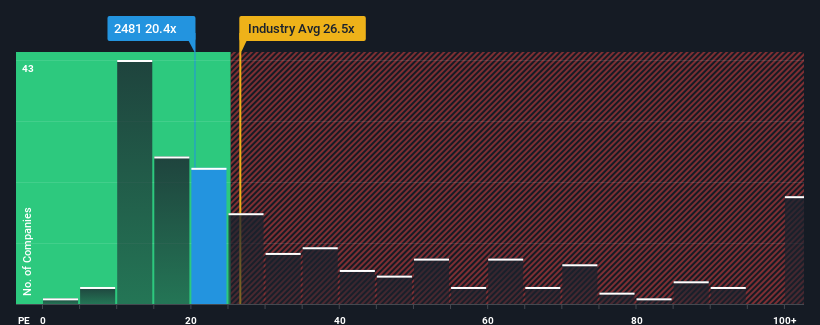

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Panjit International's P/E ratio of 20.4x, since the median price-to-earnings (or "P/E") ratio in Taiwan is also close to 21x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Panjit International hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Panjit International

Is There Some Growth For Panjit International?

In order to justify its P/E ratio, Panjit International would need to produce growth that's similar to the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 32%. This means it has also seen a slide in earnings over the longer-term as EPS is down 31% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 25% per annum as estimated by the dual analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 13% per annum, which is noticeably less attractive.

In light of this, it's curious that Panjit International's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Panjit International's P/E?

Panjit International's plummeting stock price has brought its P/E right back to the rest of the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Panjit International currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware Panjit International is showing 2 warning signs in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2481

Panjit International

PANJIT INTERNATIONAL INC. manufactures, processes, assembles, imports, and exports semiconductors in Taiwan, China, Korea, the United States, Japan, Germany, Italy, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives