- Taiwan

- /

- Semiconductors

- /

- TWSE:8110

Reflecting on Walton Advanced Engineering's (TPE:8110) Share Price Returns Over The Last Three Years

While not a mind-blowing move, it is good to see that the Walton Advanced Engineering, Inc. (TPE:8110) share price has gained 14% in the last three months. But that doesn't change the fact that the returns over the last three years have been less than pleasing. After all, the share price is down 33% in the last three years, significantly under-performing the market.

View our latest analysis for Walton Advanced Engineering

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

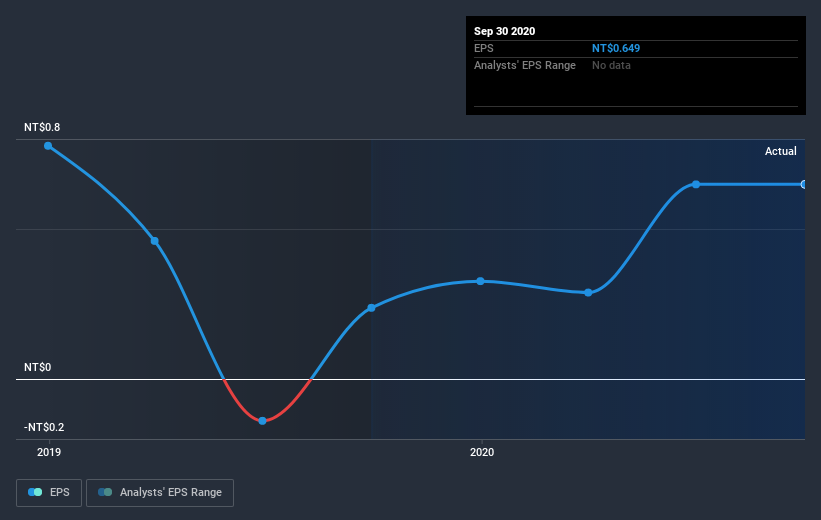

Walton Advanced Engineering saw its EPS decline at a compound rate of 25% per year, over the last three years. In comparison the 13% compound annual share price decline isn't as bad as the EPS drop-off. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Walton Advanced Engineering's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Walton Advanced Engineering's TSR, which was a 27% drop over the last 3 years, was not as bad as the share price return.

A Different Perspective

Walton Advanced Engineering provided a TSR of 3.6% over the last twelve months. Unfortunately this falls short of the market return. If we look back over five years, the returns are even better, coming in at 6% per year for five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Walton Advanced Engineering (1 doesn't sit too well with us) that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

When trading Walton Advanced Engineering or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Walton Advanced Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:8110

Walton Advanced Engineering

Provides semiconductor packaging and testing services in Taiwan and China.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives