- Taiwan

- /

- Semiconductors

- /

- TWSE:6698

FineMat Applied Materials (TPE:6698) Share Prices Have Dropped 45% In The Last Year

Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. That downside risk was realized by FineMat Applied Materials Co., Ltd. (TPE:6698) shareholders over the last year, as the share price declined 45%. That's well below the market return of 23%. Because FineMat Applied Materials hasn't been listed for many years, the market is still learning about how the business performs.

See our latest analysis for FineMat Applied Materials

We don't think that FineMat Applied Materials' modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In just one year FineMat Applied Materials saw its revenue fall by 28%. That's not what investors generally want to see. The stock price has languished lately, falling 45% in a year. That seems pretty reasonable given the lack of both profits and revenue growth. We think most holders must believe revenue growth will improve, or else costs will decline.

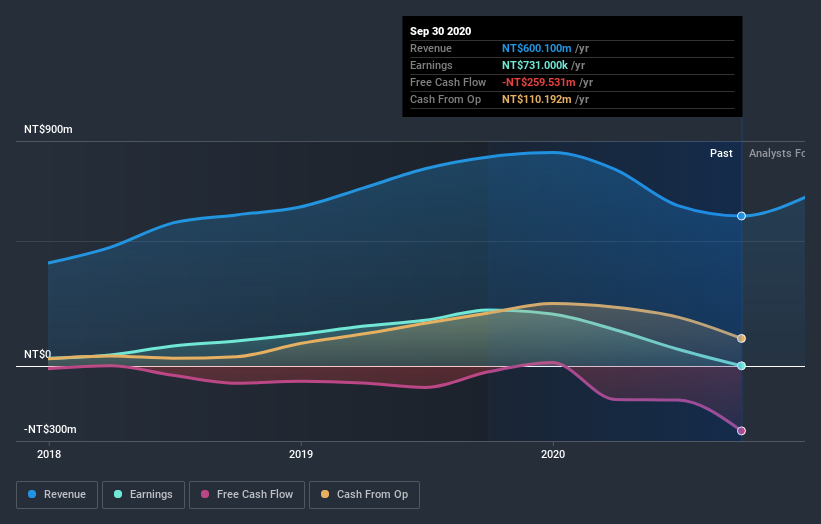

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on FineMat Applied Materials' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Given that the market gained 23% in the last year, FineMat Applied Materials shareholders might be miffed that they lost 44% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 6.1% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand FineMat Applied Materials better, we need to consider many other factors. Take risks, for example - FineMat Applied Materials has 5 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

When trading FineMat Applied Materials or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:6698

FineMat Applied Materials

Develops, manufactures, and sells high precision metal masks and other metal products in Mainland China, Taiwan, and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives