The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that TSEC Corporation (TPE:6443) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for TSEC

What Is TSEC's Net Debt?

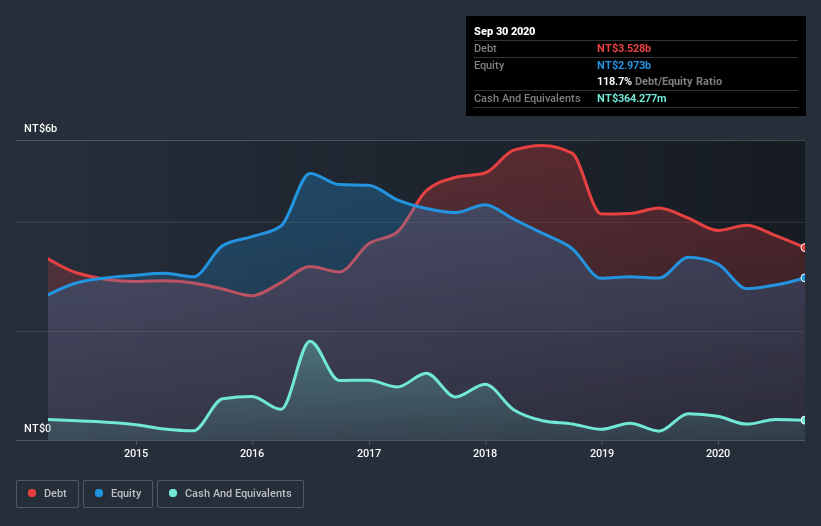

You can click the graphic below for the historical numbers, but it shows that TSEC had NT$3.53b of debt in September 2020, down from NT$4.07b, one year before. However, it does have NT$364.3m in cash offsetting this, leading to net debt of about NT$3.16b.

How Healthy Is TSEC's Balance Sheet?

The latest balance sheet data shows that TSEC had liabilities of NT$2.85b due within a year, and liabilities of NT$1.49b falling due after that. On the other hand, it had cash of NT$364.3m and NT$458.8m worth of receivables due within a year. So it has liabilities totalling NT$3.52b more than its cash and near-term receivables, combined.

TSEC has a market capitalization of NT$15.3b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While we wouldn't worry about TSEC's net debt to EBITDA ratio of 4.8, we think its super-low interest cover of 0.48 times is a sign of high leverage. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. One redeeming factor for TSEC is that it turned last year's EBIT loss into a gain of NT$48m, over the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if TSEC can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. During the last year, TSEC generated free cash flow amounting to a very robust 89% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Our View

TSEC's interest cover was a real negative on this analysis, although the other factors we considered were considerably better. In particular, we are dazzled with its conversion of EBIT to free cash flow. Looking at all this data makes us feel a little cautious about TSEC's debt levels. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for TSEC you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading TSEC or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TSEC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:6443

TSEC

Designs, manufactures, constructs, and sells solar cells, modules, and power plants in Asia, Europe, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives