- Taiwan

- /

- Semiconductors

- /

- TWSE:6120

Would Shareholders Who Purchased Darwin Precisions' (TPE:6120) Stock Three Years Be Happy With The Share price Today?

Darwin Precisions Corporation (TPE:6120) shareholders should be happy to see the share price up 16% in the last month. But that doesn't help the fact that the three year return is less impressive. Truth be told the share price declined 50% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

Check out our latest analysis for Darwin Precisions

Because Darwin Precisions made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

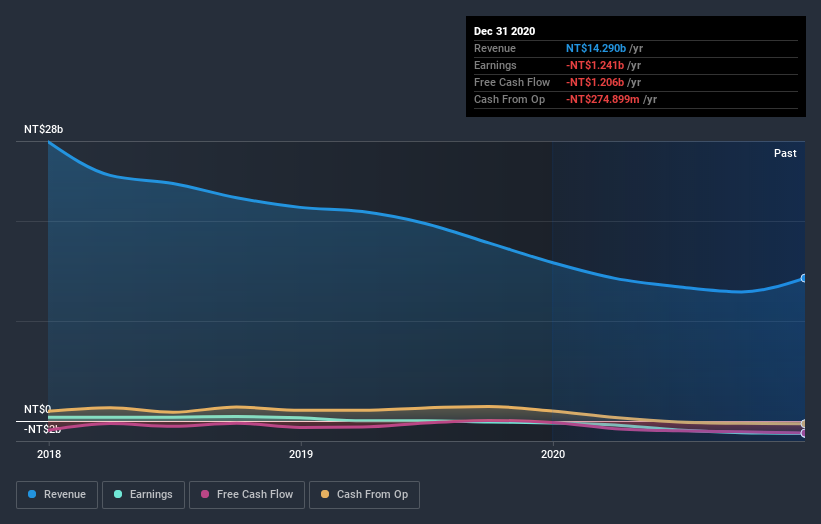

In the last three years Darwin Precisions saw its revenue shrink by 25% per year. That means its revenue trend is very weak compared to other loss making companies. With revenue in decline, the share price decline of 14% per year is hardly undeserved. It would probably be worth asking whether the company can fund itself to profitability. The company will need to return to revenue growth as quickly as possible, if it wants to see some enthusiasm from investors.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Darwin Precisions' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Darwin Precisions shareholders gained a total return of 10% during the year. Unfortunately this falls short of the market return. The silver lining is that the gain was actually better than the average annual return of 7% per year over five year. It is possible that returns will improve along with the business fundamentals. It's always interesting to track share price performance over the longer term. But to understand Darwin Precisions better, we need to consider many other factors. Even so, be aware that Darwin Precisions is showing 1 warning sign in our investment analysis , you should know about...

Of course Darwin Precisions may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade Darwin Precisions, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:6120

Darwin Precisions

Designs, manufactures, assembles, processes, and trades in backlight modules, computer peripherals, and communication equipment in Taiwan, Korea, Japan, China, and internationally.

Excellent balance sheet unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives