- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6739

Exploring Three Promising Small Cap Stocks in Asia

Reviewed by Simply Wall St

As global markets navigate a landscape of interest rate adjustments and economic shifts, small-cap stocks have shown resilience, particularly in Asia where emerging opportunities are catching the attention of investors. In this dynamic environment, identifying promising small-cap stocks involves looking for companies that demonstrate strong fundamentals and potential for growth amid broader market sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ruentex Interior Design | NA | 32.58% | 38.70% | ★★★★★★ |

| ZHEJIANG DIBAY ELECTRICLtd | 0.09% | 4.57% | 4.99% | ★★★★★★ |

| Daphne International Holdings | NA | -5.92% | 82.03% | ★★★★★★ |

| Jiangyin Haida Rubber And Plastic | 13.80% | 8.51% | -6.90% | ★★★★★★ |

| HeBei Jinniu Chemical IndustryLtd | NA | 1.40% | 16.29% | ★★★★★★ |

| Changchai Company | NA | 0.32% | -6.09% | ★★★★★★ |

| Guangdong Transtek Medical Electronics | 14.33% | -9.94% | 1.91% | ★★★★★☆ |

| Uniplus Electronics | 45.33% | 46.79% | 73.91% | ★★★★★☆ |

| Guangdong Tloong Technology GroupLtd | 48.17% | -8.59% | -20.38% | ★★★★★☆ |

| Dong Fang Offshore | 41.99% | 33.40% | 39.04% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Ningbo DonlyLtd (SZSE:002164)

Simply Wall St Value Rating: ★★★★★★

Overview: Ningbo Donly Co., Ltd focuses on the R&D, manufacturing, sale, and technical consultation of transmission equipment, door control systems, and industrial automatic control systems both in China and internationally with a market cap of CN¥8.17 billion.

Operations: The primary revenue stream for Ningbo Donly Co., Ltd is its Equipment Manufacturing Business, which generated CN¥1.47 billion. The company's market cap stands at CN¥8.17 billion.

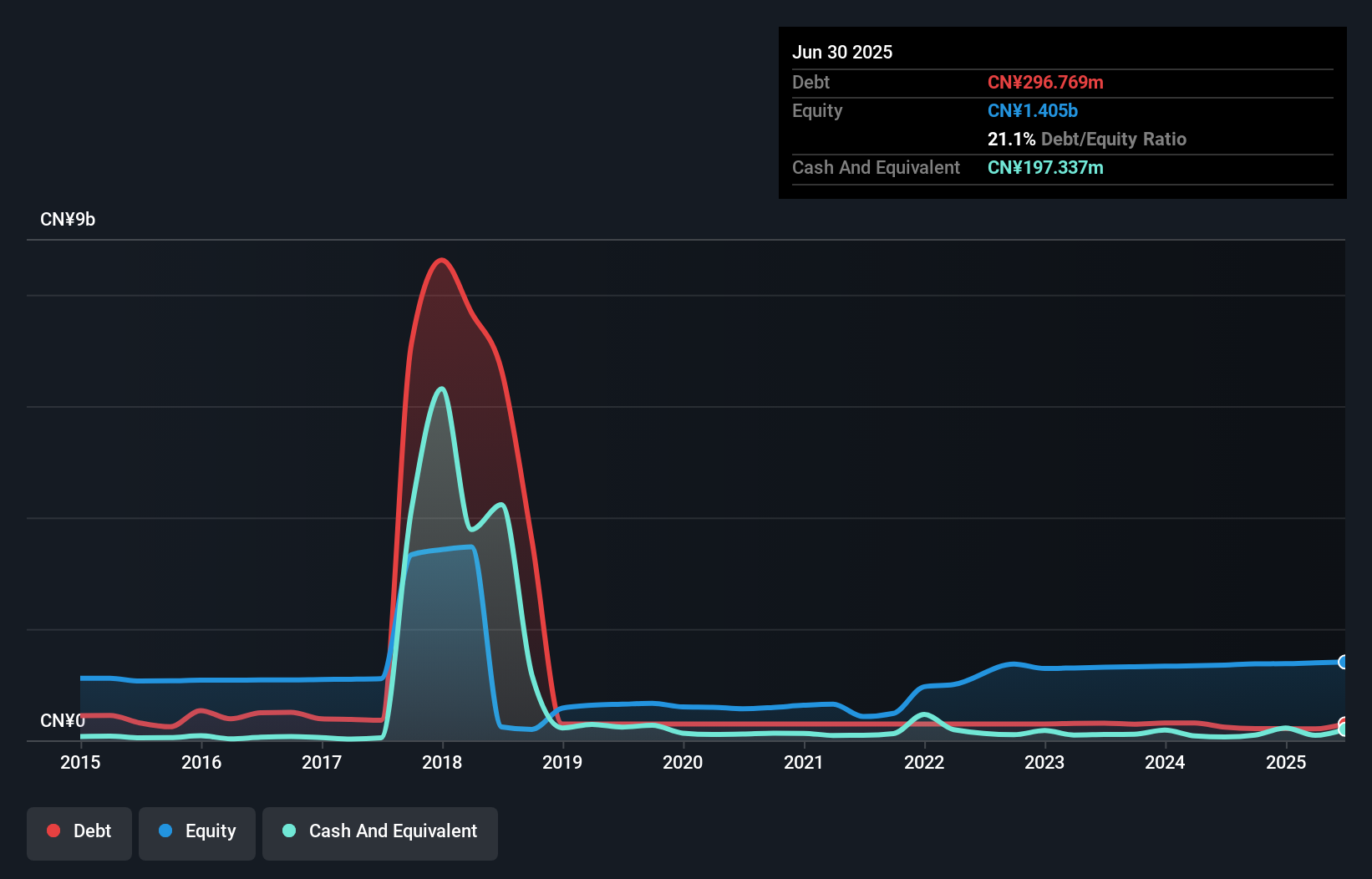

Ningbo Donly, a small player in the machinery sector, has been catching attention with its robust financials. Over the past year, earnings have surged by 34.6%, outpacing industry growth of 4%. The company's net debt to equity ratio stands at a satisfactory 7.1%, reflecting prudent financial management as it reduced from 51.9% over five years. Trading at an impressive discount of 62.8% below estimated fair value, Ningbo Donly seems to offer significant potential for value seekers. Recent half-year results show revenue climbing to CNY 734 million and net income reaching CNY 30 million, highlighting steady progress despite market volatility.

- Unlock comprehensive insights into our analysis of Ningbo DonlyLtd stock in this health report.

Assess Ningbo DonlyLtd's past performance with our detailed historical performance reports.

Gallant Micro. Machining (TPEX:6640)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Gallant Micro. Machining Co., LTD. specializes in the production and sale of machinery, equipment, precision molds, and various components across Taiwan, China, and international markets with a market cap of NT$22.70 billion.

Operations: Gallant Micro. Machining generates revenue primarily through its subsidiary Gallant Micro. Machining Co., Ltd., contributing NT$2.12 billion, and KMC Corporation, adding NT$769.75 million to the total revenue stream.

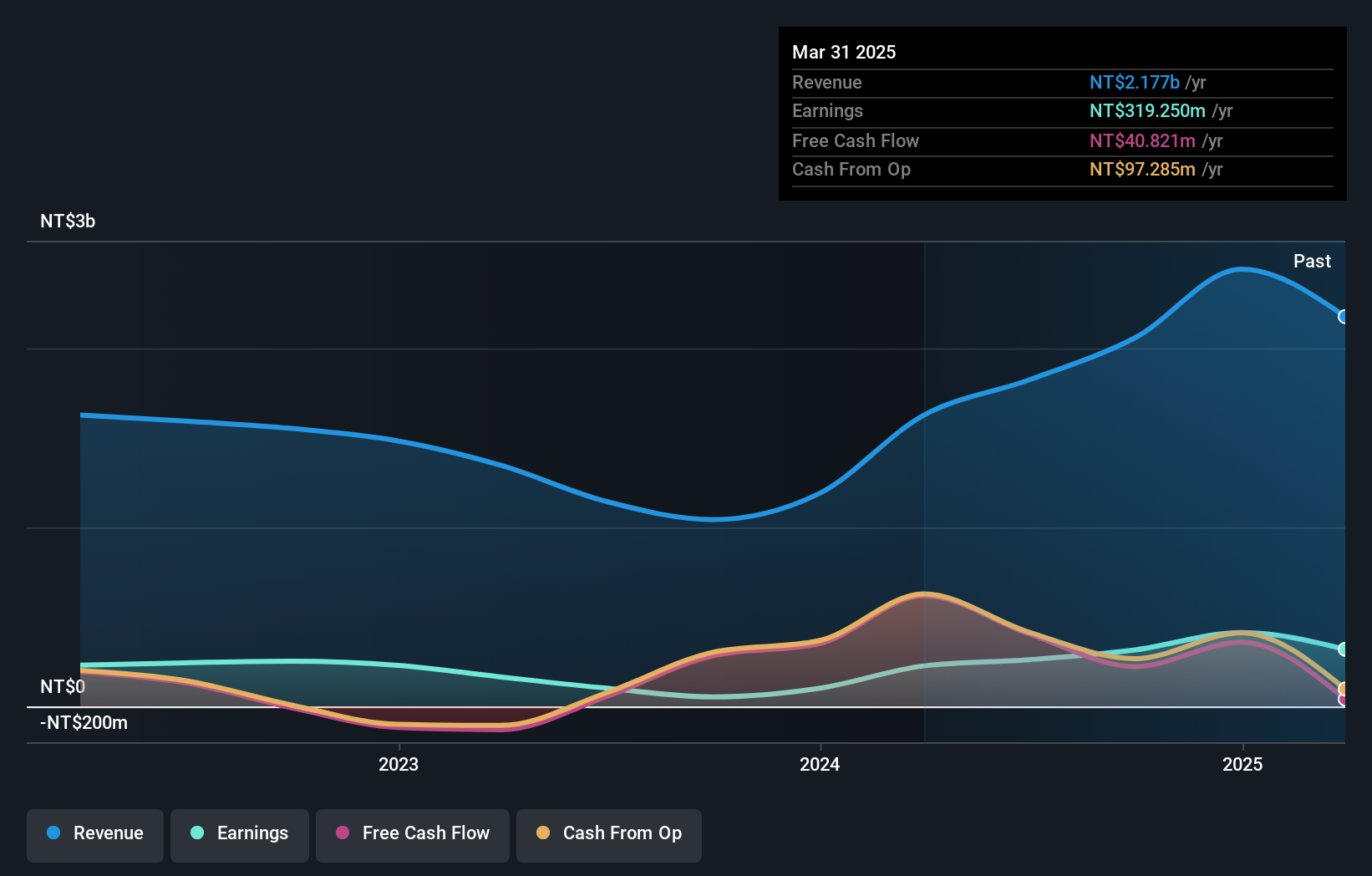

Gallant Micro. Machining, a dynamic player in the semiconductor industry, has shown impressive earnings growth of 35% over the past year, outpacing its sector's -6.5%. Its net debt to equity ratio stands at a satisfactory 28%, indicating sound financial management despite an increase in overall debt levels from 44.6% to 91.3% over five years. Recent results highlight robust sales for Q2 at TWD 737 million compared to TWD 423 million last year, with net income rising to TWD 97.91 million from TWD 64.3 million previously, showcasing strong operational performance and potential for continued growth in this competitive space.

Grade Upon Technology (TPEX:6739)

Simply Wall St Value Rating: ★★★★★★

Overview: Grade Upon Technology Corporation is a Taiwanese company that develops, manufactures, and sells sensor device products with a market capitalization of NT$19.88 billion.

Operations: The company's primary revenue stream comes from electronic components and parts, generating NT$563.65 million.

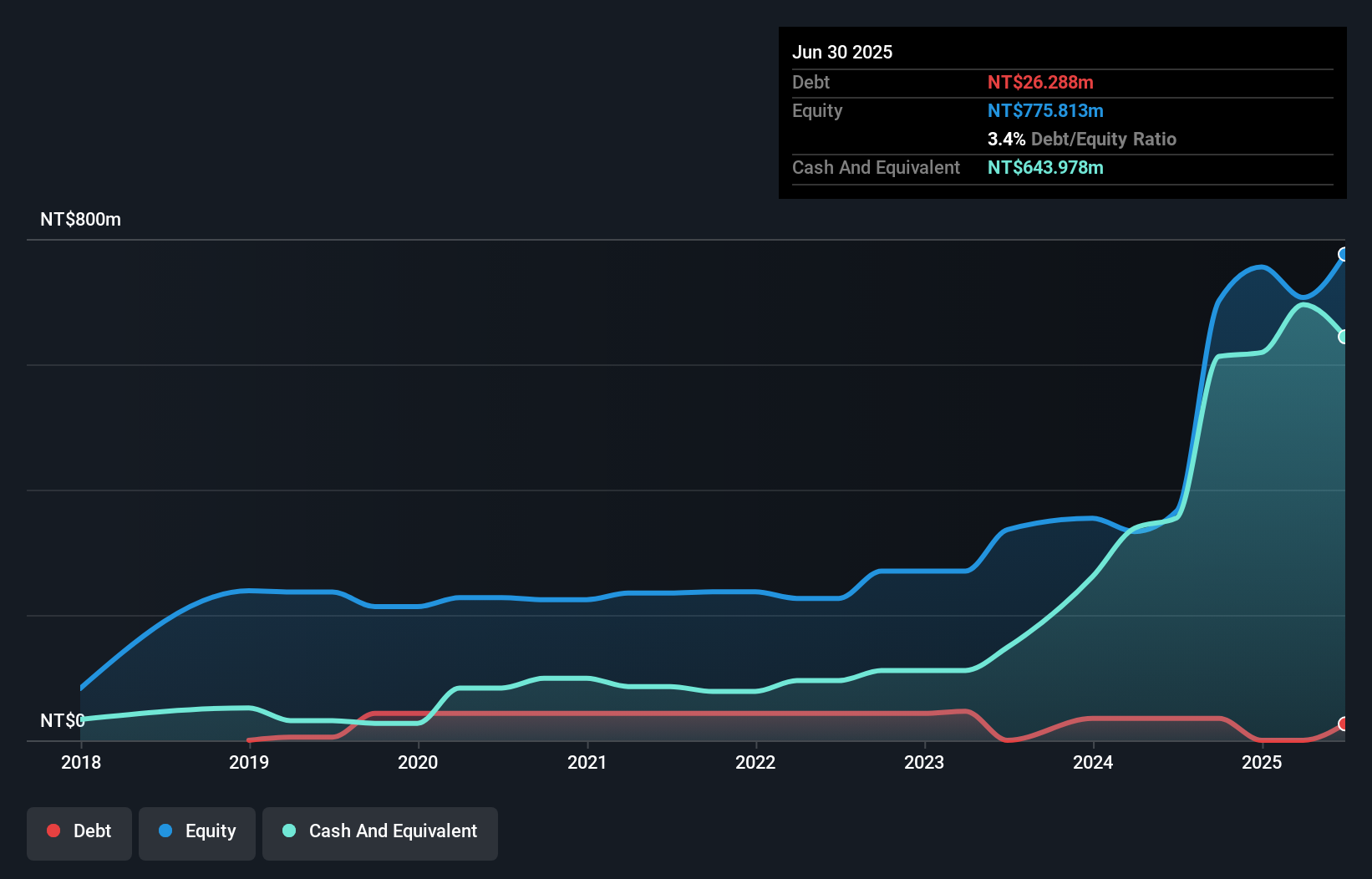

Grade Upon Technology, a nimble player in the electronics sector, has shown impressive financial strides. Over the past year, its earnings surged by 182.8%, outpacing industry norms significantly. The debt-to-equity ratio improved from 18.9% to 3.4% over five years, indicating robust financial management. Recent earnings for Q2 revealed sales of TWD 179 million and net income of TWD 70 million, reflecting a healthy growth trajectory compared to last year's figures of TWD 100 million and TWD 32 million respectively. With its inclusion in the S&P Global BMI Index, Grade Upon Technology seems poised for increased visibility among investors.

- Dive into the specifics of Grade Upon Technology here with our thorough health report.

Evaluate Grade Upon Technology's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Embark on your investment journey to our 2390 Asian Undiscovered Gems With Strong Fundamentals selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6739

Grade Upon Technology

Grade Upon Technology Corporation develops, manufactures, and sells sensor device products in Taiwan.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives