- Taiwan

- /

- Semiconductors

- /

- TPEX:6223

Asian Value Stock Picks For Estimated Growth Potential

Reviewed by Simply Wall St

As global markets grapple with renewed U.S.-China trade tensions and economic uncertainties, investors are increasingly turning their attention to Asia's stock markets, which have shown resilience amid these challenges. In this environment, identifying undervalued stocks with strong fundamentals can offer potential growth opportunities for those looking to navigate the complexities of the current market landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Century Huatong GroupLtd (SZSE:002602) | CN¥19.18 | CN¥38.19 | 49.8% |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥38.80 | CN¥76.69 | 49.4% |

| Suzhou Hengmingda Electronic Technology (SZSE:002947) | CN¥44.91 | CN¥88.95 | 49.5% |

| Sheng Siong Group (SGX:OV8) | SGD2.15 | SGD4.28 | 49.8% |

| LITALICO (TSE:7366) | ¥1226.00 | ¥2418.14 | 49.3% |

| Japan Eyewear Holdings (TSE:5889) | ¥2036.00 | ¥4037.98 | 49.6% |

| Japan Data Science ConsortiumLtd (TSE:4418) | ¥959.00 | ¥1906.05 | 49.7% |

| Guangdong Lyric Robot AutomationLtd (SHSE:688499) | CN¥60.50 | CN¥119.47 | 49.4% |

| Everest Medicines (SEHK:1952) | HK$52.25 | HK$104.21 | 49.9% |

| EVE Energy (SZSE:300014) | CN¥83.75 | CN¥166.29 | 49.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

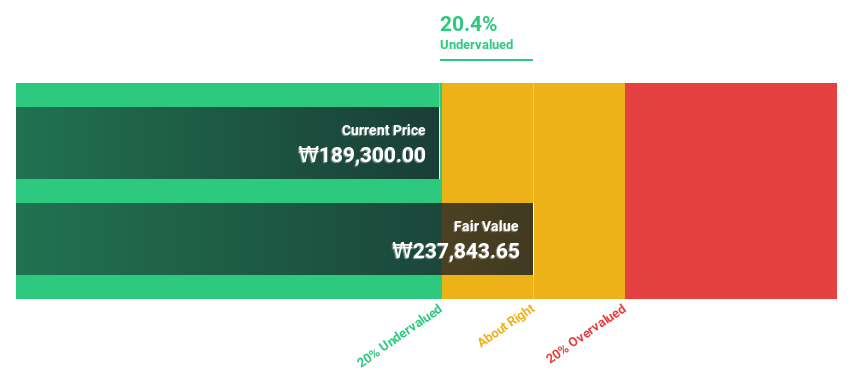

Celltrion (KOSE:A068270)

Overview: Celltrion, Inc. is a biopharmaceutical company focused on developing, producing, and selling therapeutic proteins for oncology treatments, with a market cap of approximately ₩38.77 trillion.

Operations: The company's revenue segments include Biopharmaceuticals at ₩6.66 trillion and Chemical Drugs at ₩517 billion.

Estimated Discount To Fair Value: 11.2%

Celltrion's recent FDA approval of EYDENZELT® and its strong biosimilar portfolio expansion highlight the company's robust revenue potential. Despite trading 11.2% below fair value, Celltrion's earnings are expected to grow significantly at 28.1% annually, outpacing the KR market average. However, its Return on Equity is forecasted to be low at 7.6%. The company's strategic share buyback program further aims to stabilize stock prices and enhance shareholder value amidst these developments.

- Our growth report here indicates Celltrion may be poised for an improving outlook.

- Navigate through the intricacies of Celltrion with our comprehensive financial health report here.

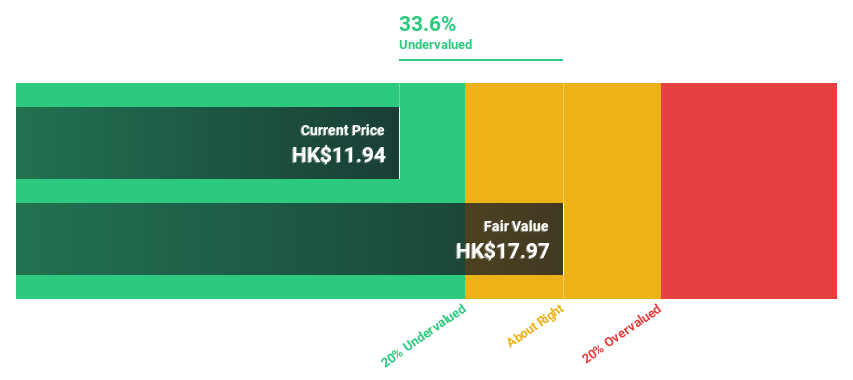

Smoore International Holdings (SEHK:6969)

Overview: Smoore International Holdings Limited is an investment holding company that provides vaping technology solutions and has a market cap of HK$95.31 billion.

Operations: The company's revenue primarily comes from the sale of advanced personal vaporizers (APV) and vaping devices and components, amounting to CN¥12.73 billion.

Estimated Discount To Fair Value: 26.1%

Smoore International Holdings is trading 26.1% below its estimated fair value of HK$20.82, with earnings forecasted to grow significantly at 33.5% annually, surpassing the Hong Kong market average. However, recent results show a decline in net income despite increased sales, with profit margins dropping from 14.4% to 8.7%. The company reported third-quarter sales of CNY 4.2 billion but experienced a decrease in net income to CNY 316.9 million from the previous year’s CNY 378.9 million.

- Upon reviewing our latest growth report, Smoore International Holdings' projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Smoore International Holdings stock in this financial health report.

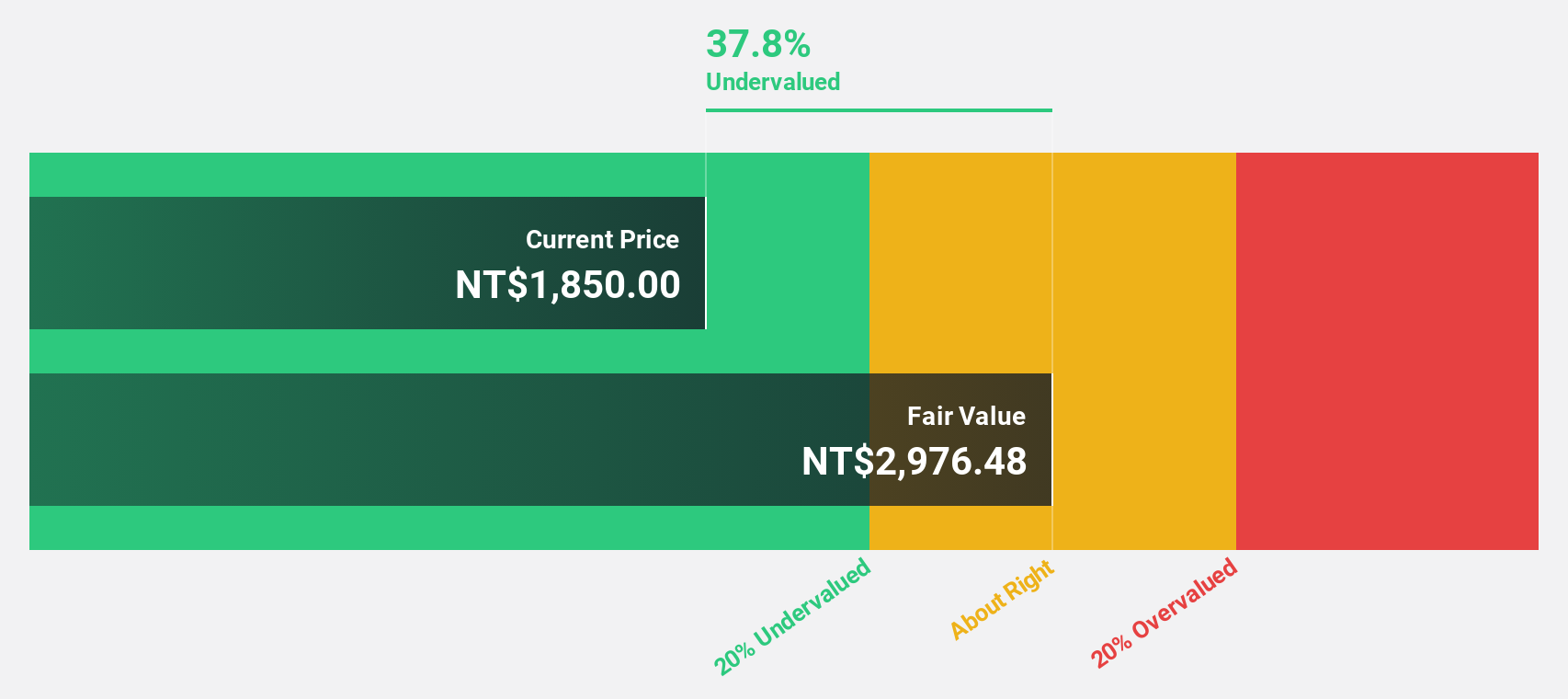

MPI (TPEX:6223)

Overview: MPI Corporation, along with its subsidiaries, is involved in the manufacturing, processing, maintenance, import/export, and trading of semiconductor production process and testing equipment across Taiwan, China, Singapore, Korea, the United States and other international markets; it has a market cap of NT$184.54 billion.

Operations: The company's revenue from Semiconductor Equipment and Services amounts to NT$11.85 billion.

Estimated Discount To Fair Value: 34.2%

MPI Corporation is trading 34.2% below its estimated fair value of NT$2,980.98, with earnings having grown by 66.8% over the past year and forecasted to grow significantly at 33.1% annually, outpacing the Taiwan market average. Recent strategic alliances aim to enhance testing solutions for photonic devices, potentially boosting operational efficiency and innovation capacity. Despite a highly volatile share price recently, MPI's strong cash flow position underlines its undervaluation based on discounted cash flow analysis.

- The analysis detailed in our MPI growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in MPI's balance sheet health report.

Where To Now?

- Click here to access our complete index of 278 Undervalued Asian Stocks Based On Cash Flows.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6223

MPI

Manufactures, processes, maintains, imports/exports, and trades in semi-conductor production process and testing equipment in Taiwan, China, Singapore, Korea, the United States, and internationally.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026