- China

- /

- Construction

- /

- SZSE:002140

Uncovering Three Promising Small Caps with Strong Foundations

Reviewed by Simply Wall St

As major U.S. stock indexes have climbed higher, buoyed by easing core inflation and robust bank earnings, small-cap stocks are also catching the eye of investors seeking opportunities in a market environment that favors value over growth. In this landscape, identifying small-cap companies with solid foundations—characterized by strong financials, innovative products or services, and potential for sustainable growth—can be particularly rewarding for those looking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Suraj | 37.84% | 15.84% | 63.29% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Middle East Specialized Cables (SASE:2370)

Simply Wall St Value Rating: ★★★★★★

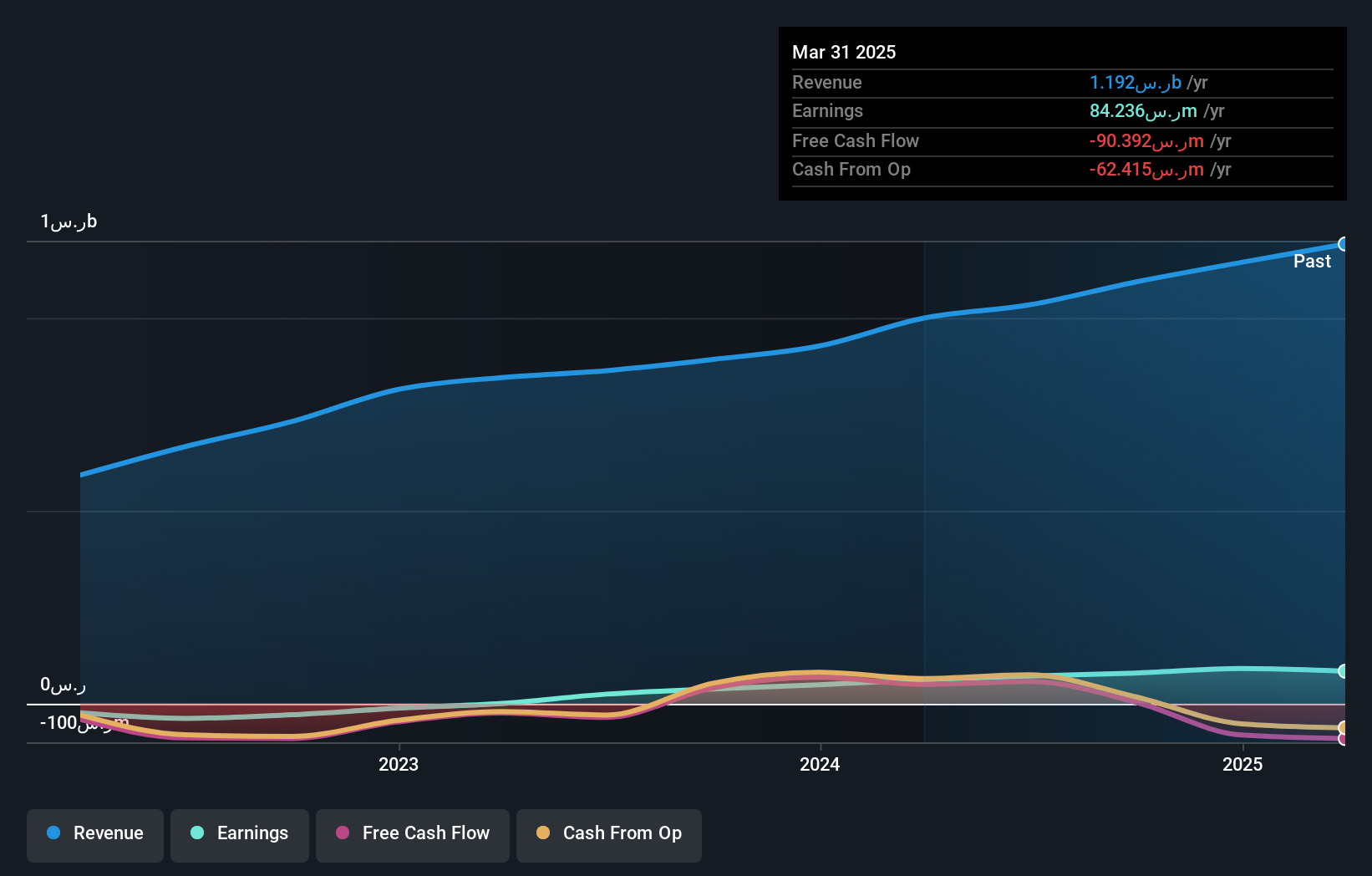

Overview: Middle East Specialized Cables Company, along with its subsidiaries, operates in Saudi Arabia and the United Arab Emirates, manufacturing and selling fiber optic cables, steel insulated wires and cables, copper insulated wires and cables, and aluminum insulated wires and cables; it has a market cap of SAR1.91 billion.

Operations: The company's primary revenue stream is derived from its wire and cable products, generating SAR1.09 billion.

Middle East Specialized Cables, a small cap entity, showcases impressive financial health with high-quality earnings and a satisfactory net debt to equity ratio of 4.6%. Over the past year, its earnings growth of 107.5% outpaced the Electrical industry average of 9.5%, highlighting its robust performance in the sector. The company's interest payments are well covered by EBIT at a multiple of 45x, indicating strong operational efficiency. Recent reports show significant sales growth for Q3 at SAR 289 million from SAR 230 million last year and net income rising to SAR 21 million from SAR 14 million, reflecting solid profitability improvements.

- Click to explore a detailed breakdown of our findings in Middle East Specialized Cables' health report.

Learn about Middle East Specialized Cables' historical performance.

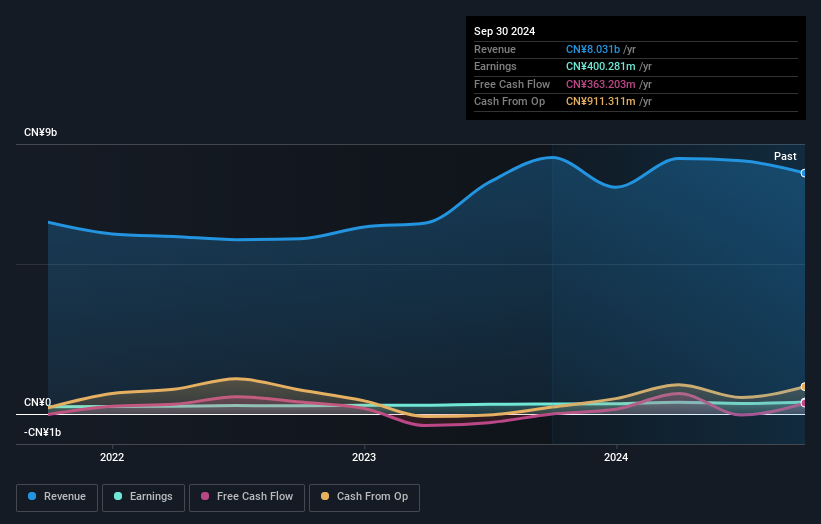

East China Engineering Science and Technology (SZSE:002140)

Simply Wall St Value Rating: ★★★★☆☆

Overview: East China Engineering Science and Technology Co., Ltd. operates in the engineering and technology sector, focusing on providing comprehensive engineering services, with a market cap of CN¥66.20 billion.

Operations: East China Engineering Science and Technology generates revenue primarily through its engineering services, with a notable focus on cost management to optimize profitability. The company's net profit margin reflects its efficiency in converting sales into actual profit.

East China Engineering Science and Technology, a smaller player in the construction sector, has demonstrated noteworthy financial resilience. Over the past year, earnings surged by 21.3%, outpacing the industry's -3.9% performance. The company trades at a value 16% below its estimated fair value, suggesting potential investment appeal. Despite an increase in its debt-to-equity ratio from 32.4% to 40.2% over five years, it remains financially robust with high-quality earnings and free cash flow positivity. Recent shareholder meetings focused on strategic decisions like stock repurchases and regulatory amendments indicate proactive management aimed at enhancing shareholder value.

ADATA Technology (TPEX:3260)

Simply Wall St Value Rating: ★★★★☆☆

Overview: ADATA Technology Co., Ltd. is a global manufacturer and seller of memory products with a market capitalization of approximately NT$23.02 billion.

Operations: ADATA Technology generates revenue primarily from its Electronics Division, contributing NT$41.31 billion, while the Biotech Department adds NT$37.68 million.

ADATA Technology, a dynamic player in the tech sector, is making waves with its robust performance. Over the past year, earnings surged by 251.4%, outpacing the semiconductor industry's 5.9% growth rate. The company's debt management has improved significantly, reducing its debt to equity ratio from 186.2% to 151.7% over five years, though the net debt to equity remains high at 129.3%. Recent financials show sales for Q3 at TWD 9 billion and net income of TWD 590 million, reflecting solid growth compared to last year’s figures of TWD 8 billion and TWD 414 million respectively.

- Click here to discover the nuances of ADATA Technology with our detailed analytical health report.

Examine ADATA Technology's past performance report to understand how it has performed in the past.

Taking Advantage

- Explore the 4651 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if East China Engineering Science and Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002140

East China Engineering Science and Technology

East China Engineering Science and Technology Co., Ltd.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)