- China

- /

- Communications

- /

- SZSE:300504

November 2024's Leading Growth Stocks With Insider Backing

Reviewed by Simply Wall St

In the wake of a significant political shift in the United States, global markets have experienced notable rallies, with major indices like the S&P 500 and Nasdaq Composite reaching record highs. This optimism is fueled by expectations of economic growth driven by potential policy changes, making it an opportune time to explore growth companies where high insider ownership aligns interests and signals confidence in future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 42.6% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 49.1% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's uncover some gems from our specialized screener.

Shanghai Lily&Beauty CosmeticsLtd (SHSE:605136)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Lily&Beauty Cosmetics Co., Ltd. engages in online cosmetics marketing and retailing services in China with a market cap of approximately CN¥3.24 billion.

Operations: Shanghai Lily&Beauty Cosmetics Co., Ltd. generates revenue through its online marketing and retailing services for cosmetics in China.

Insider Ownership: 32.5%

Shanghai Lily&Beauty Cosmetics Ltd. has shown a significant turnaround, becoming profitable this year despite a drop in sales to CNY 1.23 billion from CNY 1.93 billion year-on-year. The company’s earnings are expected to grow significantly at over 56% annually, outpacing the Chinese market average of 26.4%. Revenue growth is also projected at nearly 28% per year, surpassing the market's forecasted growth rate of 14%.

- Click here and access our complete growth analysis report to understand the dynamics of Shanghai Lily&Beauty CosmeticsLtd.

- Insights from our recent valuation report point to the potential overvaluation of Shanghai Lily&Beauty CosmeticsLtd shares in the market.

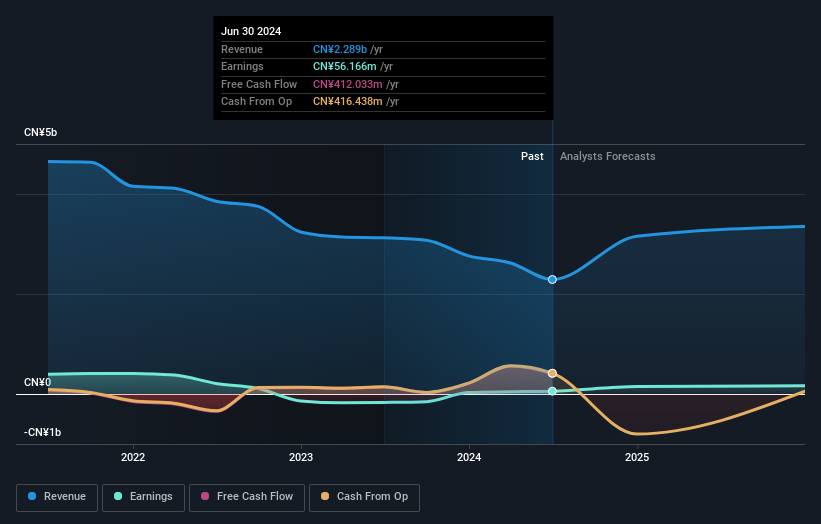

Sichuan Tianyi Comheart Telecom (SZSE:300504)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sichuan Tianyi Comheart Telecom Co., Ltd. operates in the telecommunications industry and has a market cap of approximately CN¥5.04 billion.

Operations: Sichuan Tianyi Comheart Telecom's revenue segments are not specified in the provided text.

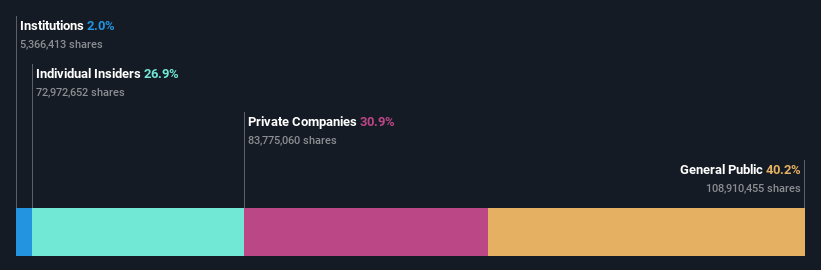

Insider Ownership: 26.9%

Sichuan Tianyi Comheart Telecom's recent earnings report showed a decline in sales to CNY 1.45 billion from CNY 2 billion year-on-year, with net income dropping to CNY 38.47 million from CNY 123.63 million. Despite this, its earnings are forecasted to grow significantly at over 64% annually, outpacing the Chinese market average of 26.4%. Revenue is expected to increase by approximately 17.7% per year, exceeding the market's growth rate of 14%.

- Unlock comprehensive insights into our analysis of Sichuan Tianyi Comheart Telecom stock in this growth report.

- Our expertly prepared valuation report Sichuan Tianyi Comheart Telecom implies its share price may be too high.

Grand Process Technology (TPEX:3131)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Grand Process Technology Corporation specializes in designing, developing, and servicing metal etching and wafer cleaning equipment in Taiwan, with a market cap of NT$53.47 billion.

Operations: The company's revenue is derived from the Equipment Manufacturing Segment (NT$1.65 billion), Equipment Sales Agent Department (NT$986.37 million), Chemical Materials Manufacturing Department (NT$1.06 billion), and Software Sales Department (NT$60.65 million).

Insider Ownership: 12.5%

Grand Process Technology is poised for substantial growth, with earnings expected to rise by 46.4% annually over the next three years, surpassing the TW market's average of 20.2%. Revenue is also forecasted to grow at 29.8% per year, outpacing the market's 12.8% growth rate. Despite a highly volatile share price in recent months and no significant insider trading activity, its strong forecasted growth metrics highlight potential for investors focused on high-growth opportunities with insider alignment.

- Delve into the full analysis future growth report here for a deeper understanding of Grand Process Technology.

- In light of our recent valuation report, it seems possible that Grand Process Technology is trading beyond its estimated value.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 1525 Fast Growing Companies With High Insider Ownership now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300504

Sichuan Tianyi Comheart Telecom

Sichuan Tianyi Comheart Telecom Co., Ltd.

Flawless balance sheet with reasonable growth potential.